- BTC is buying and selling in a slim vary, displaying indecision regardless of breaking above main assist.

- Rising futures open curiosity signifies potential volatility after the present correction section.

- Spot flows present defensive conduct, with outflows predominant and selective purchaser participation.

Bitcoin continues to commerce inside a slim vary on the 4-hour chart, suggesting a pause after the latest rally. Main cryptocurrencies confirmed decreased volatility as patrons and sellers remained cautious round key technical ranges. Market contributors look like specializing in construction somewhat than momentum, with value stability reflecting indecision somewhat than weak point.

Because of this, short-term path depended extra on positioning and flows than sudden speculative demand. Along with that, broader market situations have led merchants to attend for affirmation earlier than actively deploying funds.

A slim vary defines the short-term value construction

On the 4-hour timeframe, Bitcoin remained above the Ichimoku cloud, maintaining the short-term construction constructive. Nonetheless, costs have struggled to develop robust follow-through, suggesting restricted purchaser confidence.

The $92,300 space acted as a strong ceiling, limiting repeated makes an attempt to maneuver larger. Subsequently, merchants handled this stage as the principle set off for a breakout situation.

On the draw back, assist developed between $91,200 and $90,900 as patrons defended the pullback. Moreover, the $90,500 space has emerged as an vital zone, attracting consideration from short-term contributors.

Associated: Ethereum value prediction: Bitmine bets $4 billion as Tom Lee predicts restoration

If the transfer continues beneath this vary, the bullish stance is more likely to weaken. Because of this, if promoting strain intensifies, consideration shifts to deeper assist close to $89,200 and $86,300.

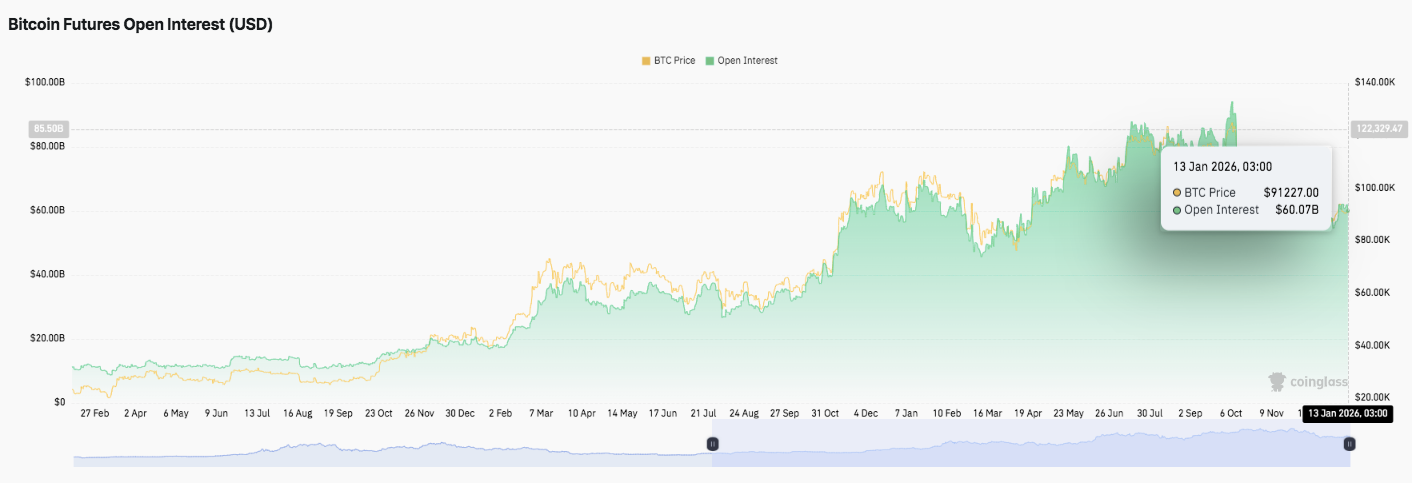

Derivatives buying and selling suggests elevated volatility danger

Bitcoin futures information reveals that participation in derivatives markets is rising. Open curiosity has steadily elevated through the consolidation section, indicating that merchants are sustaining publicity somewhat than exiting positions. Importantly, the interval of rising open curiosity is in line with earlier value will increase, reinforcing trend-following conduct.

Through the correction section, open curiosity briefly declined, however this means a decline in leverage somewhat than broader structural stress. Moreover, the latest restoration in open curiosity in direction of the $60 billion area suggests renewed confidence amongst futures merchants. Subsequently, the mixture of value stability and elevated derivatives publicity has elevated the chance of additional sharp actions sooner or later.

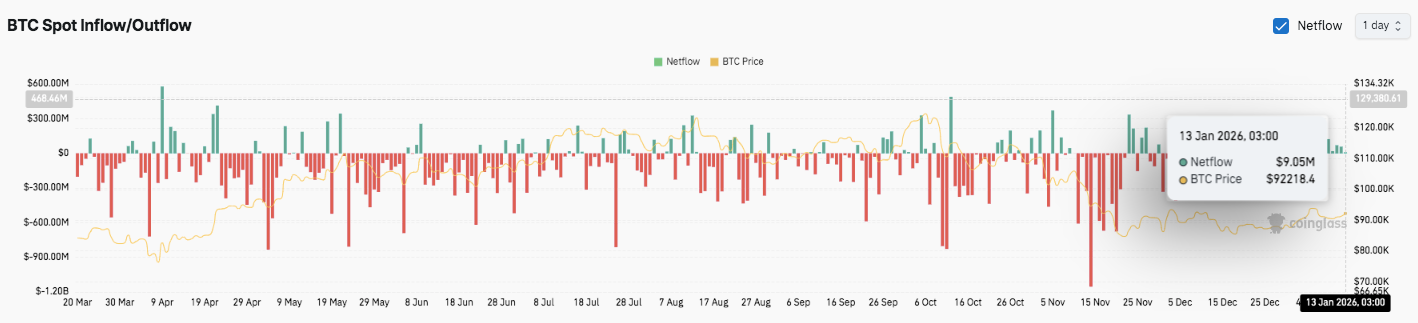

Spot flows mirror defensive market positioning

Spot market move information confirmed a extra cautious image. Sustained internet outflows have dominated latest buying and selling, highlighting defensive capital rotation by giant holders.

Brief-term influx spikes appeared throughout short-term restoration, however sustained accumulation couldn’t be established. Because of this, the market confirmed indicators of bullish promoting somewhat than long-term shopping for curiosity.

Associated: Chiliz Worth Prediction 2026: FIFA World Cup and $100M US Re-Entry Goal $0.10-$0.15

Particularly, spikes in outflows typically coincided with declines in native costs, reinforcing risk-managed actions. Moreover, latest inflows stay modest, suggesting that patrons are selectively collaborating. General, the move construction emphasised sustaining liquidity over aggressive positioning at present ranges.

Technical outlook for Bitcoin (BTC) value

Bitcoin trades inside a decent consolidation zone, so the crucial ranges stay well-defined.

The upside stage contains $92,337 as a right away resistance, adopted by $94,654 as a key ceiling that the bulls have to retake to renew pattern extension. A affirmation above $92,337 might speed up momentum in direction of the mid-$94,000 area.

On the draw back, preliminary assist is between $91,200 and $90,900 consistent with the short-term construction. Under that, $89,239 acts as a deeper demand whereas $90,517 stays the important thing pivot. If this stage just isn’t sustained, there’s a danger of heading in direction of $86,380.

Technical situations counsel that Bitcoin is compressing after the latest rally, which is usually a precursor to elevated volatility. Worth upkeep above key constructions helps a constructive bias, however confidence stays restricted.

Will Bitcoin rise?

The near-term outlook for Bitcoin value will rely upon whether or not patrons can defend the $90,500 space lengthy sufficient to problem $92,337. Stronger inflows and follow-through might push BTC nearer to $94,654.

Nonetheless, a break beneath $90,500 might weaken the construction and expose decrease assist. For now, Bitcoin continues to be within the crucial zone and requires affirmation to outline its subsequent path.

Associated: Shiba Inu Worth Prediction: SHIB is in a cooling section after a rally at first of the month

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply