- ADA stays capped under $0.41, with the every day construction remaining bearish as a consequence of supertrend and draw back resistance.

- Foreign exchange inflows proceed to sign distribution, limiting follow-through to a short-term rebound.

- Rising open curiosity and heavy lengthy positions improve draw back danger if the value breaks under the $0.37 help.

Cardano value as we speak is buying and selling round $0.385, making an attempt to stabilize after one other rejection under the descending resistance. The transfer follows a pointy selloff that pushed ADA to its December lows earlier within the week, adopted by bullish shopping for round $0.37. Regardless of the pullback, the construction stays below strain as sellers proceed to manage the pattern on increased time frames.

Day by day pattern stays bearish under supertrend and SAR

On the every day chart, ADA is firmly under the downtrend line that has capped the value since August. Whereas the supertrend is holding at $0.4075, Parabolic SAR stays overhead round $0.3310, confirming that the broader bias has not reversed.

Costs are additionally buying and selling effectively under their earlier breakdown ranges since November, with no every day shut above falling resistance in additional than six weeks. The failure to recuperate $0.41 leaves the ADA locked within the adjustment stage somewhat than the underlying construction.

Trying on the long-term image, we do not see any increased lows or pattern restoration. Till that adjustments, the rally stays weak to renewed promoting.

Intraday chart reveals rebound dropping momentum

A shorter time interval signifies why patrons are having a tough time gaining traction. On the 2-hour chart, ADA rebounded sharply from the $0.33-$0.34 zone, pushing the value again in direction of $0.39. This transfer quickly pushed the value above the 20 EMA at $0.3759 and the 50 EMA at $0.3643, offering short-term aid.

Nevertheless, the value stalled under the 100 EMA at $0.3617 and stays capped effectively under the 200 EMA at $0.3681. Failure to clear these ranges slowed the momentum.

The RSI on the two-hour chart reversed from round 70 and fell in direction of the low 60s. This alteration signifies a weakening of the upside energy somewhat than a brand new participation within the pattern.

So long as ADA stays above $0.37, patrons preserve short-term management. A lack of this stage will re-expose the latest lows.

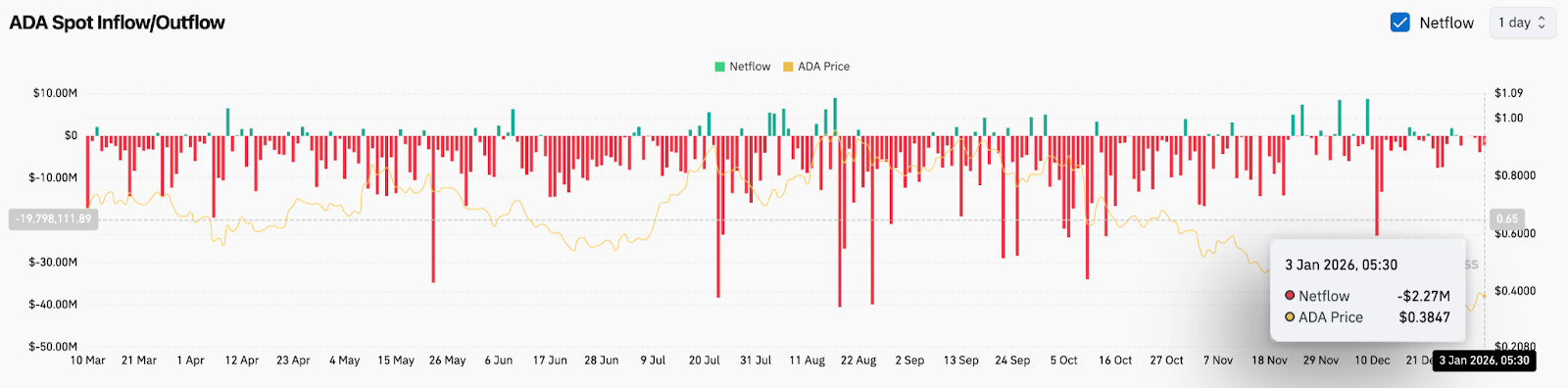

Change flows proceed to indicate distribution

Spot stream information continues to indicate headwinds. ADA has recorded sustained internet inflows to the trade throughout latest classes, together with a internet stream studying of -$2.27 million on January third. This sample extends a broader pattern of provide shifting to exchanges by means of the fourth quarter.

This conduct usually displays positioning to promote somewhat than accumulate. Even throughout rebound, the holder continues to distribute power, limiting follow-through and limiting rallies under resistance.

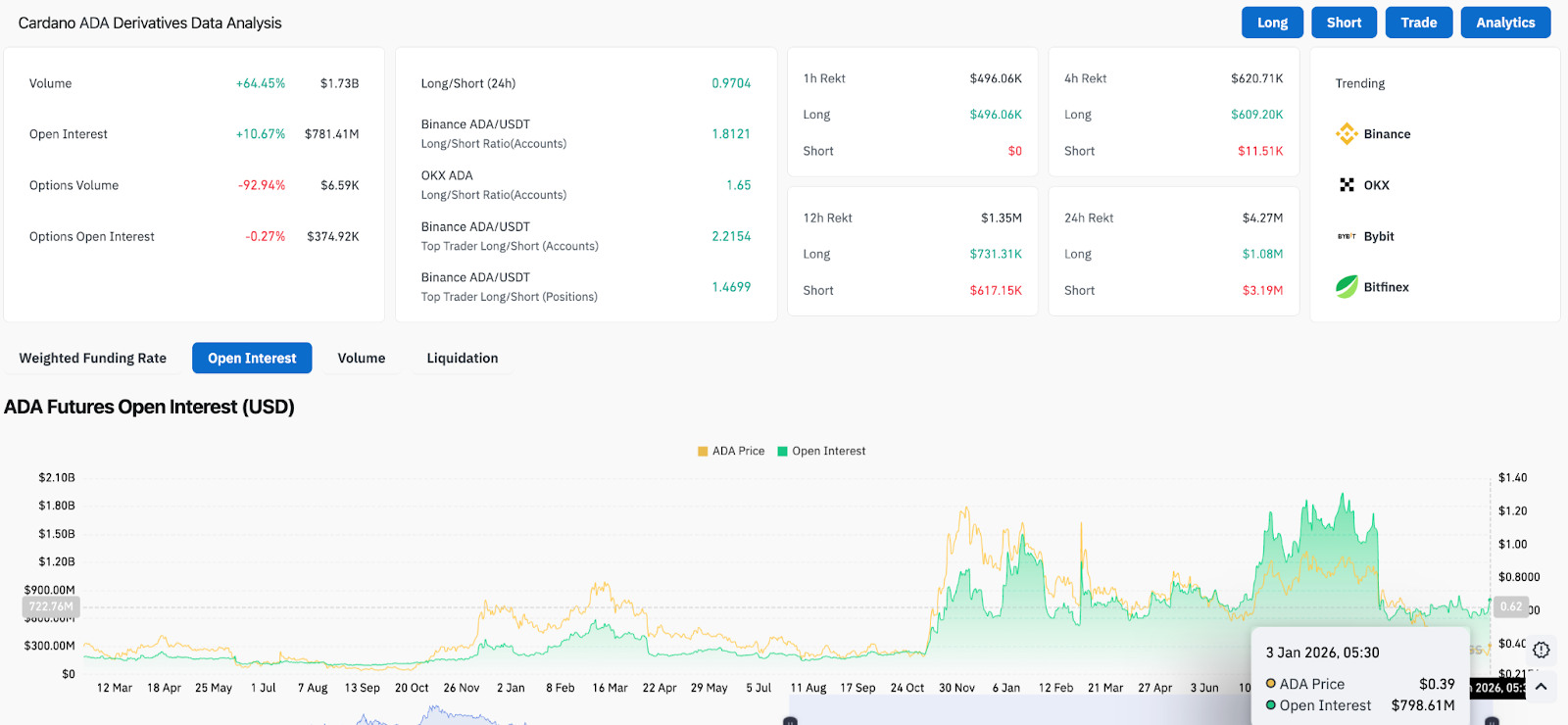

Derivatives information reveals leverage constructing

The place of derivatives additional heightens the stress. Open curiosity in ADA futures rose greater than 10% on the day, rising to about $798 million. Buying and selling quantity elevated 64% to $1.73 billion, exhibiting a rise in participation regardless of a weak value construction.

Liquidation information reveals that longs are absorbing a lot of the strain. Up to now 24 hours, lengthy positions of $4.27 million had been worn out, whereas quick positions had been price $3.19 million. This imbalance suggests merchants had been attempting to get forward of a restoration that has but to materialize.

The ratio of longs to shorts throughout main exchanges stays skewed towards longs, rising draw back danger if costs fail to keep up help.

outlook. Will Cardano go up?

Regardless of short-term stability, Cardano continues to be in a correction pattern.

- Bullish case: ADA stays above $0.37 and regained $0.41 on the every day shut, leaving room for $0.45.

- Bearish case: If the every day closing value is lower than $0.37, a steady distribution is confirmed and $0.33 is uncovered.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply