- U.S. Treasury Secretary Bessent as soon as once more emphasised the urgency of the digital foreign money market construction invoice.

- The second assembly suggests a compromise on stablecoin yields, however no settlement has but been reached.

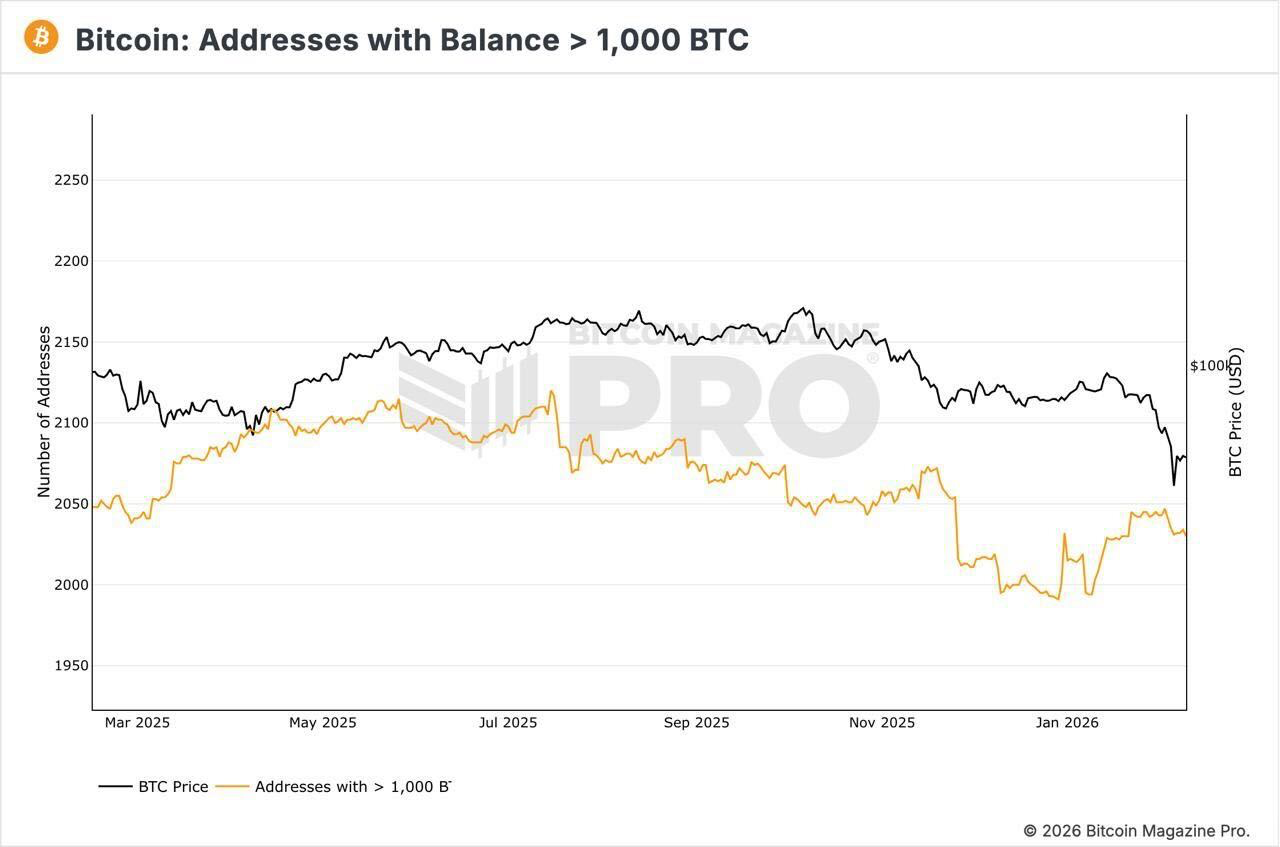

- Bitcoin whales are growing their holdings amid regulatory optimism.

U.S. Treasury Secretary Scott Bessent urged the Senate to prioritize passing the CLARITY Act. Amid discussions with the White Home over stablecoin yields, Bessent criticized business gamers who oppose the Coinbase International Inc. (NASDAQ:COIN)-led crypto market construction invoice.

“I do not suppose we are able to transfer ahead with out this. We have now to get this Readability Act throughout the end line,” Bessent stated.

Most Advocate for Passage of the CLARITY Act of 2026

In line with Bessent, the U.S. Senate must go the CLARITY Act for the U.S. to take a step ahead because the crypto capital of the world. As such, Bessent urged crypto business individuals who oppose the invoice to affix or go away the nation for different jurisdictions.

Notably, Coinbase CEO Brian Armstrong withdrew his firm’s help for the CLARITY Act, citing considerations about stablecoin yields. Armstrong stated banks ought to construct aggressive stablecoins that pay excessive yields to buyers.

It has already handed within the Senate Agriculture, Vitamin and Forestry on a party-line vote, 12-11, with no Democratic help. That is why Bessent referred to as for bipartisan help to get the invoice to the president’s desk as quickly as doable.

White Home seeks arbitration over stablecoin yield subject

The White Home below President Donald Trump has pushed to finish the bipartisan deadlock by addressing core points. On Tuesday, February tenth, the White Home convened business specialists from the banking sector and the crypto area to coordinate on the problem of stablecoin yields.

Tuesday’s assembly, the second of its sort, was led by Patrick Witt, a member of the President’s Digital Asset Advisory Council. Ripple CLO Stuart Alderroti stated there have been indicators of a compromise on stablecoin yields, however no concrete settlement had been reached.

“The Trump Administration’s resolution to proceed convening stakeholders displays a real dedication to addressing these points because the Senate Banking Committee continues its work,” stated Dan Speller, Vice President of the Blockchain Affiliation.

The necessity to go the CLARITY Act is each a political transfer and an financial place. Moreover, the U.S. cryptocurrency group exceeds 50 million folks, forming a robust voting bloc for the 2026 midterm elections.

What’s the affect in the marketplace?

The Trump administration’s unwavering help for the Cryptocurrency Market Construction Act has elevated demand from institutional buyers. As cryptocurrencies proceed to capitulate as a result of a big drop in open curiosity (OI), on-chain knowledge exhibits that enormous whales are accumulating.

For instance, Bitcoin addresses of not less than 1000 BTC have been accumulating just lately, dropping under 2000 and quickly growing till round 2050. As such, the upcoming passage of the CLARITY Act will enhance regulatory readability and probably help capital inflows into the broader altcoin market.

Associated: CFTC Revises Guidelines Permitting Nationwide Belief Banks to Challenge Stablecoins

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply