- Whereas the greenback recorded its greatest one-day achieve since November, Bitcoin failed to interrupt above $89,000, weakening the crypto market’s threat urge for food.

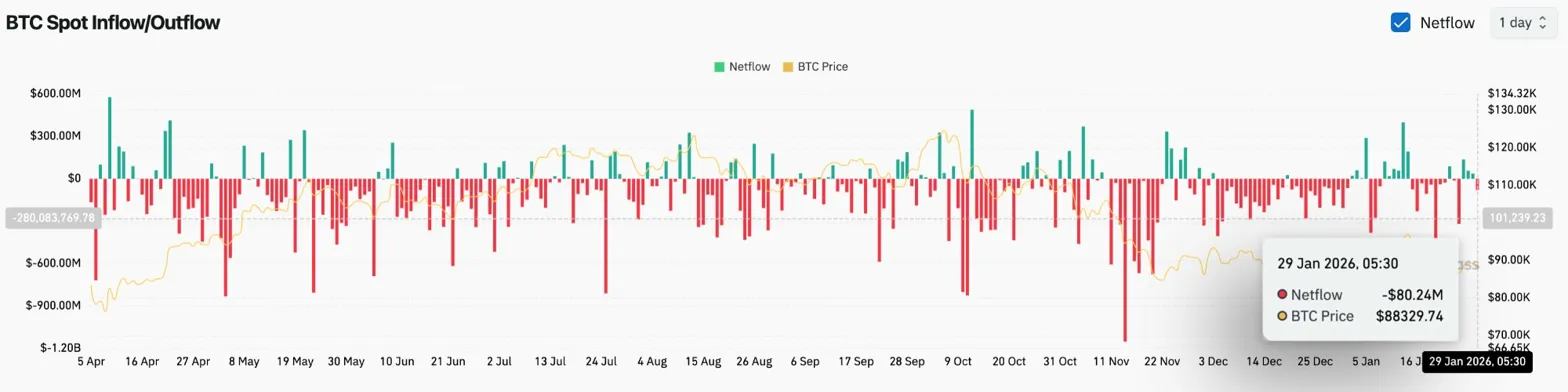

- Spot outflows reached $80.24 million on January 29, confirming that sellers stay in circulation whilst the value stays under its 50-day transferring common.

- A restoration would require a detailed above $90,073, with draw back threat in the direction of $85,000 if the uptrend line breaks.

After rejecting the $89,000 resistance zone for the third time this month, Bitcoin value is buying and selling round $88,200 immediately. The transfer follows a pointy rebound within the greenback and continued good points in gold, which topped $5,500 an oz earlier this week. BTC continues to be about 30% under its October excessive, whereas metals and shares are close to all-time highs.

Greenback rebound and gold rally solid a shadow on cryptocurrencies

The macro surroundings is unfavorable for threat belongings. Treasury Secretary Scott Bessent on Wednesday reaffirmed his administration’s coverage of strengthening the greenback, sparking the greenback index’s greatest single-session rally since November.

The transfer got here after the Federal Reserve confirmed endurance by holding rates of interest regular and refraining from additional charge cuts. The mix of a robust greenback and document gold costs has drawn capital to conventional secure havens, sidelining Bitcoin.

Analysts notice that BTC continues to commerce extra like a high-beta threat asset than a macro hedge. Whereas gold soared 15% and silver 30% through the greenback’s decline earlier this month, Bitcoin didn’t meaningfully take part in that rotation.

Distribution sample confirmed by spot runoff

International trade stream information reinforces our cautious view. Coinglass recorded web outflows of $80.24 million on January 29, persevering with a sample of regular distributions that lasted all through January.

Associated: Shiba Inu Value Prediction: SHIB faces bearish strain regardless of burn charge surging 1,200%

If spot flows flip adverse throughout consolidation, it normally signifies that holders are lowering publicity relatively than accumulating it. The shortage of inflows regardless of value stability round $88,000 means that consumers stay hesitant to intervene forward of main resistance ranges.

EMA cluster caps upside as construction weakens

On the each day chart, Bitcoin is buying and selling under all main exponential transferring averages. The 20-day EMA is $90,073, the 50-day EMA is $91,134, the 100-day EMA is $94,550, and the 200-day EMA is $98,327. This accumulation of resistance has created a ceiling that consumers haven’t been capable of break via since early January.

The Supertrend indicator stays bearish at $94,850, confirming the broader downtrend. Value motion exhibits repeated rejection close to the $89,000 stage, with spherical resistance coinciding with the 50-day transferring common zone.

The uptrend line from December lows round $85,000 is offering help via January. That construction stays intact, however the vary between trendline help and EMA resistance has narrowed, indicating a decision within the coming periods.

Struggling to construct momentum through the day

On the 30-minute chart, Bitcoin is buying and selling across the session VWAP of $88,228 after falling from the higher band at $88,601. The RSI fell to 40.48, reflecting a lack of momentum after an early session try above $89,000.

The decrease finish of the VWAP band at $87,855 represents instant help. Under this stage, the uptrend line close to $87,500 might be uncovered and the bulls might want to defend to take care of the short-term construction.

Intraday value motion has been decrease because the January 28 peak of $90,000, confirming that sellers are controlling the short-term course till consumers can confidently reclaim the $89,000 zone.

Outlook: Will Bitcoin Rise?

Whereas the value stays under the EMA cluster, the development stays bearish, however the uptrend line prevents the construction from turning right into a full breakdown.

- Bullish case: An in depth of the day above $90,073 would flip the 20-day EMA into help, marking step one towards resuming the broader development. This transfer will open the way in which to $94,500 and the 100-day EMA.

- Bearish case: A lack of the uptrend line close to $87,500 would invalidate the consolidation construction and expose the $85,000 demand zone. Under this stage, the goal is $82,000.

Associated: Solana Value Prediction: WisdomTree RWA Extension Meets Key Trendline Check

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply