- ADA has stabilized close to the important thing EMA as resistance at $0.42 has capped momentum for now.

- Falling open curiosity and spot outflows thus far sign warning for ADA rebound

- Hoskinson believes 2026 can be a yr of reset the place practicality is extra vital than hype cycles.

Cardano’s ADA token entered 2026 in a maintain sample after rebounding sharply from its late December lows. The worth restoration briefly boosted sentiment, however the momentum pale as ADA approached stiff resistance.

Consequently, merchants are actually centered on a slim vary round short-term averages, whereas the broader market narrative is shaping expectations. Along with technical alerts, feedback by Cardano management add context as to why altcoins like ADA proceed to lag behind Bitcoin.

ADA worth motion reveals compression after rebound

On the 4-hour chart, ADA has decisively rebounded from the $0.33 to $0.34 demand zone. Patrons aggressively defended the sector, pushing the worth in direction of $0.42.

Nevertheless, promoting stress arose round $0.42 to $0.43, limiting additional upside. Subsequently, ADA moved again in direction of $0.39 and began shifting sideways.

This construction now displays vary compression moderately than pattern enlargement. ADA is buying and selling near the 20EMA and 50EMA, indicating indecisiveness. Moreover, the 200 EMA is above the worth close to the earlier resistance degree, reinforcing overhead stress.

This construction stays constructive so long as ADA holds the $0.388-$0.390 help band. Shedding this space might set off a pullback to $0.37, with $0.33 appearing as vital safety.

Notes on derivatives and spot flows

Futures information provides one other factor to the outlook. Cardano’s open curiosity expanded quickly throughout the early rally, reflecting aggressive leverage. The height of greater than $1.5 billion suggests hypothesis was driving the transfer. Nevertheless, open curiosity subsequently declined in direction of $740 million as costs cooled. Consequently, pressured unwinding diminished threat and diminished liquidation stress.

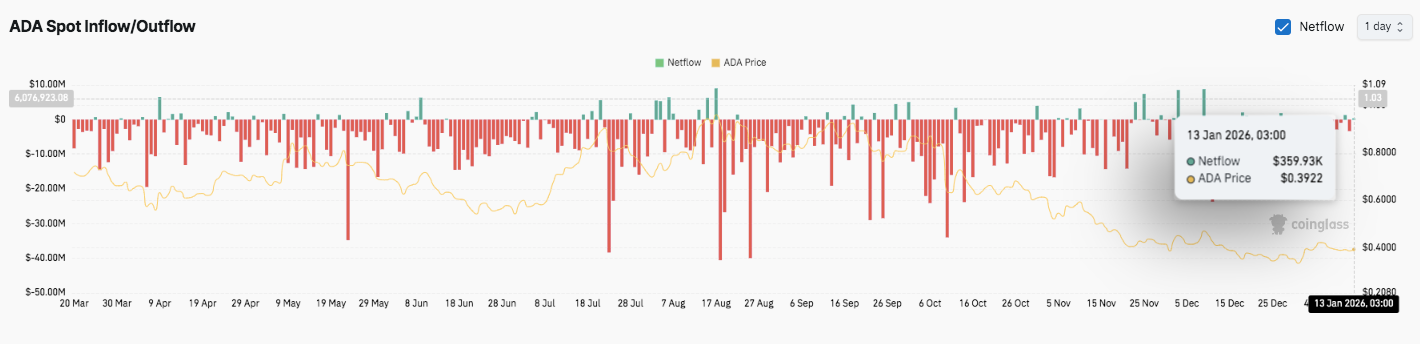

Spot move information reveals the same scenario. Sustained capital outflows dominated most periods, coinciding with the downward momentum. Though there was a sluggish influx just lately, it’s nonetheless small in comparison with earlier gross sales. Moreover, sellers stay accountable for the broader move pattern, suggesting restricted conviction behind the short-term pullback.

Hoskinson positions 2026 as a yr of reset

Past the charts, Cardano founder Charles Hoskinson provided a sober evaluation in a dialog with Scott Melker. Hoskinson defined that collapses like FTX and Luna damage retailer confidence from 2022 to 2025. Moreover, he defined that unclear rules within the US have created uncertainty and slowed the expansion of altcoins.

He argued that whereas Bitcoin has superior via institutional entry, most different networks have stagnated. Subsequently, he described 2026 as a reset moderately than a bull market. In his view, future development relies on practicality and privacy-oriented infrastructure, not simply hypothesis. Importantly, he warned that cryptocurrencies now face a alternative between institutional dominance and rebuilding retail belief.

Technical outlook for Cardano (ADA) worth

Cardano’s key ranges are nonetheless effectively outlined as ADA trades inside a slim vary.

The upside degree is situated at $0.406-$0.410 as the primary resistance cluster, adopted by $0.424-0.425 which marks the most important Fibonacci rejection zone. If a breakout above this space is confirmed, $0.48-0.49 might act as a broader resistance ceiling from the earlier distribution, extending earnings to $0.45-0.455.

On the draw back, $0.388-$0.390 stays vital short-term help. If losses on this zone proceed, the following draw back degree could possibly be between $0.365 and $0.370. The demand zone beneath that at $0.33-$0.34 is the important thing structural help and has been the idea for the latest restoration.

Technical circumstances recommend that ADA is compressing close to its short-term shifting averages, indicating reducing momentum and growing rigidity. Motion inside this vary usually precedes a rise in volatility.

Will Cardano go up?

The short-term bias relies on whether or not consumers can defend $0.388 lengthy sufficient to problem the $0.41-$0.425 resistance band. If inflows and momentum strengthen, ADA might transfer nearer to $0.45.

Nevertheless, if the help can’t be sustained, there’s a threat of additional decline in direction of $0.37 and even $0.33. For now, ADA stays a pivotal space, ready to see if it strikes within the subsequent path.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply