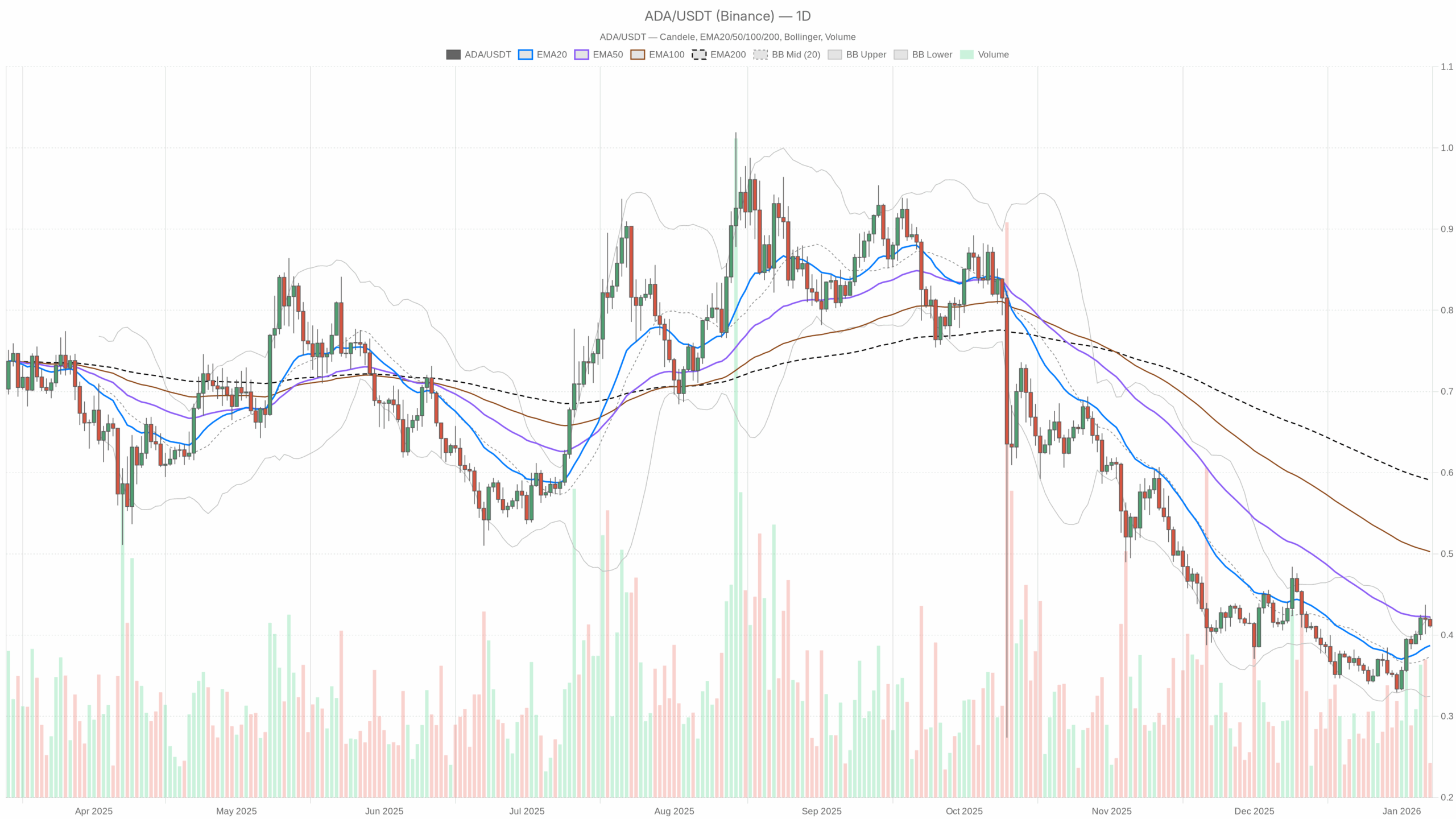

The value motion of the Cardano ADA cryptocurrency has compressed volatility and is locked in a slender vary round key ranges, with as soon as a break, the following impulsive leg is prone to be sharp.

Every day chart (D1): Impartial base with delicate bullish pattern

Development and EMA: early restoration underneath heavy higher restrict of 200 days

Each day, ADA closes on $0.41:

- Value vs EMA20/50/200: Closing value $0.41, EMA20 $0.39, EMA50 $0.42, EMA200 $0.59.

Value has regained its 20-day EMA and is hovering slightly below the 50-day, however continues to be under the 200-day. This means that though the short-term downtrend has stalled and given technique to a tactical pullback, the broader cycle stays bearish. In different phrases, the market needs to commerce ADA tactically on the lengthy aspect, however nobody believes the pattern will totally reverse so long as it stays locked across the 200-day price ticket of $0.59.

RSI: Momentum returns to middle

RSI 14 (D1): 55.98

Momentum has recovered to the higher half of the vary with out being overbought. That is typical of a market rising from a downturn and shifting right into a extra balanced, two-sided surroundings. Consumers have the ball within the brief time period, however we’re but to see a breakout.

MACD: Early bullish crossover, however not explosive

- MACD line:0

- sign: -0.01

- histogram:0.01

MACD entered a small constructive crossover with a shallow histogram. That is what preliminary stabilization seems to be like. Though the aggressive draw back has ended, follow-through from consumers continues to be modest. It helps the thought of a constructive basis fairly than a powerful pattern.

Bollinger Bands: Nonetheless shifting in direction of the higher band inside a slender vary

- mid band: $0.37

- higher band: $0.42

- Low band: $0.32

- shut: $0.41

Bandwidth continues to be comparatively subdued, however costs are driving close to the higher band. It is a signal of delicate upward stress amidst reducing volatility, and we have now not but reached full volatility enlargement. ADA is leaning greater within the vary than breaking out by itself.

ATR: compressed volatility, coiled for motion

ATR14 (D1): $0.02

The day by day ATR on an asset of $0.41 is as little as 2 cents. The vary is narrowing, which is strictly what we see earlier than a bigger pattern leg in cryptocurrencies. This doesn’t give any route, solely that merchants mustn’t get used to this calm.

Every day Pivot: $0.41 as a stability level

- Pivot (PP): $0.41

- R1: $0.42

- S1: $0.41

The value is mainly mounted on a day by day pivot. The preliminary resistance at $0.42 coincides with the higher Bollinger Band and is near the EMA50, making this zone a logical short-term choice space. A decisive day by day shut above that will be the primary actual victory for the bulls. Nonetheless, repeated failures will maintain the ADA within the body and open the door to even decrease rotations.

Taken collectively, these outline a day by day timeframe. Impartial regime with delicate bullish bias. Though the short-term pattern and momentum is up, the bigger bearish construction stays unchanged.

1 hour chart (H1): micro vary, construction flat

- shut: $0.41

- EMA20: $0.41

- EMA50: $0.41

- EMA200: $0.39

- RSI14: 46.19

- MACD: Flat (line ≈ sign, hist ≈ 0)

- bollinger bands: mid $0.41, excessive $0.42, low $0.41

- ATR14: $0.01

On the hourly chart, ADA is totally vary sure. Value is simply above the short-term EMA, which itself is flat, and is barely under the 200-hour EMA at $0.39. This helps the concept the intraday upside bias is modest however lacks actual momentum.

RSI The mid-40s and the lifeless MACD inform the identical story. Daytime superiority is just not clear from both aspect. The Bollinger Bands are very tight, hovering round $0.41 to $0.42. Mixed with a small ATR, this can be a traditional intraday compression, constructing liquidity fairly than chasing it.

When it comes to day by day setup, the H1 is don’t have A robust bullish extension was confirmed. As a substitute, it’s consolidating slightly below a significant short-term resistance cluster ($0.42/EMA50 D1/Higher Band D1). This leaves the door open to each a continuation of the breakout and failure.

15 minute chart (M15): execution timeframe, pure chop

- shut: $0.41

- EMA20/50/200: All ≈ $0.41

- RSI14:43.16

- MACD: flat

- bollinger bands: mid $0.41, excessive $0.42, low $0.41

- ATR14: ≈ 0

At this level, the 15-minute chart is simply noise. All EMAs are consistent with one another, momentum is barely weak (RSI low 40s), and there’s little volatility. That is the definition of a chop zone the place market makers, fairly than pattern merchants, are in management.

For lively merchants, this timeframe is barely vital for entry and danger placement. All strikes proven right here require affirmation from H1 or D1. In any other case, it is only a microstructure.

On-chain/DeFi context: Enhancing inner actions

fascinating background cardano It is on-chain. Main Cardano DEXs — minswap, wing rider, Sunday Swap V2, splash protocol — All companies are exhibiting vital value will increase from 7 to 30 days, with some seeing 30-day value will increase of a number of hundred p.c. This usually means elevated buying and selling volumes, extra customers circulating inside the ecosystem, and extra speculative exercise on ADA pairs and Cardano native tokens.

Nonetheless, costs haven’t damaged out. The market is on alert, with the worldwide sentiment index of concern and BTC dominance exceeding 56%. That is why I really feel nervous. Though the basics inside the Cardano ecosystem are bettering, macro crypto positioning stays defensive. That is precisely the form of mismatch that may violently resolve if danger urge for food shifts in both route.

Dominant state of affairs for D1: Impartial with upward skew

Contemplating the D1 information, the principle eventualities are: impartialleaning barely bullish. Quick-term tendencies and momentum are supportive, however longer-term downtrends and a macro risk-off backdrop are dampening expectations.

Cardano ADA Cryptocurrency Bullish Situation

In constructive circumstances, ADA makes use of this slender space as a launching pad.

What it is advisable to do:

- break and maintain on prime $0.42 On a day by day closing value foundation, it clears R1, the higher Bollinger Bands, and mainly the EMA50 cluster.

- Whereas the day by day RSI is firmly pushed into the 60-65 space, seeing the MACD histogram stretch additional up confirms that consumers aren’t simply shorting, however are literally constructing a pattern leg.

- ATR expands upwards, growing the day width in favor of inexperienced candlesticks, indicating a real follow-through fairly than a false breakout.

When these situations are met, the trail to the following structural zone is paved. First within the mid-$0.40 vary, then right into a extra significant battleground round $0.40. 200 day EMA is round $0.59. In that 200-day realm, the narrative shifts from a tactical rebound to a dialog a couple of true medium-term reversal.

What would override the bullish setting?

- A number of failed makes an attempt resulted in an entire rejection from the $0.42 space, adopted by a return to the draw back on the day by day shut. $0.39under the 20-day EMA.

- The RSI is under 50 every day, whereas the MACD is again in detrimental territory, indicating that the present rally is only a lifeless cat bounce.

- Volatility expands downward and from this compression there are extra pink days than inexperienced days.

Cardano ADA Cryptocurrency Bearish Situation

The bearish case is that this whole consolidation continues to be only a distribution based mostly on the 50-day EMA in a bearish market regime.

It seems to be like this:

- The value repeatedly fails at $0.42 and regularly begins to report decrease highs in H1 or D1 buildings.

- Decisive break under $0.39 There’s a day by day shut under the 20-day EMA, which turns that degree into resistance fairly than help.

- The day by day RSI is again within the low 40s or under, the MACD is detrimental, and the histogram is trending downward.

From there, the door opens for a revisit to the decrease finish of the Bollinger vary, initially in direction of the mid-$0.30 vary. If the broader crypto market stays risk-off and BTC’s dominance continues to rise, altcoins like ADA will usually underperform and a deeper take a look at of earlier help is probably going.

What invalidates the bearish angle?

- Strongly exceeds numerous day by day closing costs $0.42 to $0.44turning that space into a brand new help band.

- The day by day RSI stays comfortably above 55-60 even on the pullback, indicating that we’re shopping for the bull fairly than promoting.

- The H1 construction is shifting right into a sequence of upper highs and better lows that really holds the push, fairly than shifting again into the vary.

Positioning, danger and uncertainty

At the moment, Cardano ADA cryptocurrency is a ready market. Whereas the day by day pattern construction stays cautious and intraday charts present chop, on-chain exercise and DeFi utilization counsel curiosity within the ecosystem is quietly growing. This mix usually favors merchants who worth ranges first and breakout tales second.

From a positioning perspective, this can be a place the place measurement and persistence are extra vital than route. Volatility is compressed, that means any eventual transfer out of this $0.39-$0.42 field is prone to be swift and emotional. The technical degree is obvious. The near-term line of short-term upward bias is $0.39, the native ceiling is $0.42, 200 day EMA roughly $0.59 As a checkpoint on a bigger construction. How value behaves when interacting with these ranges tells us rather more than a single indicator snapshot immediately.

If you wish to monitor the market utilizing skilled charting instruments and real-time information, you possibly can open an account at: make investments Utilizing accomplice hyperlinks:

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We could earn commissions at no extra price to you.

Disclaimer: This evaluation is for informational and academic functions solely and relies on publicly accessible market information on the time of writing. This isn’t funding, buying and selling or monetary recommendation and shouldn’t be the idea for any funding choice. Cryptoassets are extremely risky and contain vital danger of loss, together with the doable lack of all invested capital. Please make sure to conduct your individual analysis and contemplate your danger tolerance earlier than partaking in any buying and selling or funding exercise.

Leave a Reply