- The U.S. financial restoration might start subsequent 12 months.

- The confluence of deregulation contains indicators that would flip round quickly.

- Evolving integration between main innovation platforms can drive productiveness good points.

Cathie Wooden, CEO of Ark Make investments, described the present state of the U.S. financial system as a “coiled spring” with the potential for a speedy and sharp restoration subsequent 12 months and past. Mr. Wooden made this rationalization in a New Yr’s letter to buyers, highlighting a wide range of elements which have characterised the U.S. financial system over the previous a number of years.

Components characterizing the present U.S. financial system

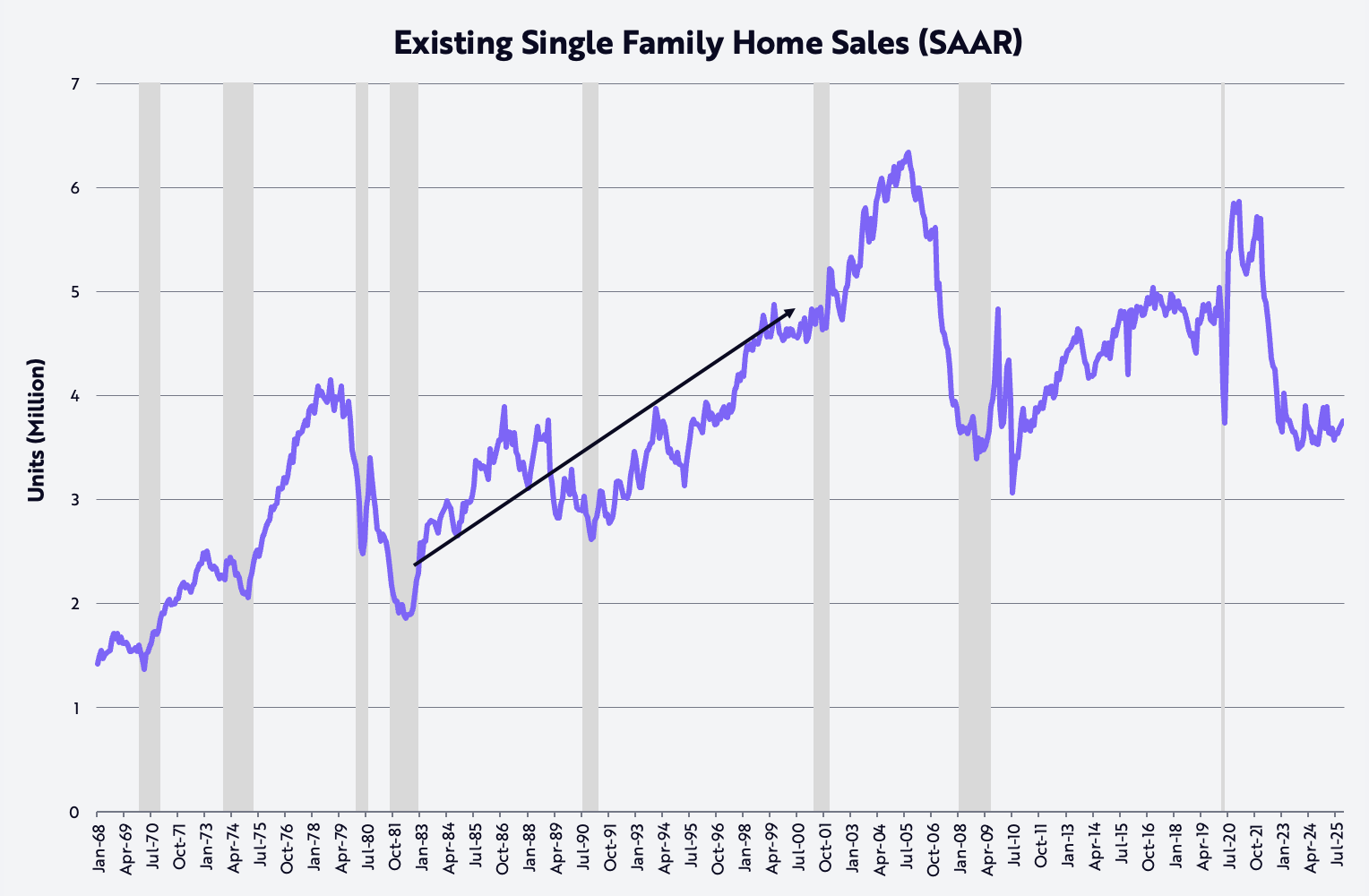

Some key elements that Mr. Wooden highlighted embrace a gentle recession regardless of sustained progress in actual gross home product (GDP) and a document 22-fold bounce within the federal funds charge from 0.25% in March 2022 to five.5% within the 16 months via July 2023. He additionally in contrast the present scenario to a situation from about 15 years in the past, when dwelling gross sales and housing gross sales fell by 40% from an annual charge of 5.9 million models in January. From 2021 to October 2023, it would attain 3.5 million folks.

Wooden defined that present dwelling gross sales are as little as they had been within the early Eighties, when the U.S. inhabitants was about 35% smaller than it’s immediately.

Supply: Ark Funding

In the meantime, Wooden cited a mixture of deregulation, tax cuts (together with tariffs), inflation and rates of interest as indicators that would change rapidly and abruptly, in addition to the gradual recession that has characterised the US lately. If that comes true, as she predicted, it might sign a restoration for the U.S. financial system.

Associated articles: Cathie Wooden’s Ark Investments Provides $10.56 Million to Bitmine Inventory Throughout Newest Buying and selling Session

Deregulation sparks innovation

Wooden additional identified that the recognized deregulation is unleashing innovation in all areas, particularly within the areas of AI and cryptocurrencies, led by the primary AI and crypto czar, David Sachs. She stated different elements driving progress in actual disposable revenue embrace tax breaks on ideas, additional time pay and Social Safety, which jumped from about 2% to about 8.3% within the closing quarter of 2025.

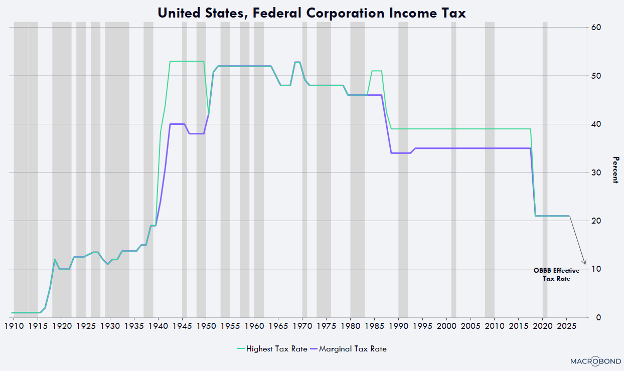

Specifically, as Mr. Wooden highlighted, the efficient company tax charge is reducing on account of accelerated depreciation of producing tools, tools, software program, and home analysis and growth.

Supply: Ark Funding

Wooden cited a number of different areas the place the U.S. financial system is reflecting compression with the potential for important restoration, highlighting the potential for non-agricultural productiveness progress. He anticipated progress to speed up by 4-6% year-on-year within the coming years for cyclical and long-term causes. Based on Wooden, evolving convergence between main innovation platforms might assist productiveness progress attain new sustainable highs, resulting in important wealth creation.

Associated articles: ARK Make investments buys $60 million in crypto shares once more as Coinbase declines

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply