- Bitcoin stays below stress, with any makes an attempt at restoration weak and buying and selling beneath the Ichimoku cloud.

- Spot outflows and derivatives contraction spotlight continued promoting and cautious sentiment.

- Bhutan’s $50 million BTC turnover is including to macro pressures, regardless that mining operations have been worthwhile since 2019.

Bitcoin continues to face sturdy draw back stress on the 4-hour chart, with sellers sustaining management beneath a number of key technical thresholds. The value pattern continues to be below the Ichimoku cloud, confirming a persistent bearish construction.

Decrease highs and decrease lows dominate the chart, whereas repeated failures close to short-term averages strengthen a fading bullish try. In consequence, Bitcoin is buying and selling close to $71,700, with merchants remaining cautious in search of short-term stability.

Bearish construction dominates 4H chart

Technical indicators stay in step with the broader downtrend. Bitcoin didn’t regain each the Tenka line and the baseline, indicating that the restoration momentum is weak.

Moreover, the Ichimoku cloud forward stays thick and tilted downward, offering stable resistance. A break beneath the 0.236 Fibonacci degree additional highlights the restricted shopping for curiosity on the draw back.

Directional migration index knowledge assist this view. The detrimental directional index stays dominant, whereas the optimistic index stays deeply suppressed. Due to this fact, the promoting stress seems to be structural somewhat than momentary.

Instant assist lies between $71,750 and $71,500, and the value is at present reacting to this vary. Nonetheless, a decisive breakout might expose $69,230, adopted by the psychological $68,000 degree.

On the upside, resistance stays layered and heavy. The primary wall is between $72,987 and $74,200, the place the short-term averages are concentrated.

Associated: World Cell Token (WMTX) Value Prediction 2026-2030

Moreover, Bitcoin must regain $76,015 to stem the downward momentum. A broader shift would require acceptance above the prior breakdown zone of $80,210.

Watch out for derivatives and spot circulation alerts

Derivatives knowledge exhibits that regardless of current stress, market participation has elevated over time. Open curiosity expanded steadily by means of a number of worth cycles, confirming deeper liquidity and engagement.

Nonetheless, a pointy decline adopted a pointy contraction, reflecting leverage flushes and compelled place reductions. Open curiosity just lately peaked at over $80 billion, however has since declined sharply, indicating danger mitigation amid heightened volatility.

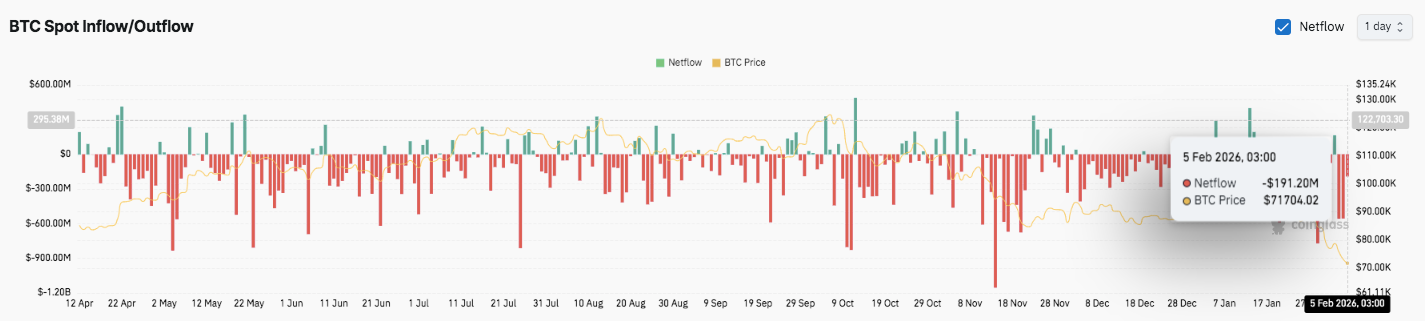

Spot circulation knowledge requires extra consideration. Latest classes have been dominated by internet outflows, indicating continued distribution stress. Moreover, extra extreme outflow spikes usually coincide with sharp declines in costs, reinforcing reactive promoting conduct.

Associated: XRP Value Prediction: Token crashes to post-election low of $1.43 as $1 goal…

In distinction, inflows stay short-lived and inconsistent, failing to assist a sustained restoration. Latest internet outflows of almost $191 million replicate weak spot in spot demand at present ranges.

Macro layer added to Bitcoin gross sales in Bhutan

As well as, sovereign exercise added to the story. After years of mining operations, Bhutan continues to promote Bitcoin in tranches of round $50 million.

The nation has generated greater than $765 million in mining income since 2019, far exceeding power investments. In consequence, these gross sales seem like strategic somewhat than difficult, and have the potential to fund broader improvement initiatives.

Bitcoin (BTC) technical outlook

Bitcoin trades inside a fragile short-term construction, so the crucial ranges stay well-defined.

On the upside, $72,987 and $74,200 function the primary restoration hurdles, adopted by $76,015 as the important thing Fibonacci degree to get better. A sustained breakout above $76,000 might open room in the direction of $80,210, the place earlier draw back stress might emerge and medium-term momentum might change.

On the draw back, $71,750 to $71,500 stays the quick assist zone. If this vary fails to maintain, $69,230 may very well be the following necessary draw back goal according to the Fibonacci base. Beneath that, $68,000 might present psychological assist and entice reactive bidding.

Technical circumstances recommend that Bitcoin stays locked in a managed downtrend characterised by falling highs and sustained promoting stress. Costs stay beneath the Ichimoku cloud, holding pattern resistance firmly overhead. The upward motion is more likely to stay corrective so long as BTC stays beneath the $74,000 to $76,000 zone.

Will Bitcoin rebound?

Bitcoin’s near-term outlook relies on whether or not patrons can defend the $71,500 area lengthy sufficient to counter the overhead resistance. A compression between assist and pattern resistance signifies a rise in upcoming volatility.

If inflows strengthen and BTC regains $76,000, momentum might shift towards a broader restoration part. Nonetheless, should you fail to retain $71,500, you danger accelerating your loss to $69,230 and even $68,000. For now, Bitcoin is at a crucial inflection level, the place technical confirmations and a stream of confidence will decide its subsequent course.

Associated: Hyper-Liquidity Value Prediction: HYPE Value Pauses After Rising as Treasury Opens New Yield Channel

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply