- Chainlink has fallen 22% from its January 18 excessive of round $14 as sellers pushed the value beneath the $12 assist zone it held from December to January.

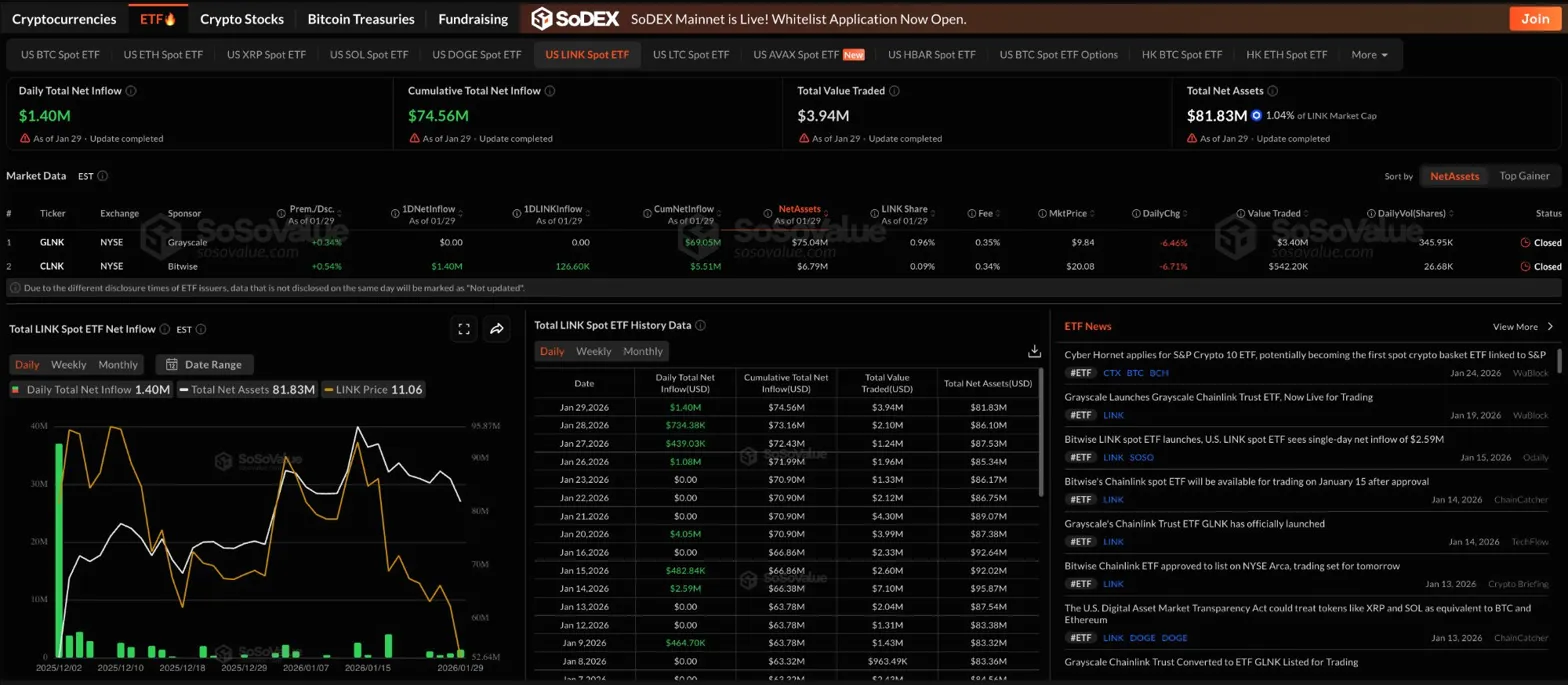

- LINK ETF recorded every day inflows of $1.4 million on January 29, bringing complete belongings to $81.83 million, indicating sustained institutional curiosity.

- A restoration would require a return to $12.26, however an in depth beneath $10.60 would open the draw back in the direction of the $9 demand zone.

Chainlink worth is buying and selling round $10.83 at this time, after falling beneath a two-month vary that held between $12 and $15. This decline occurred regardless of constructive elementary developments, together with new ETF inflows and a strategic partnership with Turtle Protocol introduced earlier this week.

Turtle Partnership fails to lift costs

On Wednesday, Turtle introduced a strategic partnership with Chainlink to carry institutional liquidity on-chain. The settlement makes Chainlink CCIP and knowledge feeds a requirement for Turtle’s liquidity infrastructure, positioning LINK because the core infrastructure for cross-chain capital markets.

Turtle connects over 410,000 wallets and tons of of institutional liquidity suppliers throughout a number of ecosystems. The partnership strengthens Chainlink’s position in pricing, danger evaluation, and cross-chain rebalancing for institutional deal flows.

Michael Mendez, Head of DeFi at Chainlink Labs, mentioned the partnership is a significant step towards defining how liquidity strikes throughout on-chain capital markets. Nevertheless, regardless of the bullish elementary backdrop, worth tendencies are transferring sharply in the other way.

ETF inflows proceed regardless of falling costs

Chainlink ETF recorded web inflows of $1.4 million on January 29, bringing cumulative inflows to $74.56 million and complete web belongings to $81.83 million. At the same time as spot costs fall, Grayscale and Bitwise LINK funds proceed to draw institutional buyers.

Furthermore, the LINK ETF considerably outperformed the DOGE fund, with practically 10 occasions extra belongings beneath administration, indicating that the establishment’s perception in Chainlink’s idea of utility stays stronger than meme coin hypothesis.

Construction shifts bearish on breakdown beneath vary

On the every day chart, LINK is buying and selling beneath all 4 main EMAs, confirming the bearish construction. The 20-day EMA is $12.26, the 50-day EMA is $12.91, the 100-day EMA is $14.09, and the 200-day EMA is $15.45. This built-up resistance creates a ceiling that patrons want to choose again as much as change momentum.

The vary between $12 and $15 from December to January has damaged into decrease territory. The value failed a number of occasions via the $15 resistance zone earlier than rolling over, and the lack of the $12 assist confirmed that sellers had taken management.

Associated: Dogecoin worth prediction: DOGE tops $0.12 as ETF flows dry up

The RSI remained at 29.77, coming into oversold territory for the primary time because the November correction. Oversold readings can precede a pullback, however don’t assure a reversal until the value motion helps it.

Hourly chart reveals accelerating weak point

On the hourly chart, LINK reveals a transparent downtrend from its January 18 excessive round $14. Parabolic SAR stays bearish at $11.09, however the worth is buying and selling beneath session VWAP of $10.85.

The decrease sure of the VWAP band at $10.76 signifies speedy assist. The value briefly rose to $10.62 in the course of the session low after which recovered, suggesting some shopping for curiosity across the $10.60 stage.

The regular decline from $14 to $10.80 over 12 days displays sustained promoting strain fairly than a single liquidation occasion. Every rebound try is bought off, with decrease highs forming persistently throughout the hourly timeframe.

Outlook: Will Chainlink go up?

Whereas the value stays beneath the EMA cluster, the development stays bearish, however the oversold RSI and constructive ETF flows recommend a rescue rebound may emerge.

- Bullish case: A every day shut above $12.26 restores the 20-day EMA and sign stabilization. This transfer would require a change in broader altcoin sentiment and will goal the $12.90 to $14 resistance zone.

- Bearish case: An in depth beneath $10.60 will affirm the continuation of the breakdown and expose the $9 demand zone from October 2024. That situation stays doubtless until spot flows enhance.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply