- CMLN moved $16.1 billion in cryptocurrencies in 2025, processing roughly $44 million every day throughout greater than 1,799 wallets.

- Since 2020, fraudulent flows to CMLN have grown 7,325 instances quicker than flows to centralized exchanges.

- Distributors are migrating platforms after the crackdown, highlighting the constraints of platform-only enforcement.

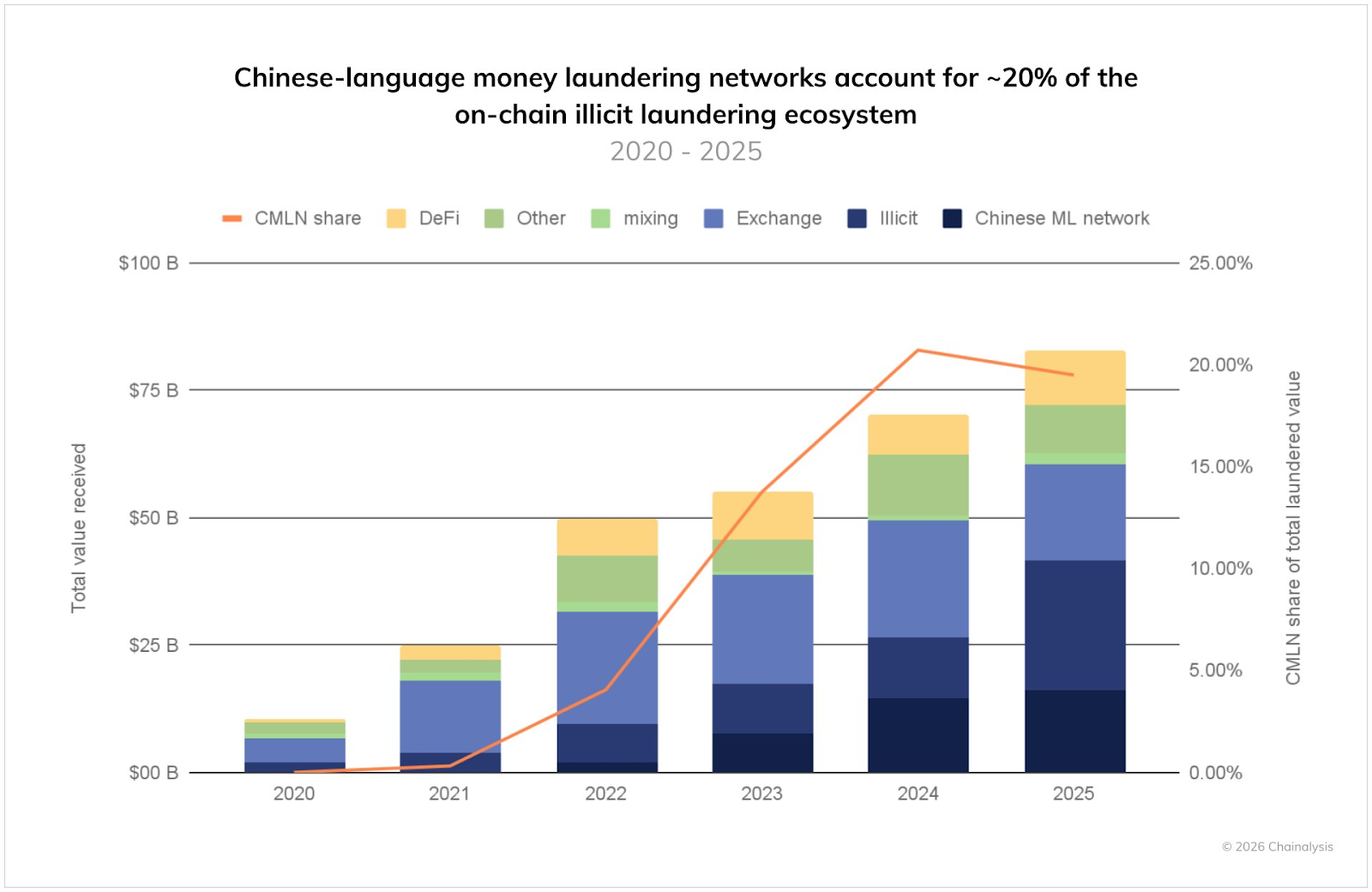

The Chinese language Cash Laundering Community (CMLN) processed an estimated $16.1 billion in illicit crypto funds in 2025, in accordance with a preview chapter of Chainalysis’ 2026 Crypto Crime Report. This exercise equates to roughly $44 million per day throughout greater than 1,799 energetic wallets, highlighting the dimensions and industrial nature of those actions.

In accordance with Chainalysis information, Chinese language cash laundering networks presently account for about 20% of identified unlawful cryptocurrency laundering operations over the previous 5 years. The report additionally reveals that since 2020, flows to those networks have grown 7,325 instances quicker than fraudulent flows to centralized exchanges, highlighting a shift away from exchange-based laundering routes.

Six service sorts outline the CMLN ecosystem

Chainalies has recognized six main service classes inside the Chinese language cash laundering community ecosystem. These embody operating level brokers, cash mules, unofficial over-the-counter providers, Black U providers, playing platforms, and cryptocurrency mixing or trade providers.

Black U providers and gambling-related providers break giant transactions into smaller quantities to keep away from detection, whereas OTC providers combination small transfers into bigger quantities for integration into the monetary system. Assurance platforms corresponding to Huione and Xinbi act as marketplaces and escrow hubs for distributors however don’t immediately handle laundering actions and have been due to this fact excluded from the entire estimates.

Speedy growth and operational infrastructure

The report notes that these companies are increasing quickly. The Black U service reached $1 billion in processed funds inside 236 days, whereas the OTC service took 1,136 days. Cash mules and funds switch providers grew extra steadily, reflecting the constraints of guide processing. Total, the ecosystem processed roughly $44 million per day in 2025.

Chainalies additionally notes structural similarities throughout vendor platforms, suggesting a coordinated or centralized working mannequin. These networks mix on-chain automation with off-chain felony infrastructure, enabling excessive velocity processing and broad geographic protection, together with reported exercise throughout Africa.

Enforcement actions and ongoing dangers

Current enforcement actions embody sanctions towards Prince Group, FinCEN’s designation of Fuione Group as a Main Cash Laundering Concern, and advisory actions focusing on Chinese language cash laundering networks. Nevertheless, the report states that distributors typically migrate to various platforms after disruptions to keep up enterprise continuity.

The report concludes that public-private collaboration, blockchain evaluation, and intelligence sharing, relatively than focusing on platforms alone, stay essential to establish and thwart launderers.

Associated: South Korea targets crypto cash laundering with new buyer verification measures

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply