Altcoin value motion stays fragile as merchants reassess dangers, with Cardano ADA at present hovering close to assist after the most recent wave of promoting.

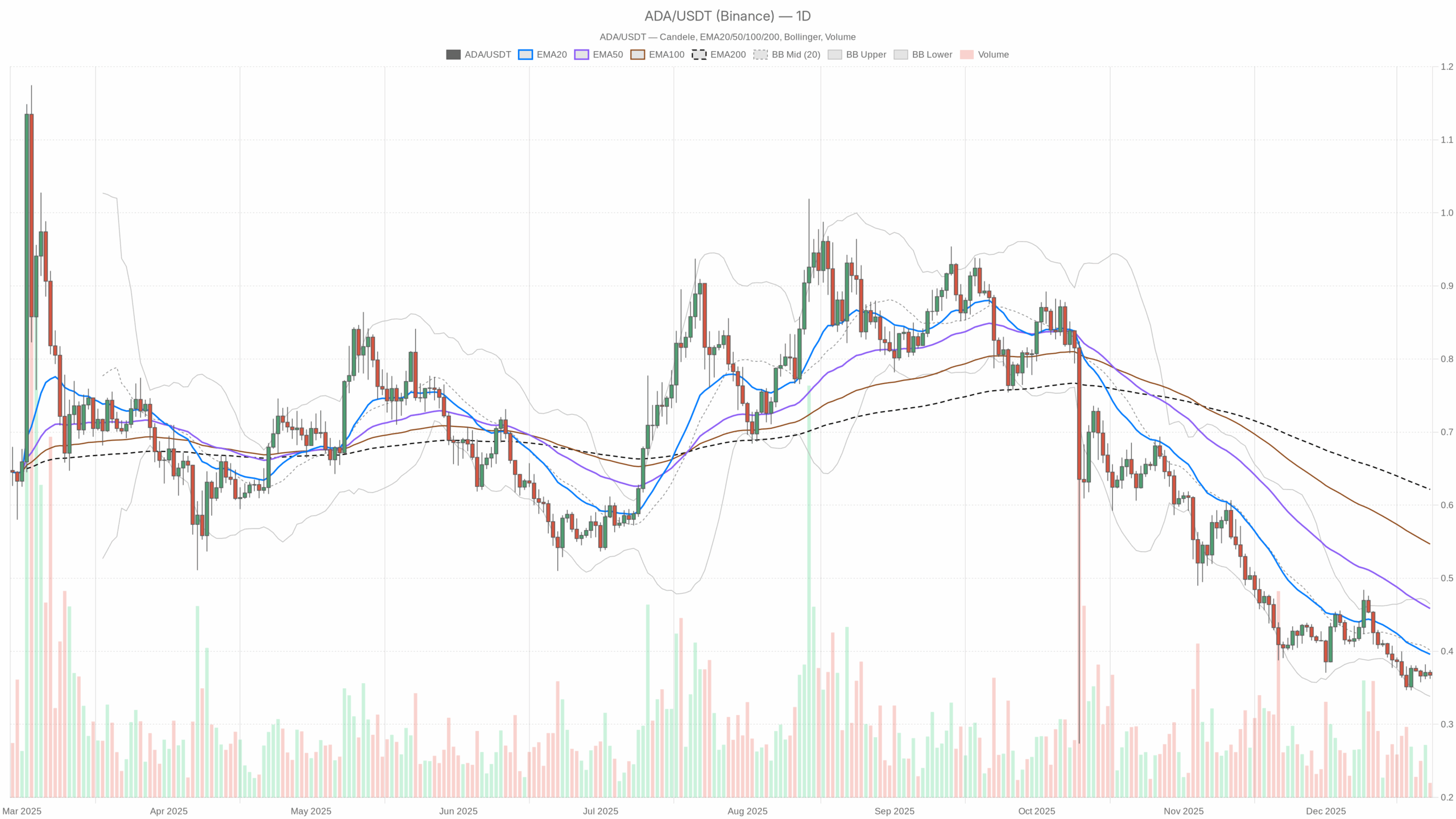

Every day timeframe (D1): Macro bias – bearish however not capitulating

Development construction – EMA

– Value (closing value): $0.37

– EMA 20: $0.40

– EMA 50: $0.46

– EMA 200: $0.62

Cardano’s ADA is being traded Beneath the 20-day, 50-day, and 200-day EMA. A stack of 20 < 50 < 200 confirms a mature downtrend, not only a random decline. The distinction between the value and the 200-day EMA (roughly $0.62) is giant, indicating that the market has been pushing the value of ADA decrease in latest months. On the identical time, the value is simply barely beneath the 20-day EMA ($0.40). Brief-term leg down has not but elevated considerably.. This favors a continuation of the pattern with intermittent imply reversion pops moderately than a right away V-shaped restoration.

Momentum – RSI

– RSI 14 (D1): 37.6

The day by day RSI is beneath 40, however it’s not oversold but. it is a traditional managed downtrend. Sellers are in management, however there’s nonetheless room for declines earlier than reaching exhaustion. It is weak sufficient to warn of pushback shopping for, however not so weak that it requires capitulation. In different phrases, Except the RSI is ready to regain and preserve the 45-50 area, a pullback from right here is more likely to be a bear market rally..

Momentum affirmation – MACD

– MACD line: -0.03

– Sign line: -0.03

– Histogram: ≈ 0

Though the day by day MACD is detrimental, the strains and alerts basically overlap and the histogram is near zero. The downward pattern is I will not speed up anymore;Momentum leveled off. It typically precedes one of many following: Lateral integration or slowly decrease the grind. Whereas not giving a transparent reversal sign, he stated the fast financing portion of the decline has probably handed for now.

Volatility and Vary – Bollinger Bands and ATR

– Bollinger bands (20,2):

• Mid: $0.40

• Prime: $0.46

• Decrease: $0.34

– ATR 14 (D1): $0.02

The worth has fallen beneath the midline and is approaching the decrease band. $0.34. The band span ($0.34-$0.46) is pretty huge, however the ATR is small. $0.02 signifies Common day by day journey is modest in comparison with your entire vary. Merely put, ADA is weak, however not in a excessive volatility panic. it’s advantageous sluggish and violent value actionsa brief squeeze could seem, nevertheless it typically fades out across the Bollinger mid- or higher bands except the macro image improves.

Brief-term reference ranges – day by day pivots

– Pivot Level (PP): $0.37

– R1: $0.37

– S1: $0.36

Automated pivot ranges maintain you targeted $0.37 to $0.36 this zone quick time period steadiness space. By holding above $0.36, ADA maintains a managed decline. Nonetheless, a clear break and day by day shut beneath $0.36 will probably open the door to a check of the decrease sure close to the Bollinger Bands. $0.34.

H1 timeframe: Intraday bias – bearish however secure pattern

Development – H1 EMA

– Value (closing value): $0.37

– EMA 20: $0.37

– EMA 50: $0.37

– EMA 200: $0.38

– Authorities: bearish

On the hourly chart, the value is calm Near clusters of EMA 20 and 50slightly below the 200 EMA. what’s it A brief-term pause inside a broader downtrend Appears to be like like. The intraday construction is about to take maintain, however except ADA can confidently retake the hourly 200 EMA round $0.38, the bears will nonetheless maintain onto the upper floor.

Momentum – RSI and MACD for the primary half of the 12 months

– RSI 14 (1H): 47.2

– MACD line: 0.00

– Sign: 0.00

– Histogram: 0.00

The hourly RSI stays beneath 50. From impartial to comfortable: There isn’t any aggressive promoting or robust push shopping for. The flat MACD line confirms that because the intraday ADA slipped into small values. equilibrium zone. In observe, because of this the primary half isn’t actively preventing the day by day bearish pattern, however additionally it is not amplifying it in the meanwhile. The following impulse from this H1 steadiness will probably decide whether or not the value retests $0.36 or makes an attempt to push in the direction of $0.40.

Vary and noise – Bollinger bands and first half ATR

– Bollinger Bands (first half):

• Mid: $0.37

• Prime: $0.38

• Decrease: $0.36

– ATR 14 (1H): ≈ 0

Because the band is tight round $0.37 and ATR is close to zero per hour, the market is low volatility coil. This often precedes a rise in volatility. The path of this breakout might be as follows. Every day bias (downward) Except a robust catalyst emerges. For now, intraday merchants are coping with a good vary and a breakout try might simply happen.

15m timeframe: Execution context – impartial, short-term rebound potential

Developments and Momentum – 15m

– Value (closing value): $0.37

– EMA 20/50/200: All-round $0.37

– RSI 14 (15m): 58.0

– MACD: flat round 0

– Authorities: impartial

On the 15 minute chart, ADA is wrapped round a brief EMAthe RSI is pushing in the direction of 60. That is gentle. short-term upward bias Contained in the flat microstructure. For an energetic dealer, that is the type of setup the place you see small intraday beneficial properties, say a $0.38-$0.39 check, with out altering the massive image in any respect.

Provided that 15m is mildly constructive whereas the day by day is decidedly bearish, the power of this timeframe ought to be handled as follows: Potential gas for higher quick sale entry or partial revenue taking of current quick gross sales. A pattern reversal has not been confirmed.

Market background and Cardano DeFi background

The broader crypto market is on the defensive: complete market capitalization $3.06 trilliondown about 2% in 24 hours, outweighed by BTC’s dominance 57%. excessive worry twenty 4 It signifies that the contributors are danger averse. Altcoins comparable to ADA sometimes endure extra at this stage as capital is concentrated in BTC and stablecoins.

Apparently, Cardano DeFi on-chain exercise isn’t lifeless. Like main DEXs Minswap, SundaeSwap V2, WingRiders I’ve seen it earlier than Vital improve in charges for 30 days Improve in 3- to 4-digit percentages. Nonetheless, we’ve got seen a decline in charges over the previous 24 hours. it’s, Gradual elementary engagement Nonetheless, with present macros, the market has not but rewarded it within the type of value will increase. For merchants, that is extra of a medium-term tailwind than a short-term buying and selling sign.

ADUSDT State of affairs

Bullish State of affairs: Imply Reversal Off Assist

For the bull, the highway passes imply reversionnot pattern following. The settings ought to seem like this:

1. Protection $0.36 to $0.34: The decrease band space held on the day by day closing value and was instantly repurchased on the intraday drop beneath $0.36.

2. RSI stabilization:The day by day RSI has bottomed out above 35 and is returning to the mid-40s, reflecting the lack of draw back momentum.

3. breakout by hour: ADA collects and holds in 1H. Above the 200 EMA (~$0.38)turning that stage into assist moderately than resistance.

4. first upside goal:Push close to the day by day Bollinger intermediate and 20-day EMA cluster $0.40 to $0.41.

5. enlargement: If broader market danger urge for food returns as BTC stabilizes and considerations subside, there might be a squeeze in the direction of the higher band or close to the EMA50. $0.46 turns into attainable. It might nonetheless be a countertrend transfer inside a bigger bearish construction.

What invalidates the bullish situation?

a Clear Every day closing value beneath $0.34mixed with the day by day RSI falling beneath 30, means that the market has moved from a managed downtrend to a brand new capitulation. If that occurs, the main focus will return to draw back discovery moderately than common reversals.

Bearish situation: continuation of the downtrend

So long as the macro is risk-off, the chance of pattern continuation prevails.

The essential parts are:

1. Fail at $0.38 to $0.40: The intraday bounce has stalled beneath the hourly 200 EMA and day by day 20 EMA, with sellers defending that zone repeatedly.

2. Break of $0.36: Hourly and day by day closing instances are as follows $0.36turning it into resistance and pushing the value to the underside of the Bollinger Bands. $0.34.

3. momentum rollover: The day by day RSI is transferring from the late 30s to the low 30s and not using a robust rebound, however the MACD stays detrimental and is beginning to widen its downward pattern once more.

4. new vary is decrease: after tag or break $0.34ADA establishes a brand new sub-integration space. In a demanding atmosphere, it might develop right into a wider vary of $0.28 to $0.34 relying on the liquidity of Bitcoin and the general market.

What would invalidate the bearish situation?

sustained motion exceeding Every day 20 EMA and $0.40 to $0.41 spaceThe case for bearish continuation will weaken if the day by day RSI returns to 50 and is supported by a clearly rising hourly construction. In that scenario, highs and lows above $0.38 might be essential. In that case, bears would want to deal with the rally close to $0.46 as a brand new resolution level, moderately than assuming a straight decline.

Click on right here for the positioning, dangers, and philosophy of ADA

The construction of the day is bearisheach hour Steady however not reversing15m is Impartial with a barely bullish pattern throughout the day. This mixture is often advantageous within the following circumstances:

– pattern dealer We’re leaning in the direction of the day by day downtrend and are contemplating promoting power to $0.38-$0.40 as a substitute of driving weak point to $0.34.

– imply reversion dealer Take the opposite facet solely in well-defined excessive circumstances. This implies taking much less danger and shopping for close to the decrease band or $0.34, or fading the rally in the direction of $0.46 if it arrives on a weaker band.

Volatility is at present comparatively subdued, ATR is low on the intraday chart, and a get away of this slim vary might change shortly. As market sentiment stays in excessive worry and BTC’s dominance is rising, Altcoin beta model is bidirectional. ADA might underperform on account of additional risk-off, nevertheless it might additionally rebound considerably if the market finally comes again to life.

So $0.37 ADA is Half of the vary is weak, however not but within the give up zone. The benefit lies in respecting the prevailing downtrend whereas getting ready for a sudden sentiment-driven squeeze when worry peaks.

If you wish to monitor the market utilizing skilled charting instruments and real-time knowledge, you may open an account with Investing utilizing our companion hyperlink.

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We could earn commissions at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and displays a technical view of market situations on the time of writing in 2024. This isn’t funding, monetary or buying and selling recommendation and shouldn’t be the only real foundation for any buying and selling or funding selections. Markets are unstable and unpredictable. At all times do your personal analysis and take into account your danger tolerance earlier than committing capital.

Leave a Reply