- Bitcoin consolidates beneath key EMA as sellers cap good points and strengthen vary buying and selling

- Robust demand close to $87,000 maintains construction regardless of general weak momentum indicators

- Enhance in open curiosity and spot outflows displays cautious stance in direction of 2026

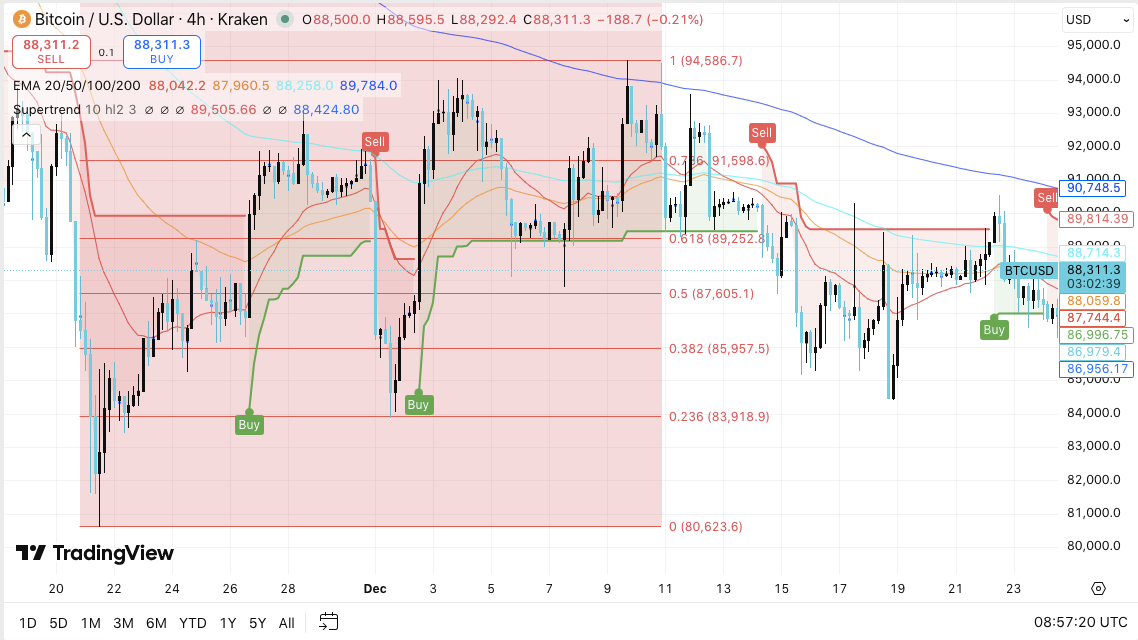

Bitcoin ended 2025 in a slim vary, reflecting a market torn between warning and long-term confidence. On the 4-hour chart, BTC is buying and selling close to the $88,500 zone, the place repeated pullbacks confronted sustained promoting stress.

Subsequently, the worth development steered a consolidation quite than a transparent directional breakout. Whereas merchants proceed to observe technical ranges, broader market indicators level to subdued optimism heading into 2026.

Quick-term construction exhibits stress

Bitcoin maintained its short-term bearish construction on the 4-hour time-frame. Costs fell beneath the falling 100-EMA and 200-EMA and had been concentrated across the $89,800 to $90,000 space.

Consequently, this zone acted as a ceiling that restricted upward momentum. Repeated makes an attempt to regain the excessive floor have failed, and sellers’ management has tightened.

Moreover, momentum indicators mirrored hesitation. The supertrend remained in promote mode, however the worth fashioned decrease highs. This construction steered that patrons defended the assist however lacked the energy to drive a sustained rally. So long as BTC stays beneath $89,900, the market supported vary buying and selling and one other take a look at of the low demand zone.

Key resistance ranges included $89,500 to $89,900, adopted by the earlier swing excessive of $91,600. Furthermore, the broader provide space lies between $94,500 and $95,000, posing a serious hurdle for the bulls.

Associated: Shiba Inu worth prediction: SHIB market reset because of falling open curiosity…

Regardless of the bearish indicators, Bitcoin continued to search out demand close to established assist ranges. The zone between $87,700 and $87,300 absorbed repeated declines and confirmed aggressive shopping for curiosity. Moreover, the $86,600 to $85,950 space coincided with Fibonacci assist and a earlier consolidation.

A deeper breakdown beneath $83,900 might expose BTC to the $80,600 macro assist. Nevertheless, the broader construction remained intact as costs stabilized above short-term assist. Consequently, the market didn’t proceed to say no aggressively, however as a substitute trended towards a gradual development.

Derivatives, spot flows, and company warning

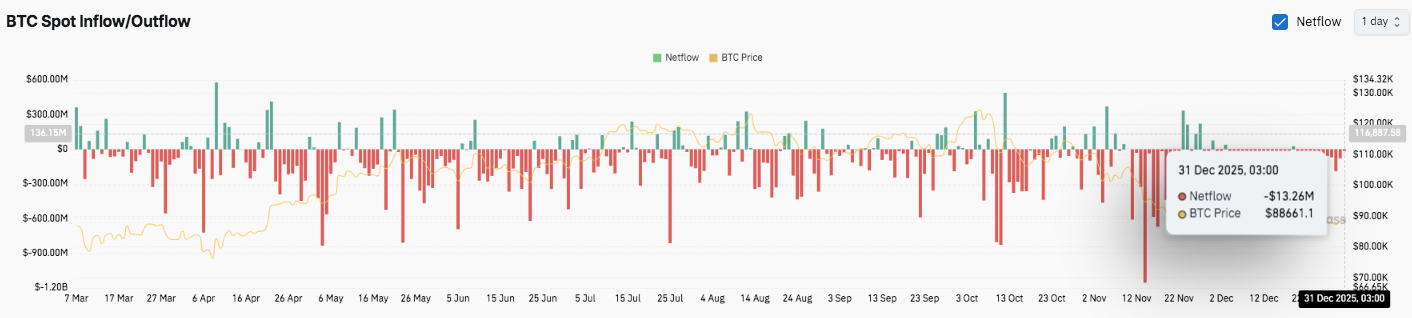

Derivatives information confirmed sustained engagement by 2025. Bitcoin futures open curiosity has been steadily growing and was over $55 billion as of late December. Importantly, the rise in open curiosity throughout the consolidation suggests continued leveraged positioning and sensitivity to spikes in volatility.

Nevertheless, spot stream information painted a defensive image. Outflows persistently exceed inflows, indicating distribution quite than accumulation. Furthermore, merchants seemed to be promoting aggressively, limiting any restoration momentum.

Company habits mirrored this warning. Prenetics, backed by David Beckham, has suspended its purchases of Bitcoin authorities bonds following months of market weak point.

Associated: Cardano Worth Prediction for 2026: Midnight Launch and Solana Bridge May Push ADA Above $2.50

The corporate allotted capital to its shopper companies, reflecting selective danger administration. Subsequently, whereas long-term curiosity in Bitcoin stays, short-term positioning displays restraint as 2026 approaches.

Technical outlook for Bitcoin (BTC) worth

Bitcoin trades inside a slim 4-hour vary, so the important thing ranges stay well-defined.

Notable upside ranges embody the 100-EMA, 200-EMA, and the supertrend convergence at $89,500 and $89,900. A confirmed breakout above $90,000 might open the door to $91,600, adopted by the next resistance zone round $94,500-$95,000. These ranges point out earlier swing highs and a wider space of provide.

On the draw back, quick assist is between $87,700 and $87,300, a zone that pulls repeat patrons. Under that, $86,600 and $85,950 act as essential Fibonacci assist bands. A breakdown of this space exhibits $83,900 uncovered and $80,600 as a broader low and macro assist.

The technical construction means that Bitcoin stays compressed beneath the falling transferring averages, reflecting near-term bearish stress. Costs proceed to make new highs, indicating restricted upward momentum for now. Nevertheless, repeated defenses of assist point out that the vendor lacks sturdy follow-through.

Will Bitcoin rise additional?

Bitcoin’s near-term path will rely upon whether or not patrons can get better and maintain onto greater than $90,000. If the pair sustains acceptance above this stage, momentum might head in direction of $91,600 and $94,500.

Nevertheless, failure to maintain $87,300 will enhance the danger of an extra pullback in direction of $85,950 and $83,900. For now, Bitcoin is at a pivotal inflection level, and volatility is more likely to enhance as soon as this vary clears.

Associated: Solana Worth Prediction for 2026: Firedancer, Western Union USDPT, and $476 Million ETF Influx Goal is Above $350

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply