- Bitcoin stays under the important thing downtrend line and the built-up EMA, with the broader construction remaining corrective somewhat than bullish.

- Continued spot outflows into December point out that sellers stay energetic, and thus far there are solely short-term indicators of stabilization.

- A transfer above $91,500 is required to alter momentum, however a break under $88,500 dangers one other drop.

As January begins, Bitcoin value in the present day is buying and selling round $89,950, with the market locked under the downtrend line that has capped any pullback since mid-November. This construction displays stabilization somewhat than restoration, with sellers nonetheless controlling the upper timeframe tape and patrons struggling to regain misplaced momentum.

Rejection of development line and EMA maintains construction safety

On the every day chart, Bitcoin continues to commerce under the 20-day, 50-day, 100-day, and 200-day EMAs and is at present hovering between $88,600 and $100,400. This bearish correction confirms that earlier help has became overhead provide.

The downtrend line drawn from the November peak stays the principle technical characteristic. The value tried to regain that line a number of occasions by December, however all approaches round $91,000 to $92,000 failed, and sellers tightened their management. The parabolic SAR continues to outperform costs, indicating that draw back stress has not absolutely reset.

The sharp decline in December has slowed, however the every day construction stays corrected as a result of lack of upper highs. Consumers are holding the extent however not pushing the tape larger.

Brief-term charts present steadiness somewhat than accumulation

On the 30-minute chart, Bitcoin is buying and selling inside an intraday ascending channel that has guided value actions since mid-December. This construction signifies larger lows, however momentum is flattening as value stalls under resistance.

The RSI is close to 49, reflecting a impartial state of affairs somewhat than bullish energy. The MACD has reversed and is now barely unfavorable, indicating that the upward momentum has rapidly light after pushing towards $91,000 in late December.

Confirm vendor remains to be energetic with spot movement information

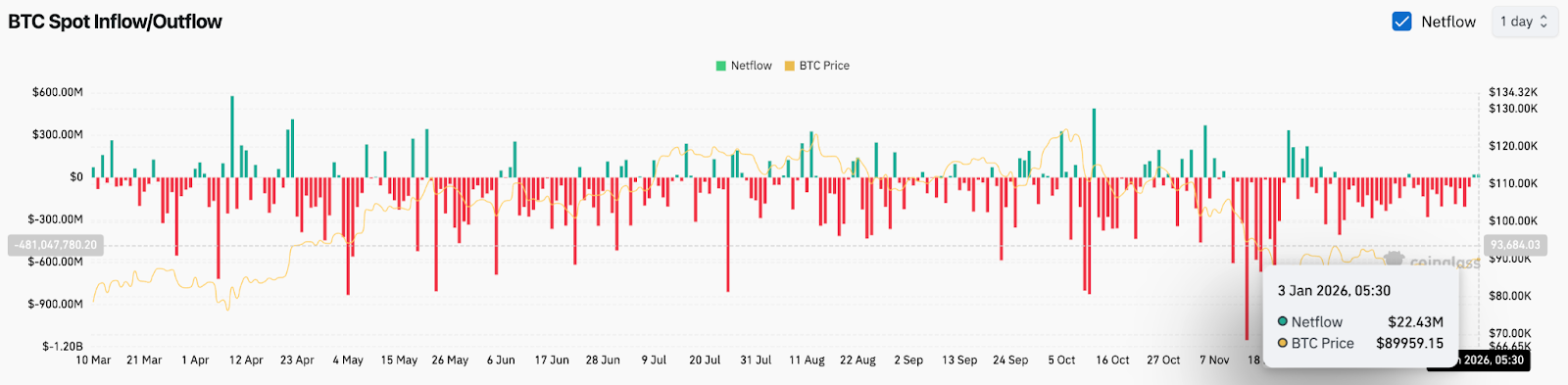

Spot movement information weighs defensive reads. In accordance with Coinglass, Bitcoin recorded steady internet spot outflows all through December, with a number of periods with outflows exceeding $300 million. These strikes have been made after every failed restoration try.

On January 3, netflow briefly turned optimistic at +$22.4 million, at which period Bitcoin was buying and selling close to $89,959. Whereas this quantity signifies a discount in promoting stress, it doesn’t characterize a reversal of the general development. The inflow of a single session after prolonged supply usually leads to stabilization somewhat than sign accumulation.

Spinoff exercise is a buying and selling sign, not a conviction

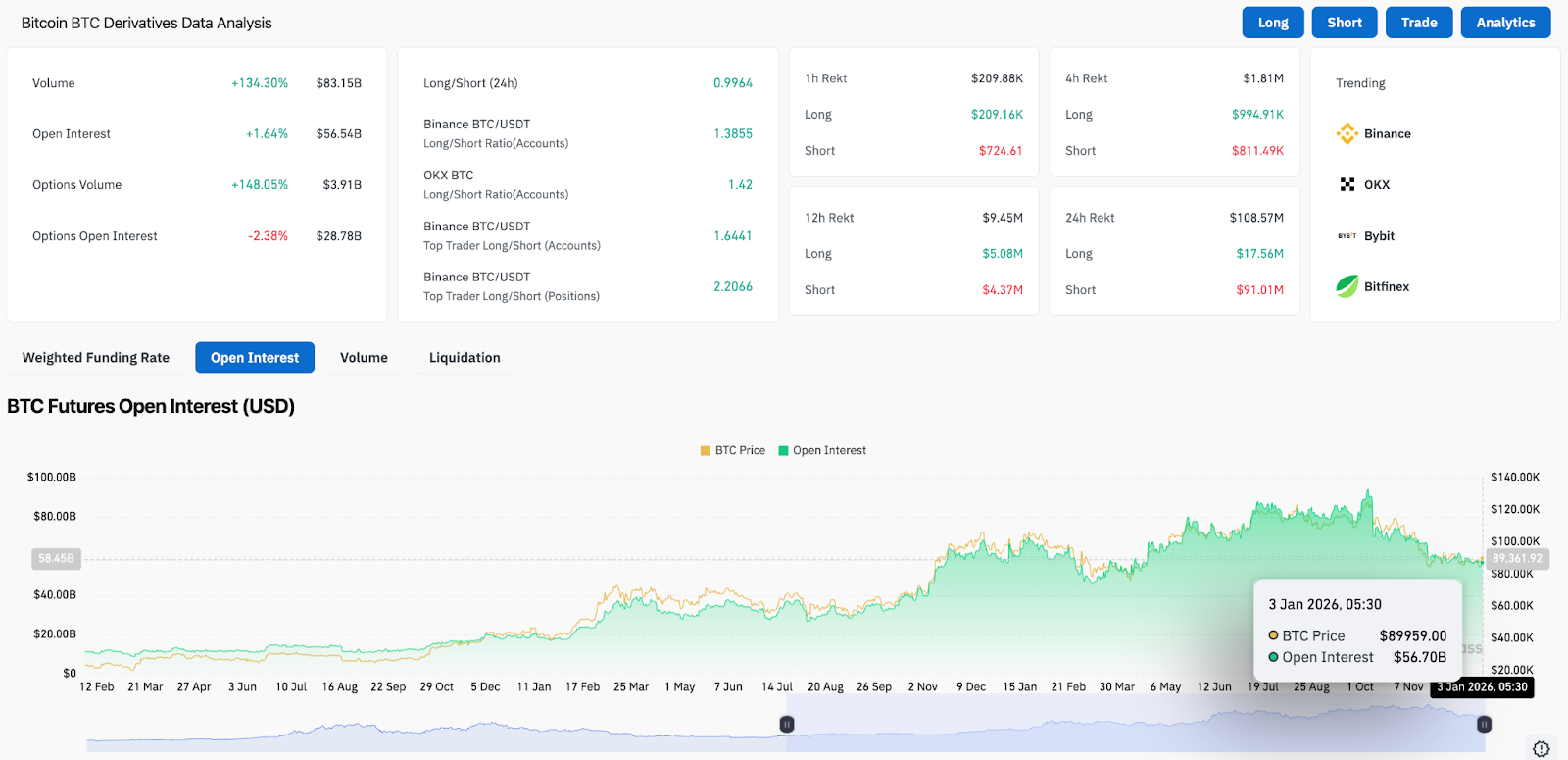

Derivatives information is turning into more and more alarming. Bitcoin derivatives buying and selling quantity elevated by 134% to roughly $83.1 billion, whereas open curiosity elevated barely by 1.6% to $56.7 billion. This divergence suggests aggressive positioning somewhat than aggressive directional betting.

The 24-hour long-to-short ratio of near 1.0 highlights the steadiness between accounts, however the prime dealer information nonetheless exhibits a protracted bias. This bias exhibits optimism amongst skilled merchants, however not sufficient confidence to power a breakout.

Liquidation information exhibits redemptions somewhat than development affirmation. Complete liquidations prior to now 24 hours amounted to $108.5 million, of which $91 million was attributable to quick positions. These flashes pushed costs larger in the course of the day, however there was no follow-through, reinforcing the view that the squeeze is on the promote.

outlook. Will Bitcoin go up?

Bitcoin will enter January 4th in a state of compression, not restoration. The vendor has misplaced urgency, however the purchaser has not regained management.

- Bullish Case: A definitive shut above $91,500 and subsequent acceptance above $96,800 would point out a structural change and open the way in which in direction of the $100,000 space as soon as once more.

- Bearish case: The $88,500 loss confirms new draw back stress, places $85,000 again into play, and if spot outflows resume, the danger extends to the low $80,000s.

Till considered one of these ranges breaks, Bitcoin shall be trapped in a value decline and any rally shall be handled as a check somewhat than a development reversal.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply