The market is down, with Aster worth holding assist as broad crypto sentiment stays defensive and volatility is compressed throughout main time frames.

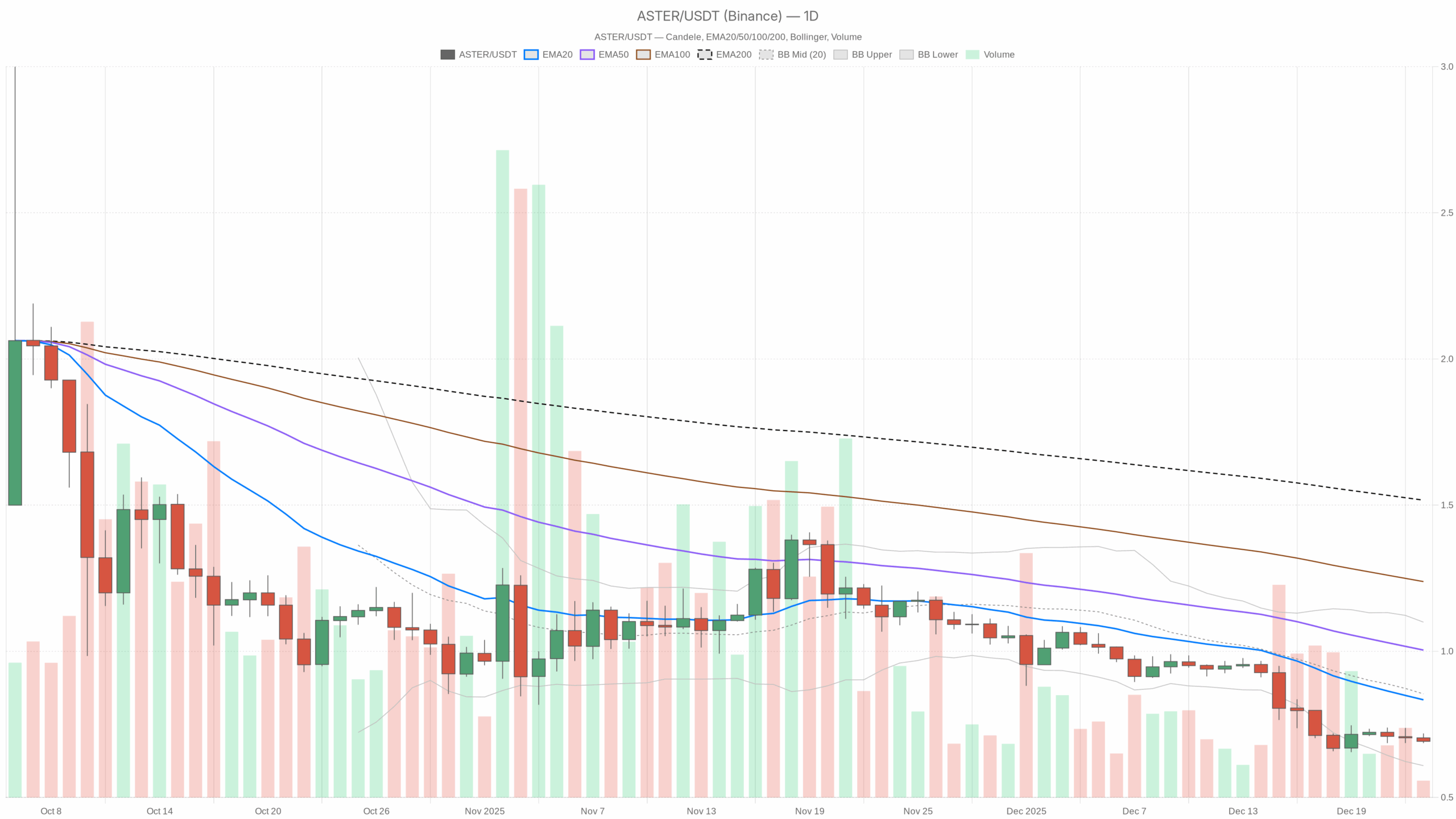

Aster worth every day development (D1): clear downward development, exhibiting oversold standing

Construction of EMA

Every day, aster worth shall be traded at $0.69 and:

- EMA 20: $0.83

- EMA50: $1.00

- EMA200: $1.52

Worth is beneath all three EMAs and is stacking bearishly (20 < 50 < 200). weak authorities Flag. It is a textbook downtrend. A pullback to the 20-day EMA (~$0.83) is more likely to be offered, and provided that the value recovers and sustains above the 50-day EMA (~$1.00) will the long-term development turn out to be constructive once more.

In layman’s phrases, the trail of least resistance remains to be down, and whereas costs stay caught beneath $0.83-$1.00, any rebound is responsible till confirmed in any other case.

RSI (14)

RSI 14 (D1): 29.96

The every day RSI is slightly below 30 and in actual phrases oversold area.

Which means the decline shall be extended within the quick time period. Whereas it doesn’t assure a backside, it warns that if sellers are unable to push costs considerably decrease from right here, contemporary shorts shall be delayed and the chance of a snapback rally will increase.

MACD

MACD line: -0.10, sign: -0.09, histogram: -0.01

The MACD is detrimental, confirming that the downtrend is widening, however the histogram is simply barely beneath zero.

The downward momentum remains to be there, however it isn’t accelerating. bear I am in management, however I am not urgent the gasoline pedal. They only hold the strain on. That is according to a market that might fall however is susceptible to a short-covering rebound.

bollinger bands

BB mid: $0.85, higher: $1.10, decrease: $0.61

worth: $0.69, close to the underside band

aster It’s buying and selling within the decrease a part of the band vary, not locked into an absolute edge, however clearly inside a pocket of low volatility.

that is, managed downtrend As an alternative of a waterfall, sellers don’t give up and proceed to decrease costs. So long as the value stays inside the decrease band, the development will stay intact. A return in direction of the mid-band round $0.85 would sign the start of imply reversion.

ATR (14)

ATR 14 (D1): $0.06

The every day ATR is 6 cents and the value is $0.69, indicating medium volatility. It isn’t useless, but it surely’s removed from being blown away.

Now, the market is bleeding relatively than collapsing. Which means if liquidity declines, the chance is biased in direction of sluggish grind losses and surprising spikes.

every day pivot

Basic every day pivot ranges:

- Pivot level (PP): $0.70

- Resistance 1 (R1): $0.71

- Assist 1(S1): $0.68

The $0.69 worth is slightly below the every day pivot and simply above S1.

In the course of the day, it is a typical stability zone. Consumers on the draw back will shield the value round $0.68, whereas short-term sellers will lean in direction of the $0.70-$0.71 space. If both workforce can get a clear break, there’s a good probability that the following quick leg shall be determined.

Hourly scenario (H1): Bearish development, however draw back momentum is slowing down

Construction of EMA

On the hourly chart:

- worth: $0.69

- EMA 20: $0.70

- EMA50: $0.71

- EMA200: $0.75

Worth is barely beneath the 20EMA and 50EMA and nicely beneath the 200EMA with regime nonetheless marked bearish.

Within the quick time period, the market is in a gradual downward development, however not sharply. An hourly bounce between $0.70 and $0.71 could be the primary space the place intraday sellers are more likely to emerge, however a push to $0.75 could be a extra severe take a look at of the downtrend.

RSI (14)

RSI 14 (H1): 41.02

The hourly RSI is beneath 50 however comfortably above oversold.

bear We nonetheless have the higher hand throughout the day, however the fast strain is just not excessive. Promoting right here is much less emotional and extra methodical.

MACD

MACD line:0.00, sign:0.00, histogram:0.00

A MACD that’s flat close to zero on an hourly foundation is mainly a “no sturdy impulse” print.

Momentum has paused and the market is deciding whether or not $0.69 would be the benchmark for a pullback or only a preparatory step for one more drop.

bollinger bands

BB mid: $0.70, higher: $0.72, decrease: $0.69

The worth is simply above the decrease band and the band width could be very slender.

The tape is compressed and barely bearish. Tight bands are sometimes fronted by uneven pop. For the reason that general development is down, the default continuation price shall be low except patrons can reclaim the mid-band round $0.70.

ATR (14)

ATR 14 (H1): $0.01

Hourly volatility is low, with the typical candlestick shifting round 1 cent.

The liquidity pocket may finally result in irregular slippage in comparison with the present ATR when the motion out of this slender vary widens.

Pivot by hour

H1 compresses the pivot desk.

- PP: $0.69

- R1: $0.69

- S1: $0.69

All come collectively on the similar worth, reflecting a really slender vary.

It is a typical consolidation. The market is marking time round $0.69 with neither aspect actively committing, ready for the following set off.

quarter-hour (M15): Execution zone, micro-integration

Construction of EMA

About M15:

- worth: $0.69

- EMA 20: $0.70

- EMA50: $0.70

- EMA200: $0.71

Worth is positioned straight beneath a good EMA cluster, weak authorities Flag.

Within the very quick time period, it is a sideways to downward drift. A 15-minute shut rally of greater than $0.70 could be the primary trace that patrons wish to regain some management throughout the day.

RSI (14)

RSI 14 (M15): 39.28

Though the RSI is beneath 50, it isn’t oversold.

Though the microstructure is bearish, there is no such thing as a panic. Somewhat than chasing low costs, scalpers concentrate on pops.

MACD

MACD line:0.00, sign:0.00, histogram:0.00

When the MACD reaches zero once more, it signifies the dearth of a transparent impulse on this time-frame.

The market is ready. Within the minimal time-frame we’re , there is no such thing as a sturdy strain from both aspect.

Bollinger bands and ATR

BB mid: $0.70, higher: $0.70, decrease: $0.69

ATR14(M15): ~0.00

The band could be very tight and the ATR is nearly flat.

That is the volatility coil. By itself, it doesn’t point out course, however in a broader downtrend, there’ll often be a draw back break except there’s a sturdy catalyst to the upside.

Abstract: Essential bearish situations with rebound dangers

The message is constant throughout time frames. Aster/USDT enamel bearish. The every day and hourly EMAs are all falling and the value is buying and selling beneath them, the regime is marked bearish on all three time frames, and your complete crypto market is in risk-off mode with excessive BTC dominance and excessive concern.

The nuance is within the momentum. Day by day RSI is oversold And MACD’s downward push is not accelerating. The 1-hour and 15-minute charts present compressed volatility and a flat MACD. In different phrases, the downtrend stays intact, however probably the most aggressive promoting part could also be paused right here.

Aster worth bullish situation

The constructive path from right here could be:

- worth Defend S1 assist at $0.68 The bottom worth is not up to date every day.

- Break and maintain the highest worth on the 15 minute chart and the 1 hour chart. $0.70 to $0.71dragging the value via the short-term EMA.

- The every day RSI has risen once more above 30-35, indicating that the promoting strain is really easing and never only a pause.

- On this case, the preliminary upside goal is Day by day Bollinger Midband and 20-day EMA roughly $0.83 to $0.85. With stronger tightening, the value may lengthen to the psychological $1 degree, the place the 50-day EMA is at present positioned.

What invalidates the bullish situation?

A clear break and the top of the day beneath $0.68 Pushing the RSI deeper into the 20s would negate the pullback concept and argue that the downtrend is merely extending, maybe in tandem with broader altcoin weak point.

Aster worth bearish situation

Given the present construction, the dominant situation continues to the draw back.

- failure to get well worth $0.70 to $0.71 And we proceed to respect the 20-day EMA (round $0.83) as sturdy dynamic resistance.

- Consolidation round $0.69 to $0.70 falls and breaks $0.68 We then stroll downwards alongside the underside of the Bollinger Bands. $0.61which is the present low band degree.

- The hourly RSI stays beneath 50 even throughout the failed rally, indicating that each one the pullbacks are being offered relatively than accrued.

On this case, the market will doubtless worth in additional risk-off for altcoins general. aster It continues to underperform the majors as funds are concentrated in BTC, ETH, and stables.

What would invalidate the bearish situation?

Decisive transfer again to prime $0.83 to $0.85 If the every day shut is above the 20-day EMA and the RSI continues to get well above 40, it signifies that the downtrend is shedding momentum. An increase in ATR as the value rises would verify that patrons are lastly prepared to chase the decline relatively than simply dilute it.

Aster worth positioning, dangers and uncertainties

From a commerce perspective, aster Costs are in a late-stage downtrend as a consequence of short-term volatility compression. This mix is troublesome. Pursuing shorts right here will expose you to an oversold squeeze, whereas blind buys shall be preventing the bearish construction that’s nonetheless in play.

The principle traces of battle are easy.

- quick line on the sand: 0.68 to 0.71 {dollars}. That is at present’s intraday vary centered round Pivot and S1. A break-and-hold on both aspect is more likely to result in elevated volatility.

- Resistance that determines the development:0.83~1.00 {dollars}. So long as the value stays beneath the 20-day and 50-day EMAs, any pullback is technically an uptrend.

- The next danger zones: A sustained transfer beneath $0.68 will improve the percentages of a cease cascade if liquidity is skinny, opening the door to testing the draw back of the Bollinger Bands round $0.61.

Presently, every day and compressed intraday volatility is average, typically previous extra violent strikes when one or the opposite finally steps up. Macro headlines and uncertainty are on the rise as your complete market is in excessive concern. BTC Swings can shortly override native technicals.

For these actively engaged on this pair, the technical message is evident. Respect the overall downtrend in Aster worth, however do not ignore the elevated danger of a short-covering rebound from oversold ranges. Precisely outline your invalidation degree and dimension your place with the understanding {that a} quiet tape can shortly turn out to be a speedy market.

Open an Investing.com account

This part comprises sponsored affiliate hyperlinks. We could earn commissions at no extra price to you.

Disclaimer: This text is market commentary and displays technical views on Aster costs on the time of writing. This isn’t funding recommendation and doesn’t take into consideration your private circumstances. At all times do your personal analysis and think about your danger tolerance earlier than making any buying and selling choices.

Leave a Reply