- The Bitcoin Spot ETF recorded every day inflows of $118 million, marking a fourth consecutive day of institutional accumulation led by BlackRock.

- Outflows from spot exchanges amounted to $126.52 million, indicating that retail and short-term merchants are allocating funds to ETF-led power.

- Worth stays constrained under the 100-day EMA of $95,981, and the bulls want to shut above $99,500 for momentum to alter.

Bitcoin worth is buying and selling close to $95,676 immediately after failing to regain the 100-day EMA for 3 consecutive classes. The transfer comes as institutional and retail flows diverge, making a tug-of-war between ETF accumulation and spot distributions.

ETF inflows proceed for 4 consecutive days

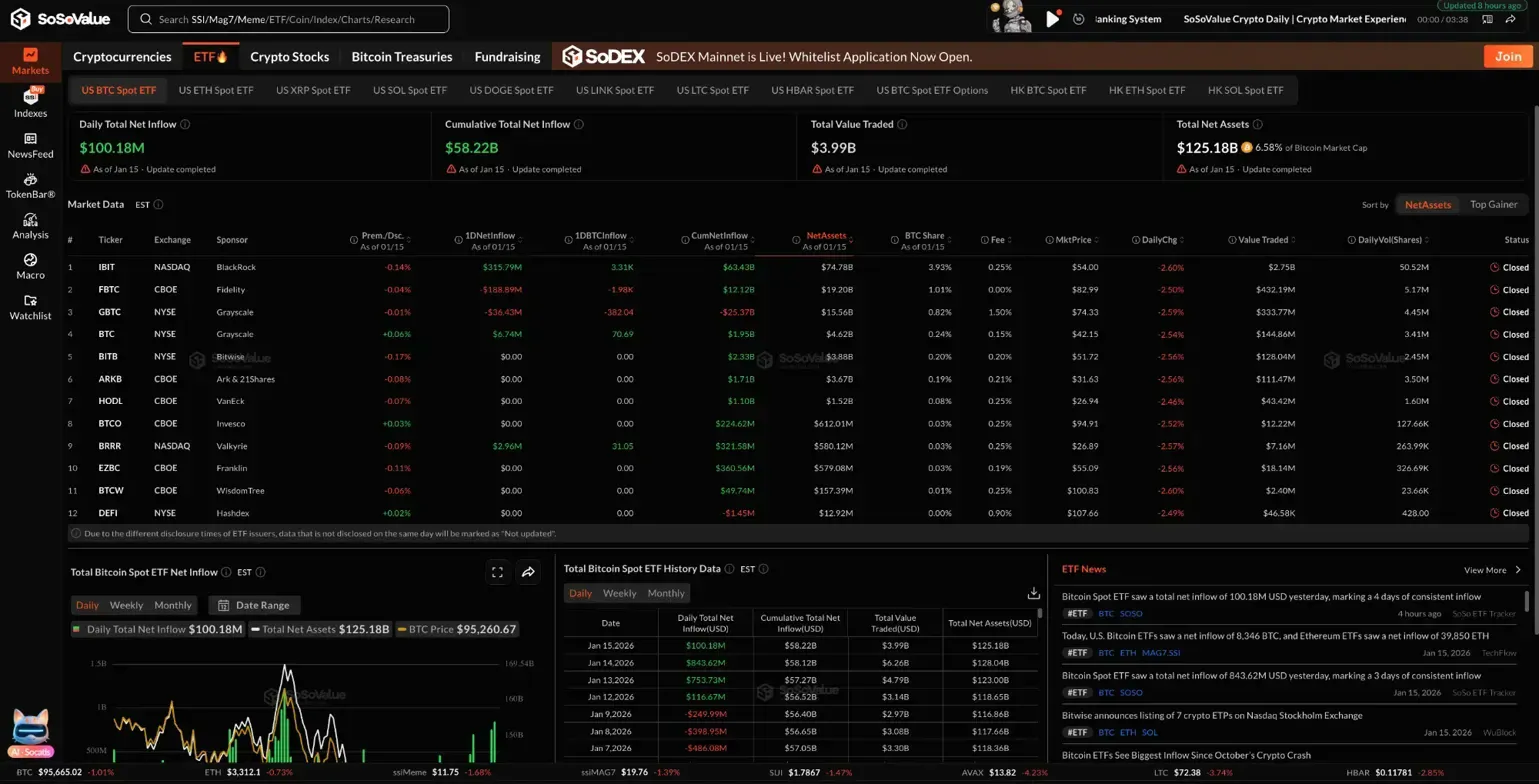

Institutional demand stays sturdy regardless of unstable worth traits. In keeping with SoSoValue, the Bitcoin Spot ETF recorded web inflows of $118 million on January 15, marking the fourth straight day of consecutive will increase in inflows.

BlackRock’s IBIT led the session with $315.79 million in new capital. Constancy’s FBTC adopted with $188.89 million. Grayscale’s GBTC continued to bleed, shedding one other $36.43 million as conventional holders switched to lower-fee merchandise.

The ETF’s complete belongings underneath administration at present stand at $125.19 billion. Cumulative web inflows since launch have reached $58.22 billion, reflecting sustained institutional investor perception whilst costs stay under key resistance ranges.

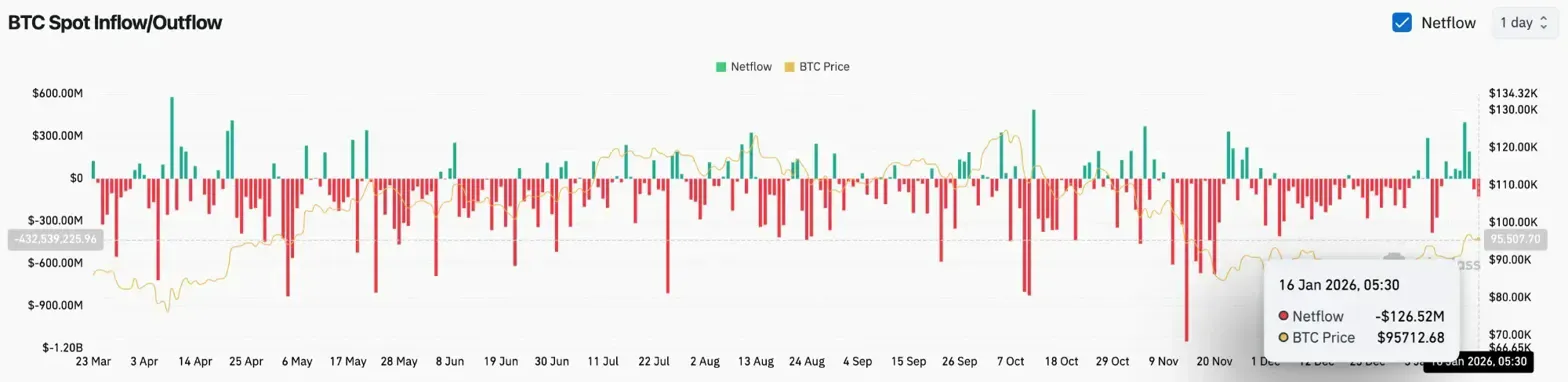

Spot outflow sign distribution

The spot market tells a special story. As of January 16, web outflows from the alternate had been $126.52 million, in keeping with Coinglass information. Cash are returning to exchanges slightly than chilly storage, a sample that often accompanies promoting stress.

Associated: Shiba Inu worth prediction: Burn fee collapses by 87% as there are solely 550,000 Shiba Inu…

This discrepancy is vital. ETF consumers accumulate by regulated automobiles, and spot holders distribute to their bids. Because of this, though the market absorbs the promoting with out collapsing, the market lacks the momentum to push up costs.

When flows are inconsistent, costs are likely to fluctuate. This transfer explains the tight consolidation between $94,000 and $98,000 over the previous week.

Worth stalls under 100-day EMA

On the every day chart, Bitcoin stays trapped between the 50-day EMA of $92,173 and the 100-day EMA of $95,981. The 200-day EMA is above $99,512, which is a significant resistance that the bulls have to get well.

Latest construction exhibits a sequence of lows forming from December’s lows close to $80,000. Worth has recovered inside the ascending channel however continues to face rejection on the higher finish close to $98,000.

The present main ranges are:

- Quick resistance: $95,981 (100 EMA)

- Key resistance: $99,512 (200 EMA)

- Brief-term help: $92,139 to $92,173 (20/50 EMA cluster)

- Breakdown stage: $88,496 (Supertrend)

The Supertrend indicator stays bullish on the every day timeframe, suggesting that the broad restoration development stays so long as the value stays above $88,500.

Associated: Dogecoin Worth Prediction: Dogecoin rebounds after plunge, however resists…

Hourly chart exhibits consolidation close to cloud help

On shorter time frames, we see the market looking for route. On the hourly chart, Bitcoin is buying and selling inside a transparent cloud, reflecting indecision amongst consumers and sellers.

Parabolic SAR is $95,081, barely under the present worth. A detailed under this stage would flip the short-term momentum bearish and open the door to a retest of $94,000.

Consumers have defended the $95,000 zone in a number of intraday checks. That stage now serves as a line within the sand for short-term positioning.

Outlook: Will Bitcoin Rise Additional?

This development stays constructive, however much less sure. ETF flows are supporting the bid, however spot distributions are dampening the upward momentum. The vary situation continues till one overwhelms the opposite.

- Bullish case: A every day shut above $95,981 clears the 100 EMA and targets $99,500. A retracement of the 200 EMA together with quantity confirms the resumption of the development in the direction of $104,000.

- Bearish case: Shedding $92,000 destroys the EMA cluster and drains $88,500. A detailed under the supertrend will trigger a bearish reversal of the construction, beginning at $85,000.

Bitcoin is at an inflection level. The following sustained transfer will depend upon whether or not ETF accumulation can take up spot promoting stress and push costs increased by overhead resistance.

Associated: Web Laptop Predictions for 2026: Mission70 to scale back inflation by 70%, AI integration targets $8-12

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply