- ASTER stalls under $0.65 as Fibonacci resistance continues to restrict upside momentum

- The strain on the Ichimoku cloud stays heavy, and the rebound correction will not be bullish.

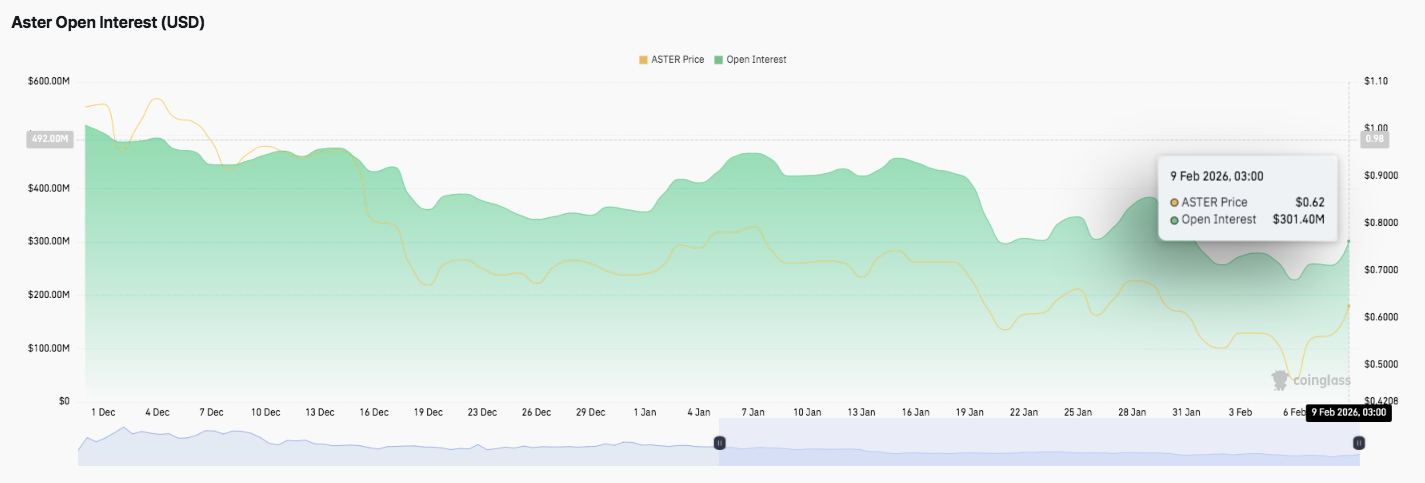

- Open curiosity stabilizes round $300 million, whereas spot inflows recommend early accumulation

Aster is seeking to stabilize after a pointy selloff, with the worth rebounding from the swing low of $0.406. The restoration has pushed ASTER again into the $0.62-$0.63 vary and is being intently watched by merchants on this space. This zone overlaps with a serious Fibonacci retracement and former provide space.

The result’s a short-term barrier that continues to restrict upward momentum. Market information means that this motion displays stabilization somewhat than a transparent change in pattern. Subsequently, merchants stay cautious whereas the worth trades under the confirmed breakout degree.

Resistance limits restoration makes an attempt

The value motion on the 4-hour chart reveals that ASTER has repeatedly stalled under the $0.65 space. This degree coincides with the 0.618 Fibonacci retracement and the earlier rejection level.

Importantly, sellers defend this zone with a number of assessments, limiting follow-through. The upper resistance band lies between $0.71 and $0.72, which beforehand signaled a serious breakdown. Breaking into this vary would require sustained shopping for energy and broader market assist.

Within the Ichimoku setup, ASTER is rising towards the cloud, however not passing by way of it. Clouds stay thick overhead, indicating continued overhead strain.

Presently, the bottom line close to $0.61 supplies fast assist, whereas the tenka line close to $0.60 displays short-term stability. Nevertheless, value wants to stay above the cloud to verify a bullish shift. Till then, constructions will proceed to drive a coordinated restoration.

Momentum indicators assist a cautious outlook. Directional motion indicators point out that bullish momentum is weakening and optimistic directional energy is reversing. However, ADX continues to be rising, indicating that the earlier pattern continues to be influencing the worth motion.

Associated: Solana Value Prediction: SOL defends $87 after 20% bounce as ETFs proceed to retreat

Because of this, the rebound seems to be fragile with out renewed momentum. A decisive 4-hour shut above $0.65 might revive curiosity within the upside. Failure at resistance will increase the danger of a pullback in the direction of $0.60 or $0.55.

Derivatives and spot information recommend stabilization

Open curiosity tendencies add additional context. Derivatives information reveals a gentle contraction from early December to late January. Open curiosity decreased from greater than $450 million to $300 million as costs fell.

This sample means that merchants decreased their leveraged exposures somewhat than actively rotating into new positions. Moreover, in the course of the latest rally, open curiosity stabilized close to $300 million. This stabilization means merchants are ready for clearer path earlier than committing capital.

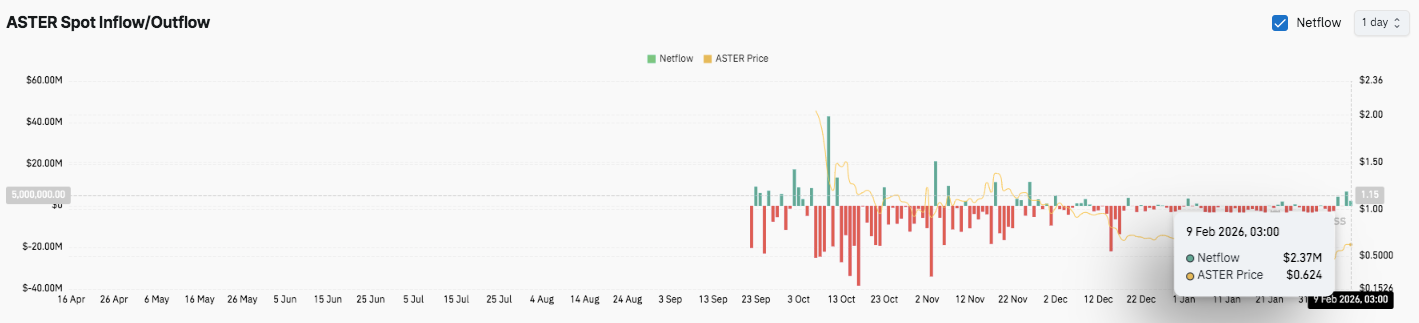

Spot circulation information reveals extra constructive indicators. ASTER skilled sustained internet outflows by way of the second half of 2025, reflecting sustained sell-side strain. Nevertheless, the promoting momentum weakened in early 2026.

Flows lately turned barely optimistic, exhibiting a internet influx of $2.37 million. Moreover, this alteration means that curiosity is approaching a decrease degree. Though capital inflows stay restricted, it signifies that downward strain is reducing and market stability is bettering.

Aster Expertise Outlook (ASTER)

Aster’s key ranges are clearly outlined as value trades near key choice zones. ASTER is presently above short-term assist however continues to face overhead provide, sustaining a impartial to cautious construction.

High degree: Fast resistance lies between $0.65 and $0.67, with the worth dealing with repeated rejections. A confirmed break above this zone might pave the best way to $0.71-$0.72, which might point out a deeper Fibonacci retracement of the earlier breakdown degree. Above that, the pair might head in the direction of the $0.78 area if momentum holds, however that situation would require stronger quantity and pattern affirmation.

Cheaper price degree: On the draw back, the primary assist space stays at $0.60-$0.61, supported by the earlier consolidation and short-term pattern construction. Shedding this zone will doubtless expose $0.55 to $0.56, adopted by $0.50. This represents the final excessive and low construction from the latest rally.

Higher restrict of resistance: The $0.65 space stands out as a key degree for near-term bullish continuation. Costs are nonetheless under the thick a part of the Ichimoku cloud, suggesting a restoration somewhat than a pattern reversal. If we will keep above this space, the medium-term outlook will enhance.

The broader technical image means that ASTER has compressed after a pointy rebound and is beginning to lose momentum. Stabilizing open curiosity and bettering spot flows point out much less draw back strain, however confidence stays restricted. Subsequently, any enhance in volatility is prone to depend upon a decisive break from the present vary.

Will Asters rise additional?

ASTER’s near-term path will depend upon whether or not consumers can maintain out the $0.60 assist lengthy sufficient to problem the $0.65-$0.67 resistance cluster. A clear breakout might see a continuation in the direction of $0.71, however a rejection dangers one other drop in the direction of $0.55. For now, ASTER continues to be within the essential zone, with confirmations somewhat than expectations figuring out the subsequent leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply