- Bitcoin is holding at $90,000 after rebounding from $87,400, however the worth stays beneath all 4 EMAs as macro headwinds enhance.

- A research by the Peterson Institute warns that U.S. inflation might exceed 4% this yr, probably delaying the Fed’s fee cuts anticipated by crypto bulls.

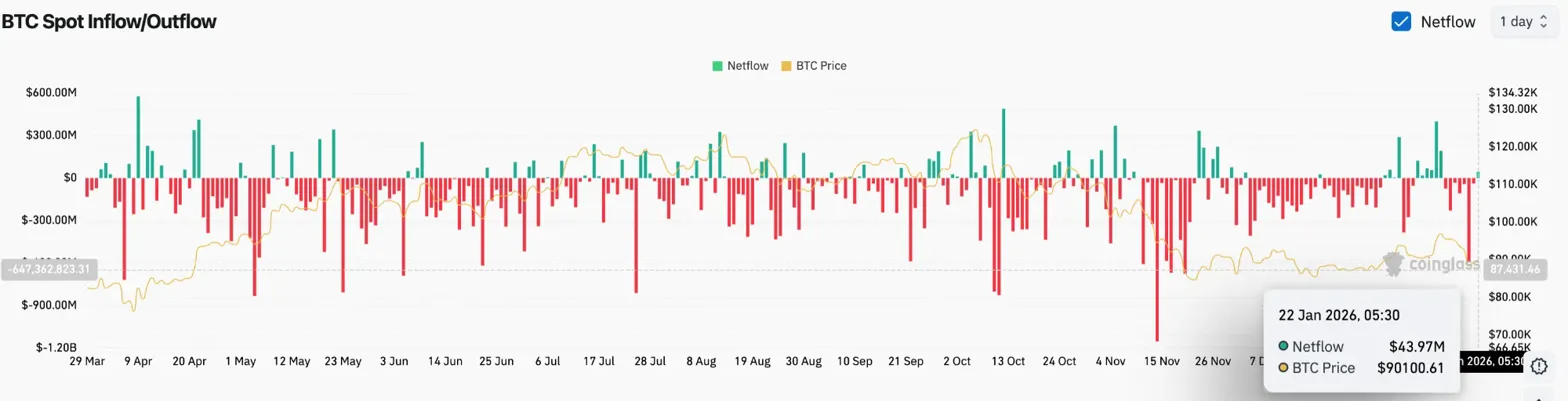

- Spot international alternate inflows reached $43.97 million, down 4% on the week, displaying accumulation regardless of rising U.S. Treasury yields.

After defending the $87,400 help examined earlier this week, Bitcoin worth is buying and selling round $90,091 at present. The restoration comes as new analysis warns that inflation might derail the rate of interest minimize narrative that has supported danger property and add a brand new layer of uncertainty to the macro backdrop.

Inflation warning challenges bulls’ idea

A brand new evaluation from the Peterson Institute and Lazard predicts that U.S. inflation might exceed 4% this yr, contradicting market expectations for continued disinflation and aggressive Fed fee cuts.

Adam Posen and Peter Orszag say elements pushing costs up embrace Trump-era tariffs being handed on to customers, a good labor market attributable to potential deportations, a price range deficit exceeding 7% of GDP, and easing monetary situations. They argue that these forces will outweigh productiveness positive factors from AI and decrease housing inflation.

Forecasting is essential for cryptocurrencies as a result of bull markets rely closely on decrease borrowing prices. If inflation flares up once more, the Fed will battle to chop charges as aggressively because the market expects. Funding banks are presently predicting fee cuts of 50-75 foundation factors this yr, and a few cryptocurrency analysts are predicting much more fee cuts.

Treasury yields are already reflecting the considerations. The ten-year bond yield hit a five-month excessive of 4.31% this week, marking a file excessive for Japanese authorities bonds. Rising yields make danger property much less engaging by growing the chance value of holding non-yielding investments like Bitcoin.

Spot inflows point out continued accumulation

On January twentieth, Coinglass noticed its worth drop to $88,427 and recorded a large internet outflow of $591.61 million, one of many largest single-day distributions in current months. The subsequent day noticed one other $38.6 million in trades, leaving BTC holding practically $89,454.

Associated: Chainlink Value Prediction: Hyperlink open curiosity cools as merchants slowly rebuild positions

The sample modified on January 22, with internet inflows of $43.97 million, suggesting that consumers had lastly stepped in to soak up the promoting. When flows flip from high-volume distribution to accumulation at low costs, it usually signifies a possible regional backside.

A complete of $630 million in distributions over two days worn out the underdogs who entered through the rally above $95,000. These sellers are actually exiting, decreasing overhead provide and creating room for restoration when macro situations stabilize.

Value defends the help of the uptrend line

On the each day chart, Bitcoin has rebounded from an uptrend line drawn from December lows round $80,000. This construction has up to now included modifications, and every check attracted consumers who defended the sample.

Value remains to be beneath all 4 EMAs, reflecting short-term weak spot.

- Rapid resistance: $91,694 (20 EMA)

- Secondary resistance: $91,997 (50 EMA)

- Key resistance: $95,465 (100 EMA)

- Supertrend resistance: $96,483

- Development resistance: $99,042 (200 EMA)

- Uptrend line help: $88,000 to $88,500

- Breakdown objective: $85,000

The supertrend indicator turned bearish at $96,483 and continues to behave as overhead resistance. A return to this degree would sign that momentum is returning in the direction of consumers.

Associated: River Value Prediction: River pulls again from excessive as open curiosity reaches new peak

Intraday restoration signifies stabilization

The shorter the timeframe, the extra apparent the dynamics of the bounce. On the 30-minute chart, the value recovered from $87,400 and examined the $90,000 resistance. The RSI rose to 56.16 after reaching an oversold excessive throughout Monday’s decline.

The MACD exhibits a bullish crossover forming, with the histogram turning optimistic for the primary time since final week. This implies that promoting strain has dried up at present ranges, at the least briefly.

The $90,000 degree will act as a pivot. A transfer above this zone will verify a rebound and goal the 20 EMA at $91,694. A failed maintain will as soon as once more open the door to a retest of trendline help close to $88,000.

Outlook: Can Bitcoin take up macro pressures?

Cautious setup is required. Rising yields, inflation considerations and tariff uncertainty are creating headwinds that did not exist two weeks in the past. Whereas the technical pullback seems optimistic, macro elements might override short-term indicators.

- Bullish case: Value sustains above the $88,000 trendline help and retakes the 20 EMA at $91,694. A detailed above $92,000 signifies the correction is over and the goal is $95,000.

- Bearish case: Inflation information confirms the Peterson Institute’s warnings, with yields rising and danger property falling. A detailed beneath $88,000 would break the trendline help, with a goal of $85,000 and a possible $80,000 if the selloff accelerates.

Associated: Seeker (SKR) Value Prediction 2026: Can Solana’s Cell Token Problem Apple and Google?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply