- Bitcoin rebounded 1.32% to $87,706 after touching the decrease finish of the Bollinger Band at $85,721, a degree that has traditionally attracted consumers.

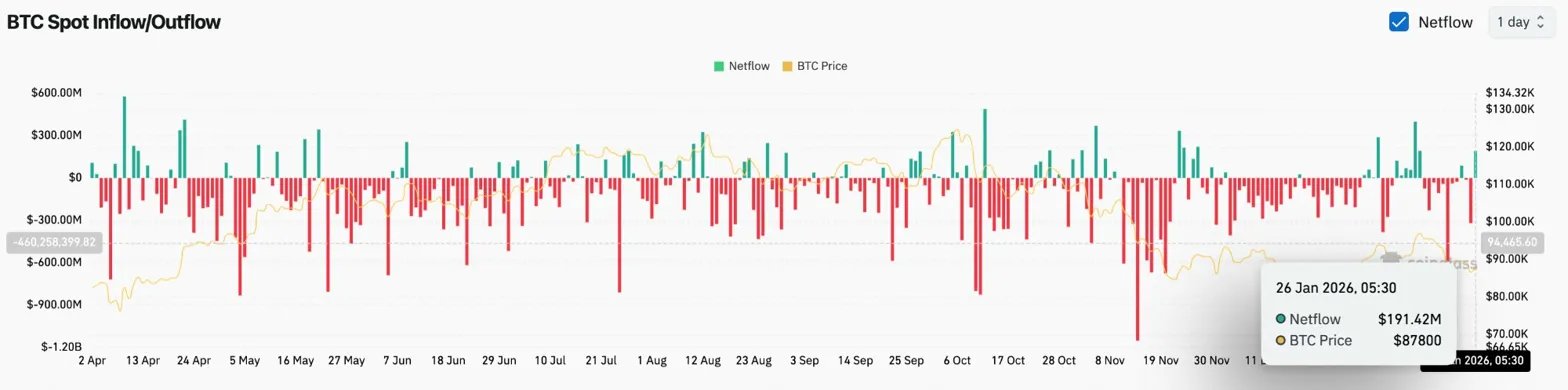

- Flows into spot exchanges surged to $191.42 million, one of many largest single-day cumulative occasions in current months and an indication of sturdy conviction shopping for.

- Silver has gained 270% in 13 months, whereas Bitcoin has fallen 11%, highlighting the shift from threat belongings to onerous cash alternate options.

Bitcoin worth is buying and selling round $87,706 at this time after bouncing off the decrease Bollinger Band and rising trendline assist. Whereas this restoration has been accompanied by large spot accumulation, the broader macro image reveals valuable metals dramatically outperforming cryptocurrencies as capital seeks security.

Macro pressures proceed as consumers intervene on key assist

The broader macro atmosphere presents challenges. In accordance with the Kobessi Letter, the worth of silver has risen 270% prior to now 13 months, whereas Bitcoin has fallen 11% throughout the identical interval. Silver’s market capitalization is at the moment 3.5 occasions that of Bitcoin.

Foreign exchange circulate information reveals aggressive shopping for at assist. Coinglass recorded web inflows of $191.42 million on January twenty sixth, one of many largest single-day cumulative occasions in current months.

The magnitude of this inflow stands out in comparison with current, extra reasonable influx patterns. If the buildup spikes whereas the worth is falling on established assist, it often signifies that assured consumers are viewing that degree as a possible entry level.

bollinger bands assist maintain

On the day by day chart, Bitcoin rebounded from the decrease Bollinger Band at $85,721, however this degree contained a correction by means of a consolidation part. The uptrend line from the December low converges with this assist, forming a confluence zone.

Present main degree:

- Rapid resistance: $90,471 (20EMA/BB Center)

- Secondary resistance: $91,409 (50 EMA)

- Key resistance: $94,894 (100 EMA)

- BB Higher Resistance: $97,275

- Development resistance: $98,611 (200 EMA)

- BB decrease assist: $85,721

- Trendline assist: $85,000 to $86,000

- Breakdown objective: $80,000

The center line of the Bollinger Bands at $91,498 converges with the 20EMA and 50EMA, forming a resistance cluster that the bulls have to reclaim to verify a rebound.

Intraday momentum turns bullish

The shorter time-frame reveals the dynamics of restoration. On the 30-minute chart, BTC has rebounded from the $86,000 low and regained $87,500, forming a possible even increased low sample.

The RSI rose to 51.82, above the impartial 50 degree for the primary time because the decline accelerated. The MACD reveals a bullish crossover and the histogram shortly turns optimistic, confirming that short-term momentum is enhancing.

The $88,000 to $88,500 zone shall be your first check. A break above this degree will verify a rebound and goal psychological resistance at $90,000.

Outlook: Can BTC regain its EMA cluster?

The setup is displaying sturdy accumulation in response to technical assist, however macro headwinds persist. The silver comparability highlights that capital is selecting conventional protected havens over digital alternate options. Bulls have to show that spot accumulation can overcome macro rotation.

- Bullish case: The worth is above $88,500 and focusing on the $90,000 to $91,500 EMA cluster. An in depth above $91,500 confirms that the correction is over and begins at $95,000.

- Bearish case: The bounce fails to regain $90,000 and the worth retests the Bollinger Band assist at $85,721. An in depth under $85,000 will break the uptrend line and goal $80,000.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply