- Bitcoin worth is aiming to retest the important thing resistance degree close to $99,000.

- In response to on-chain knowledge, Bitcoin whales have been actively offered in This autumn 2025, however haven’t proven any new curiosity.

- Supportive cumulative fundamentals might be a significant bullish sign for BTC in 2026.

The spectacular restoration in Bitcoin (BTC) worth in 2026 doesn’t invalidate the medium-term bearish development. The cryptocurrency neighborhood is trying ahead to the Bitcoin worth constantly ending above $99,000, impressed by whale buyers.

Bitcoin worth approaches key tipping level in the direction of 2026

BTC Whales lose grip

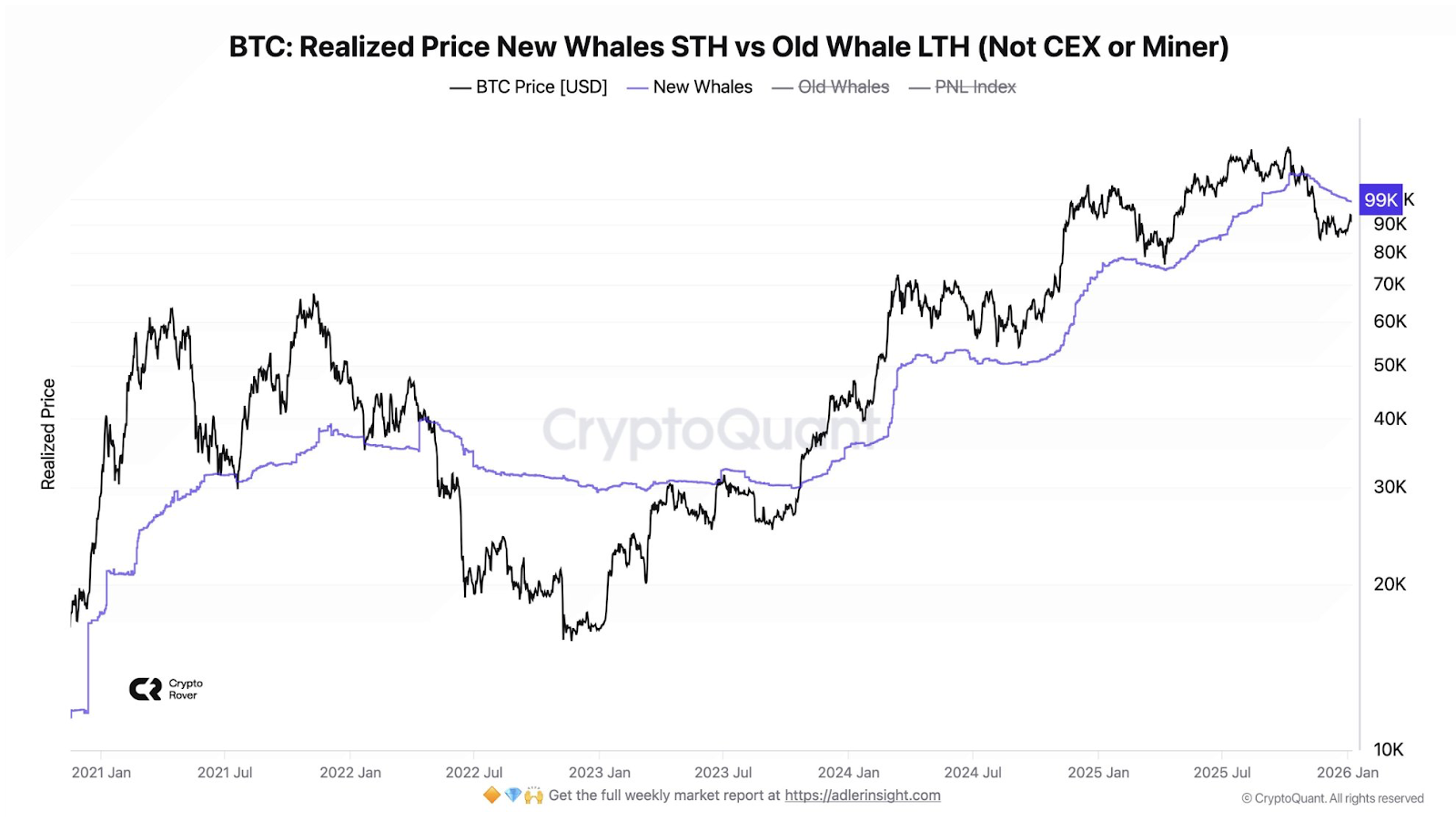

In response to CryptoQuant’s on-chain knowledge evaluation, the realized worth of Bitcoin for short-term holders of latest whales and long-term holders of previous whales, excluding miners and CEX, has fallen to $99,000. As such, Crypto Rover acknowledged that Bitcoin worth is approaching a big resistance degree as short-term holders of the brand new whale are prepared to promote on the break-even worth of $99,000.

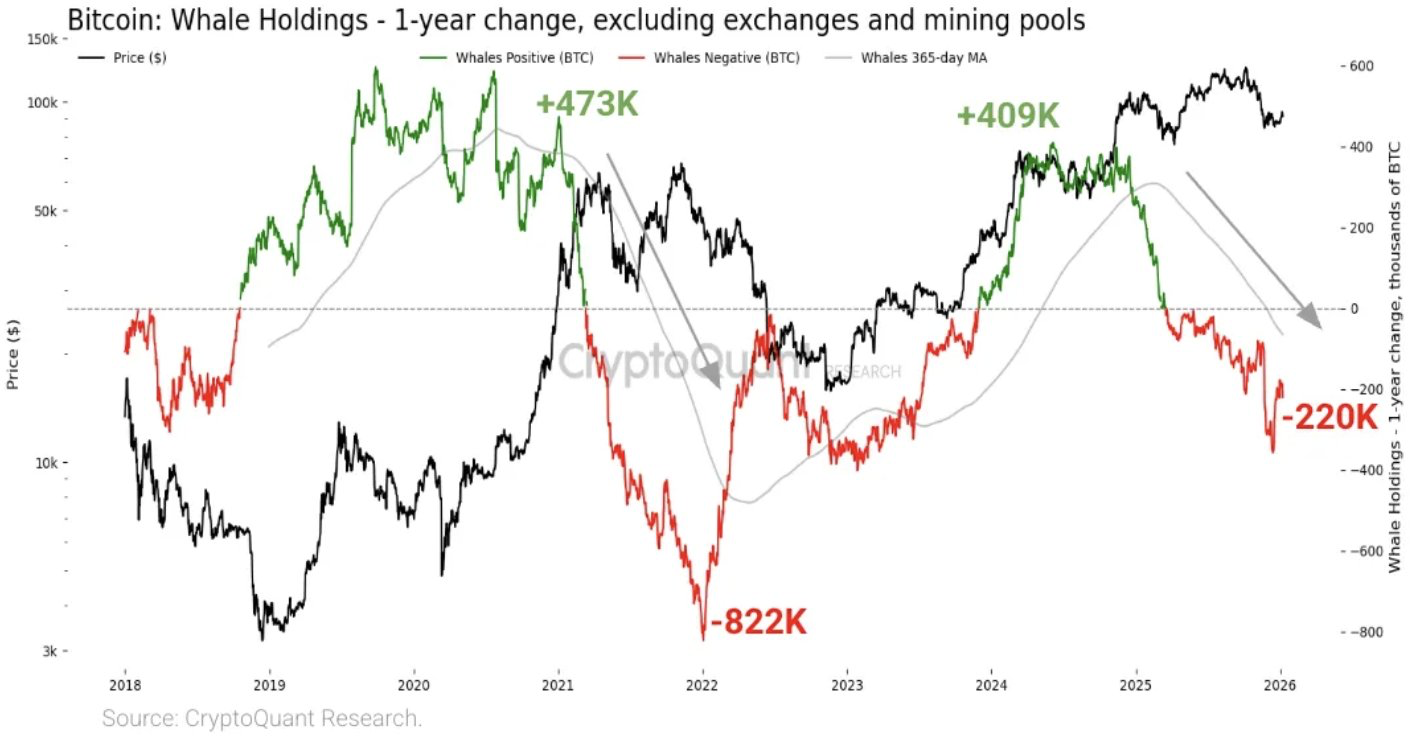

CryptoQuant knowledge additionally exhibits that enormous Bitcoin buyers are usually not shopping for the push after the capitulation in 2025. Particularly, the variety of Bitcoin addresses amongst whales holding 1,000 to 10,000 BTC has decreased by 220,000 BTC in comparison with the earlier yr, marking the quickest decline because the starting of 2023.

As such, Crypto Rover acknowledged that $99,000 can be the important thing resistance for Bitcoin to interrupt out with a view to validate the parabolic rally in 2026.

Associated article: 4 explanation why Bitcoin might return to six-digit orbit

Issues a few potential US authorities shutdown

Crypto Rover additionally famous that Bitcoin costs are approaching a hawkish occasion following President Donald Trump’s announcement that one other authorities shutdown might start on January 30, 2026.

Over the last US authorities shutdown, BTC worth fell by practically 20%. Subsequently, a possible US authorities shutdown amidst low BTC demand from whales would additional strengthen the medium-term bearish temper.

The large image: BTC/XAU quick squeeze

Although the above situation is prone to play out within the quick time period, the worldwide cryptocurrency neighborhood stays agency on the concept the four-year Bitcoin cycle is over. Wall Road analysts led by Tom Lee are proposing a Bitcoin supercycle pushed by cumulatively robust fundamentals and anticipated capital turnover from the dear metals business.

For greater than eight months, gold and silver have posted consecutive month-to-month highs (ATHs). Nonetheless, Bitcoin costs have been risky, dropping greater than 10% in 2025.

From a technical evaluation perspective, the capital turnover from gold to Bitcoin is about to speed up in parallel with the rise in international cash provide. Particularly, the BTC/XAU pair on the each day timeframe has shaped a possible reversal sample characterised by an inverted head-and-shoulders (H&S) form, coupled with an rising oversold Relative Power Index (RSI) divergence.

Subsequently, there’s a good probability that Bitcoin worth will rise to $99,000 within the close to future with macroeconomic assist.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply