- Bitcoin rebounded from a low of $75,355, rising 1.29% to $76,637, as Michael Burley warns of a dying spiral for company BTC holders.

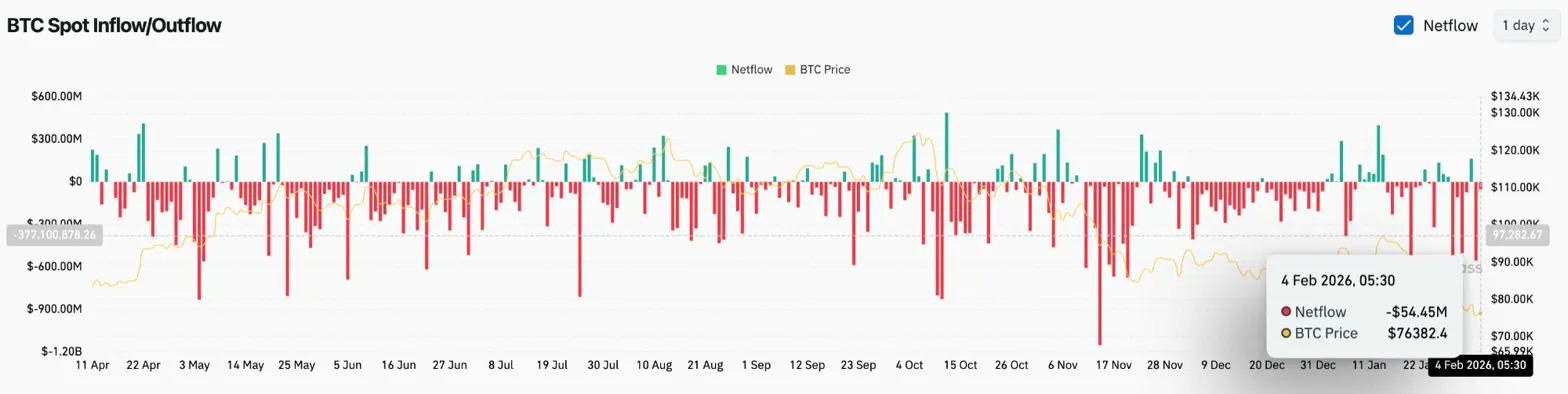

- Spot outflows reached $54.45 million on February 4, with distributions widening as costs traded 40% under October highs.

- A restoration would require a return to $84,468, however an in depth under $74,000 would open the draw back in the direction of the $65,000 demand zone.

Bitcoin value is buying and selling round $76,637 immediately after testing the $75,355 degree, its lowest since late 2024. The rally comes as investor Michael Varley, who famously shorted the housing market in 2008, warned that company Bitcoin holders face a possible dying spiral if costs fall one other 10%.

Burley warns of company Bitcoin collapse

Michael Burley posted a stern warning on Monday that Bitcoin is a speculative wager, not a real hedge. He famous that whereas gold and silver have soared on issues a few weaker greenback, Bitcoin has not reacted, undermining its story as a retailer of worth.

Berry’s core focus is on company stability sheets. He warned that if Bitcoin have been to fall one other 10% from present ranges, Technique, the most important Bitcoin holder, may discover itself within the pink and unable to boost capital. Miners would be the subsequent to interrupt by, he mentioned.

Given Barry’s monitor document, this warning carries weight. His dying spiral concept means that pressured gross sales by distressed firm homeowners can set off a sequence of liquidations, driving down costs and creating much more distressed sellers in a reflexive suggestions loop.

Bitcoin is at the moment down 40% from its October excessive, justifying the issues of these questioning the knowledge of company monetary methods constructed round unstable belongings.

Spot outflows proceed at $54 million

Based on Coinglass knowledge, spot outflows on February 4 have been $54.45 million, persevering with the distribution sample that has characterised the previous two weeks. Promoting stress from the spot market confirms that holders are lowering their publicity relatively than accumulating at decrease ranges.

The circulation sample from late January to early February exhibits constant internet outflow with no significant cumulative days. If spot promoting persists throughout a crash, it signifies vendor confidence and raises questions on the place pure shopping for demand will emerge.

Associated: PI Value Prediction: PI trades in downtrend as provide unlocks close to February peak

If Barry’s concept proves right and firm homeowners start pressured gross sales, spot outflows may speed up considerably from present ranges.

Each day RSI reaches oversold territory

On the day by day chart, Bitcoin is buying and selling effectively under all 4 main EMAs throughout the descending channel that has guided the worth motion since October. The 20-day EMA is $84,468, the 50-day EMA is $88,280, the 100-day EMA is $92,655, and the 200-day EMA is $97,132.

The RSI fell to twenty-eight.75, coming into oversold territory for the primary time because the November 2024 correction. Oversold readings can precede a pullback, however don’t assure a reversal with out supporting value actions and bettering flows.

The downtrend line from October continues to constrain upside, with costs constantly slicing greater highs and decreasing lows. The horizontal assist zone at $65,000 represents the subsequent main space of demand if $74,000 fails.

Quick-term construction exhibits Bollinger Band compression

On the two-hour chart, Bitcoin broke under the decrease Bollinger Band at $74,743 earlier than recovering to $76,650. The 20-period SMA sits at $77,435, indicating instant resistance to any restoration try.

The Supertrend indicator stays bearish at $78,137, confirming a short-term downtrend. Value is making an attempt to regain the decrease certain of the Bollinger Bands after an oversold flash, a sample that might point out short-term stabilization.

The higher Bollinger Band at $80,126 represents the primary significant resistance zone. Bulls want an in depth above this degree to sign a change in momentum. Till then, the rally stays a salvage rebound inside a bigger downtrend.

Outlook: Will Bitcoin Rise?

The development stays bearish regardless of the worth buying and selling under the EMA cluster and the chance of a company sell-off looming.

- Bullish case: A day by day shut above $84,468 will retake the 20-day EMA and mark the $75,000 zone as an area backside. To realize this, it’s essential to stabilize company sentiment and enhance spot circulation.

- Bearish case: A detailed under $74,000 would verify Berry’s dying spiral concept and goal the $65,000 demand zone. This situation has significant likelihood as company stability sheets are beneath stress and spot outflows proceed.

RELATED: Dogecoin Value Prediction: Musk Moon’s Feedback Keep Flat as DOGE Struggles to Keep $0.10

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply