- ADA has rebounded from $0.33 with greater highs, however there’s nonetheless no affirmation above $0.42.

- Value is above the short-term EMA because the supertrend turns bullish, however the 200 EMA is capping the upside.

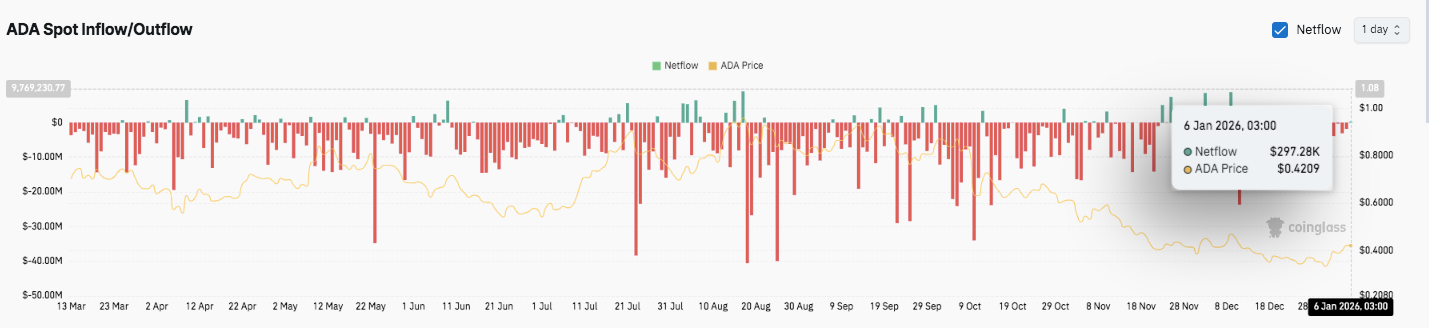

- Derivatives stay excessive as bodily outflows proceed, exhibiting indicators of consolidation slightly than beliefs

In accordance with current market observations, Cardano’s ADA has entered a cautious restoration part on the 4-hour chart. The worth pattern reveals a transparent rebound from the lows round $0.33 in late December, when consumers intervened aggressively. Since that rebound, ADA has shaped greater highs and better lows, indicating an enhancing short-term construction.

Because of this, market contributors at the moment are centered on whether or not this restoration will mature right into a broader pattern reversal. Nonetheless, analysts be aware that the transfer nonetheless lacks affirmation from greater resistance ranges. Value power stays selective, with merchants persevering with to stability optimism and danger administration.

Brief-term momentum improves, medium-term limitations stay

Technical analysts report that ADA is at present buying and selling above the 20, 50, and 100 exponential shifting averages. This correction usually displays stronger short-term upward momentum.

Moreover, the supertrend indicator reversed to the bullish path and strengthened short-term assist above the $0.39 space. Nonetheless, the value remains to be buying and selling beneath the 200 EMA round $0.42. Analysts are due to this fact describing the present transfer as an upswing within the restoration slightly than a confirmed pattern reversal.

Resistance between $0.428 and $0.432 stays necessary. If the 4-hour closing value stays above this vary, the next upside goal could also be achieved. Importantly, the $0.45-$0.455 space stands out as a earlier breakdown zone.

Many merchants count on to e-book earnings on this space. Moreover, the $0.48 to $0.49 vary signifies a big retracement and vary excessive. A breakout right here would doubtless end in a shift in broader sentiment.

On the draw back, analysts spotlight $0.40 to $0.395 as the primary necessary defensive zone. On this space, we mix a number of shifting averages and prior consolidation. Subsequently, consumers might attempt to defend this degree throughout the pullback.

Associated: 2026 Sui Value Prediction: Protocol Privateness and $441M Treasury Allocation Goal is $5-8

Beneath that, the vary from $0.38 to $0.376 has sturdy technical significance. Sustaining above it can maintain the present bullish construction. Nonetheless, beneath $0.38, ADA may very well be uncovered to even larger losses in direction of $0.35 and $0.33.

Watch out for derivatives and spot stream alerts

Futures market information provides one other aspect to the outlook. Open curiosity expands and contracts in cycles relying on value momentum. Current readings above $800 million counsel that merchants are positioning themselves forward of volatility slightly than near-term upside. Nonetheless, open curiosity stays steady, indicating diminished leverage danger and consolidation.

Spot stream information reinforce this cautious pattern. Analysts say web outflows proceed, indicating continued distribution pressures. Though there’s a small spike in inflows throughout the consolidation part, outflows nonetheless dominate. Because of this, spot demand stays restricted even when near-term technicals enhance.

Cardano’s technological panorama: ADA approaches determination territory

Cardano’s key ranges stay well-defined, as ADA shall be traded inside a creating restoration construction.

The primary hurdle on the upside lies between $0.43 and $0.432, adopted by $0.45 and $0.455. If the breakout continues, it may pave the way in which for $0.48 to $0.49, which might mark the prime quality and an necessary pattern reversal zone.

On the draw back, $0.40 to $0.395 serves as quick assist and is strengthened by the short-term shifting averages. Beneath that, $0.38 to $0.376 serves as the important thing demand space that maintains the bullish construction. A deeper decline to $0.35-$0.33 would threaten the restoration and invalidate the present setup.

Higher restrict of resistance: The 200 EMA close to $0.42 stays an important degree for regaining medium-term bullish momentum. ADA is buying and selling above the shorter EMA, however until this ceiling may be reversed, the corrective transfer will proceed.

Outlook: Will Cardano Rise?

ADA seems to be compressed between $0.40 and $0.45, suggesting extra volatility forward. If consumers maintain on to $0.40 and follow-through by $0.43, the momentum may prolong to $0.45 and $0.48.

Nonetheless, whether it is rejected close to the resistance, there’s a danger of additional consolidation or a pullback in direction of $0.38. For now, ADA is at an inflection level, and its affirmation is determined by a big breakout of the $0.42-$0.43 zone.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply