The market remains to be in a managed correction because the Bitcoin cryptocurrency Prezzo falls under a key resistance stage, however sentiment is displaying concern wanting an entire capitulation.

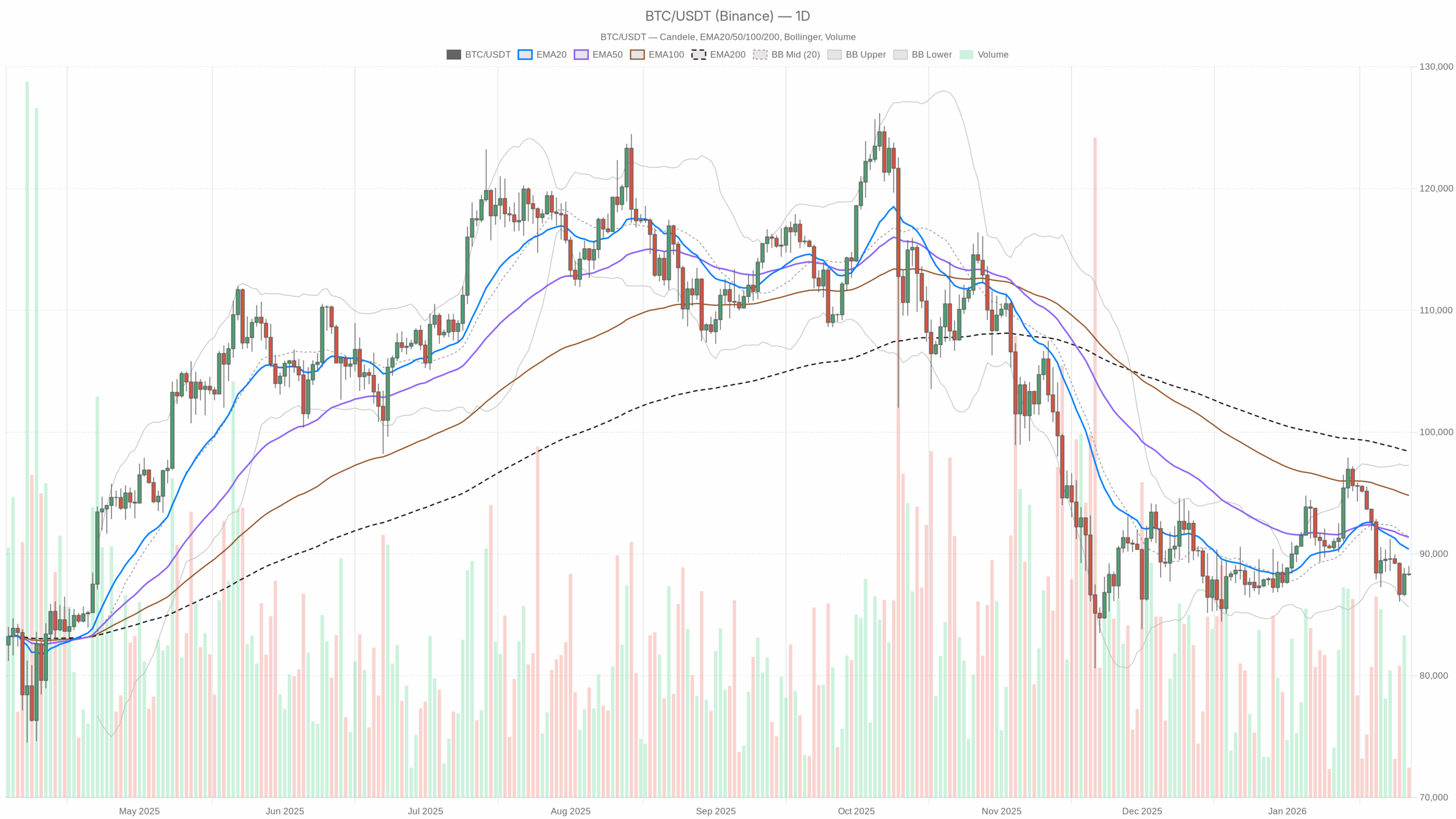

Every day Timeframe (D1): Important Bias – Bearish Correction

Every day common holidays: $88,300 (Virtually in keeping with the every day pivot of $88,501.61).

Development construction – EMA

• EMA 20: $90,388.33

• EMA 50: $91,368.53

• EMA200: $98,420.36

The value is under all three EMAs and the system flags the every day regime as follows: bearish. The short-term development (20 EMA) is already under the medium-term development (50 EMA) and each are shifting down in direction of the worth. The 200 EMA rising close to $98,000 factors to a bigger structural line within the sand.

What it means: BTC is in a mature draw back section. Until the bulls reclaim and maintain that 50-day EMA, a rally from $90,000 to $92,000 is now extra more likely to promote than provoke a sustained reversal.

Momentum – RSI (14)

• RSI (14): 42.13

RSI is under the midline however not oversold.

What it means: The bears have the higher hand, however there are not any indicators of depletion but. It is a typical pullback or correction space, not a washed out backside. Costs have room to fall earlier than excessive readings push worth consumers into the combination.

Confirming momentum and traits – MACD

• MACD line: -722.96

• Sign line: -63.91

• histogram: -659.05

The MACD line is deep in unfavourable territory, under the sign line, and has a reasonably unfavourable histogram.

What it means: This isn’t a short lived decline, however fairly a downward momentum has been established. Nonetheless, when the MACD drops this a lot, it typically means the straightforward a part of the transfer is over. There should be decrease lows, however they’re extra uneven than a straight crash and have a tendency to revert to the imply.

Volatility and Vary – Bollinger Bands and ATR

• BB mid: $91,455.72

• BB higher: $97,276.58

• BB decrease half: $85,634.85

• ATR(14): $2,234.25

Bitcoin is buying and selling under the mid-range band and near the draw back band, however it’s not holding there. An ATR of roughly $2.2,000 means a typical every day volatility of roughly 2.5% in comparison with the present value.

What it means: We’re in a managed, reasonably unstable downtrend. Worth is bearish throughout the band construction, however there isn’t a explosive volatility but. The decrease band round $85.6,000 is the primary apparent stretch zone the place short-term pullbacks typically start.

every day pivot stage

• Pivot level (PP): $88,501.61

• R1: $88,808.39

• S1: $87,993.21

Spot is buying and selling just under the pivot. Preliminary resistance may be very near overhead, whereas preliminary help is just a few hundred {dollars} decrease.

What it means: The market is undulating across the intraday equilibrium just under the pivot. Till BTC leaves this $88,000 space decisively, there can be no actual development change, and we may see a brief squeeze and lengthy liquidation in each instructions.

Timeframe (H1): Stabilization try roughly $88,000

Closed each hour: $88,305.87

Development construction – EMA

• EMA 20: $88,252.88

• EMA 50: $88,252.70

• EMA200: $89,981.65

• Authorities: impartial

The value is sitting simply above the 20 and 50 EMAs, that are primarily flat and overlapping, however the 200 EMA remains to be above the worth.

What it means: On the hourly chart, the sharp promoting has come to an finish and the market is attempting to determine a base round $88,000. Nonetheless, with the 200 EMA nonetheless overhead, that is extra seemingly a pause within the downtrend fairly than the start of a full development reversal. Quick-term gamers commerce on each side. Secular bears nonetheless have a structural benefit.

Momentum – RSI (14)

• RSI (14): 52.17

RSI is simply above 50.

What it means: Intraday flows are barely biased in direction of the purchase facet. That is in keeping with a bailout or consolidation rebound amid a broad every day decline fairly than a brand new bullish transfer.

Momentum – MACD

• MACD line: 141.94

• Sign line: 136.75

• histogram: 5.19

The MACD line is barely above the sign line and reveals a small optimistic histogram.

What it means: The bulls have regained some very short-term momentum, however their probabilities of profitable are slim. That is the sort of MACD profile you’d see in a sideways consolidation with a slight bullish slant fairly than a powerful intraday development.

Volatility and Vary – Bollinger Bands and ATR

• BB mid: $88,210.20

• BB higher: $88,925.63

• BB decrease half: $87,494.78

• ATR(14): $392.18

The value is simply above mid-band, the band is fairly tight, and the ATR is below $400.

What it means: The hourly tape is comparatively calm. This compression of volatility after a decline typically precedes a continued decline in direction of $87,000 after which $86,000, or a directional transfer under $89,000.

Pivot stage by hour

• Pivot level (PP): $88,301.24

• R1: $88,402.48

• S1: $88,204.63

spot is sitting that is proper With hourly pivots.

What it means: There’s a steadiness of short-term merchants right here. In apply, a breakout above R1 or under S1 is extra significant than noise inside this slim band.

15 minute timeframe (M15): Execution context as a substitute of indicators

Distance near 15m: $88,305.87

EMA and microstructure

• EMA 20: $88,431.09

• EMA 50: $88,365.46

• EMA200: $88,261.95

• Authorities: impartial

The value is barely under the 20 and 50 EMA, however barely above the 200 EMA.

What it means: On the minimal timeframe, BTC is chopping sideways with a slight draw back slope. The 200 EMA close to $88,260 serves as a really short-term pivot. For those who can lose it cleanly, liquidity can decline rapidly.

Momentum – RSI and MACD

• RSI (14): 44.54

• MACD line: -40.63

• Sign line: -5.64

• histogram: -34.99

RSI is under 50 and MACD is unfavourable on the line under the sign.

What it means: Very short-term impulses are biased downward. That is in keeping with the concept that intraday bulls are being rapidly erased by scalpers, even when the timeframes are nonetheless balanced.

15m Bollinger Bands, ATR, Pivot

• BB mid: $88,491.26

• BB higher: $88,836.23

• BB decrease half: $88,146.30

• ATR(14): $112.79

• Pivot level (PP): $88,271.56

• R1: $88,343.13

• S1: $88,234.31

The value is simply above the 15m pivot, the ATR is low and the band is comparatively tight.

What it means: Liquidity is concentrated on this slim vary of $88.2K to $88.4K. For these buying and selling fill-level entries, it is a low volatility zone the place cease placement will must be tightened. Breaking by this pocket often triggers a speedy growth of $100 to $200.

Market context: Threat urge for food vs. concern

The market capitalization of digital forex is roughly $3.07 trillionroughly to the highest 0.44% in 24 hourshowever the quantity is usually down 18%. BTC benefit is 57.4% He says Bitcoin stays an anchor on this area, whilst its circulation wanes. of Concern and Greed Index 29 (Concern) Individuals indicated that they had been cautious however not in a state of utmost panic.

What it means: This isn’t a danger collapse, however a risk-off surroundings. In conditions like this, Bitcoin typically falls or stays flat, and altcoins underperform on a beta foundation. Moreover, mean-reverting bounces could be sharp, however until there’s a clear macro catalyst or robust technical restoration on the every day chart, they’re often bought.

Bullish situation for Bitcoin (presently countertrend)

Contemplating the every day knowledge, a bullish view remains to be potential. reverse development play.

What the bull should do:

1. Maintain and Construct Over $88,000 on the hourly chart. The present steadiness across the hourly pivot (roughly $88,300) ought to see a sequence of latest lows within the first half of the yr and would ideally be protected on a decline in direction of $87,500-88,000.

2. Break and maintain above $89,000-$90,000. This zone contains the hourly 200 EMA and lies just under the every day 20 EMA. A sustained breakthrough could be the primary significant signal that the bears are dropping management.

3. Every day closing value is above the 20 EMA (roughly $904,000)ideally a follow-through day focusing on the 50 EMA close to $91.4,000.

If the bulls can handle this sequence, an affordable upward path opens as much as:

• Preliminary resistance $91,000 to $92,000 Bands (50 EMA and BB Mid every day).

• Then probably $95,000 to $97,000 On this space (the higher half of the every day Bollinger channel), revenue taking is predicted within the absence of robust macro catalysts.

Here is what invalidates the bullish situation: Clear every day shut under Bollinger Band decrease help 85.6 thousand {dollars}Particularly if the RSI is falling towards the mid-30s, it signifies that the tried rebound has failed and the market has opted for a continued decline fairly than a imply reversion.

Bitcoin bearish situation (in keeping with every day development)

The nonetheless highly effective forces are every day downward development. Quick and defensive positioning is structurally advantageous so long as BTC trades under the 20 and 50 EMAs.

How bears can use their benefit:

1. Defend $89,000 to $90,000 in the course of the intraday rally. If all strikes into that zone are bought and the primary half fails to shut above the 200 EMA round $89,982, it should verify that sellers are nonetheless answerable for the availability overhang.

2. Pushing BTC under $87,500 and additional under $86,000. That manner, the worth will strategy the every day decrease Bollinger Band (about $85.6 thousand) and the MACD will stay considerably unfavourable, confirming the continuation of the development.

3. Maintain the RSI under 50 on the every day timeframe. So long as every day momentum is on the bearish facet of the ledger, the push is extra more likely to prolong than to fully reverse.

On this situation, the unfavourable path could be:

• First tactical help: Close to the underside of the every day scale, $85,000 – $86,000.

• If it collapses convincingly, a wider flash $82,000-$83,000 We count on extra aggressive bullish curiosity and stronger volatility spikes on this area.

Here is what invalidates the bearish situation: Steady every day closing Over $91.5k (Reliably recovering each the 20 and 50 EMAs) If the MACD histogram shrinks in direction of zero and the RSI returns above 50, it should point out a big change. At that time, the prevailing tone will shift from a promoting rebound to purchasing a push, and the present bearish argument can be off the desk.

What does this imply for merchants and buyers?

The multi-timeframe image is obvious.

• day by day: Bearishly, BTC is under the key EMA and leaning towards the decrease half of the Bollinger vary.

• Hourly: It’s impartial and is attempting to interrupt out of the bottom round $88,000 with reasonable bullish momentum.

• 15 meters: Noisy, considerably bearish, and greatest used just for fine-tuning entries and exits.

Bitcoin is in a typical correction section, the place the upper timeframe development (lower) collides with short-term stabilization makes an attempt. This often results in two-sided volatility and false breakouts, particularly round apparent ranges just like the $88,000, $90,000, and every day bands.

Key factors concerning positioning are:

• Quick-term merchants are coping with: medium volatility (ATR roughly $22,000 per day) Compressed daytime vary. It is a recipe for speedy growth if one facet overextends.

• Individuals with extra time horizons $85,000 – $86,000 help band, $90,000 to $92,000 Resistance pocket as an necessary choice zone. A break and retest round these ranges will decide whether or not that is only a dip in a bigger bullish cycle or the start of a deeper structural correction.

In different phrases, the market is defensive however not damaged. So long as every day momentum stays under the key shifting averages, draw back danger and potential for additional losses stay, even when there’s a tradeable rebound alongside the way in which. Technical setup will not be assured. The one fixed right here is uncertainty, and sizing, timing, and danger limits are extra necessary than single-way bets.

If you wish to monitor the market utilizing skilled charting instruments and real-time knowledge, you’ll be able to open an account with Investing utilizing our accomplice hyperlink.

Open an Investing.com account

This part accommodates sponsored affiliate hyperlinks. We could earn commissions at no extra price to you.

Disclaimer: This text is market commentary for informational and academic functions solely. This isn’t funding, buying and selling or monetary recommendation and shouldn’t be the only real foundation for making choices. Cryptoassets are extremely unstable, so it’s best to fastidiously assess your danger tolerance and conduct your personal analysis earlier than coming into the market.

Leave a Reply