- ADA is dealing with regular promoting stress and is under key resistance and Fibonacci ranges.

- Quick-term help between $0.283 and $0.280 is prone to maintain, however the development stays fragile and bearish.

- Declining open curiosity and outflows point out cautious sentiment and restricted purchaser confidence.

In accordance with latest market information from Kraken, Cardano continues to face continued promoting stress on the ADA/USD 4-hour chart. The broader construction signifies a sustained downtrend, characterised by decrease highs and decrease lows.

Along with weak worth tendencies, technical indicators and stream information help a cautious outlook. Whereas merchants are reluctant to construct aggressive positions, sellers look like persevering with to defend key resistance zones. Subsequently, ADA stays weak to additional declines except consumers restore crucial ranges and momentum situations enhance.

Downtrend construction controls bears

Worth motion reveals that ADA is buying and selling under the supertrend resistance stage, which continues to restrict any rebound makes an attempt. Importantly, a break under the 0.382 Fibonacci stage round $0.333 accelerated promoting stress. This transfer shifted the market’s focus to deeper retracement ranges.

The value is at present hovering across the $0.283-$0.280 zone, which is appearing as short-term demand. Nevertheless, the construction stays weak and purchaser follow-through is restricted.

Moreover, the $0.268 stage stands out as a key technical marker. This space coincides with an entire retracement of the earlier upswing. A decisive break under this stage may verify the continuation of the development. Subsequently, analysts are pointing to a variety of $0.250 to $0.240 as the following draw back goal if the sell-off continues.

On the upside, a number of layers of resistance are limiting a bullish restoration. The realm between $0.308 and $0.310 would be the first rebound barrier. This zone coincides with the 0.236 Fibonacci retracement. Moreover, the earlier help at $0.333 is now appearing as a stable ceiling. Sellers proceed to aggressively defend this stage.

Associated: Solana Worth Prediction: SOL recovers from $95 lows as Jupiter polymarket commerce lifts ecosystem sentiment

Past that, the $0.353 to $0.372 space types a broader provide zone. This space overlaps with the Fibonacci retracement from 0.5 to 0.618. Subsequently, a rally into this vary may entice renewed promoting curiosity, particularly within the absence of stronger quantity help.

Momentum metrics additional help the defensive outlook. CMF measurements stay unfavorable, indicating continued capital outflows. Nevertheless, a short-term pullback won’t enable the indicator to show constructive. This motion suggests a corrective pullback moderately than a development reversal.

Circulate and leverage mirror emotional cooling

Knowledge from market members helps the cautious outlook. The development in open curiosity reveals a gentle decline, indicating decrease leverage and decrease dealer confidence.

Beforehand, a rise in open curiosity was accompanied by a rise in worth, however latest developments are totally different. Because of this, merchants look like mitigating danger moderately than taking aggressive upside positions.

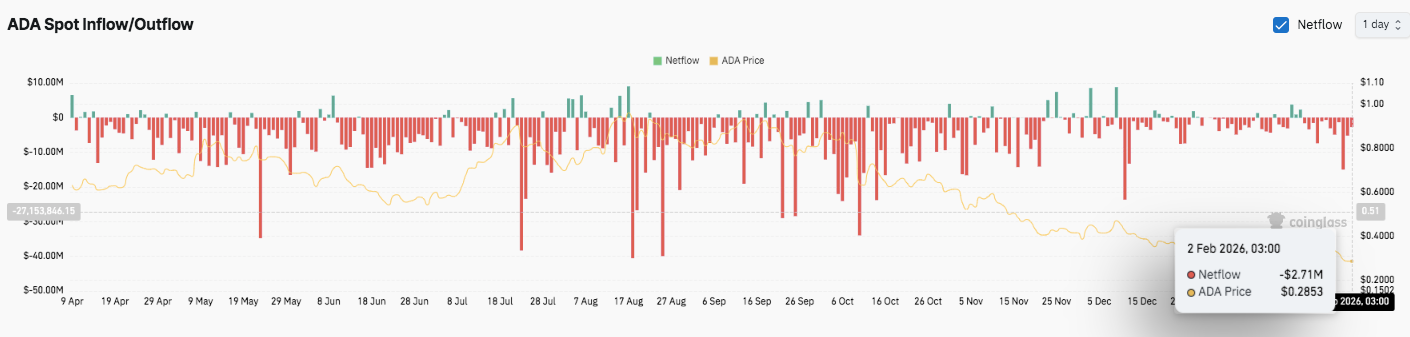

Spot stream information additionally spotlight persistent distributions. Even throughout the momentary rebound, outflows proceed to exceed inflows.

Associated: Hyper-Liquidity Worth Prediction: Can HYPE Get Again to $32.00 or Is Deeper Consolidation Forward?

Moreover, consumers can’t maintain the buildup section, limiting their resilience. Total, stream dynamics recommend cautious sentiment and continued provide stress, reinforcing the broader bearish construction.

Cardano (ADA) technical outlook

Key ranges stay effectively outlined as ADA trades inside a well-established downtrend on the 4-hour chart.

High stage: Close to-term resistance is between $0.308 and $0.310, with short-term rebounds repeatedly stalling. A sustained breakout of this zone may ship it heading in direction of the earlier 0.382 Fibonacci help at $0.333. Past that, $0.353 to $0.372 represents a big provide cluster alongside the 0.5 to 0.618 retracement vary, which is prone to cap any upside makes an attempt.

Cheaper price stage: Close to-term help lies between $0.283 and $0.280, which is the short-term demand space at present underneath stress. If this zone fails to carry, the main target shifts to $0.268, a key structural stage that coincides with an ideal Fibonacci retracement. If that breaks down, ADA will seemingly be uncovered to the $0.250-$0.240 vary the place historic demand has manifested prior to now.

Higher restrict of resistance: $0.333 stays a key stage that bulls should get well to cancel the draw back momentum and stabilize the construction. With out this restoration, the rally dangers remaining corrective.

Technically, ADA seems to be compressing inside a descending construction characterised by declining highs and weak follow-through on the bounce. Momentum indicators proceed to mirror distribution moderately than accumulation, however declining open curiosity suggests continued deleveraging. This mixture is commonly preceded by an prolonged consolidation or one other volatility growth leg down.

Will the value of Cardano be secure?

Cardano’s near-term prospects rely upon whether or not consumers are capable of defend the $0.268 help zone and gradual the present development. If the maintain is profitable, the value may problem the resistance cluster between $0.308 and $0.310. However with out adjustments in capital flows and affirmation of momentum, any try at an upward transfer might wrestle to achieve traction.

If sellers power a clear break under $0.268, ADA dangers accelerating in direction of the mid-$0.20s, reinforcing the broader bearish construction. For now, Cardano is at a pivotal inflection level. Market construction favors warning, and affirmation, not expectations, determines the following route.

Associated: Bitcoin Worth Prediction: Silver Collapse Drops BTC Under $85,000

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply