- Coinbase inventory, just like the broader crypto market, might have hit backside.

- Goldman Sachs raised its ranking on COIN inventory from Impartial to Purchase because of the robust financial backdrop.

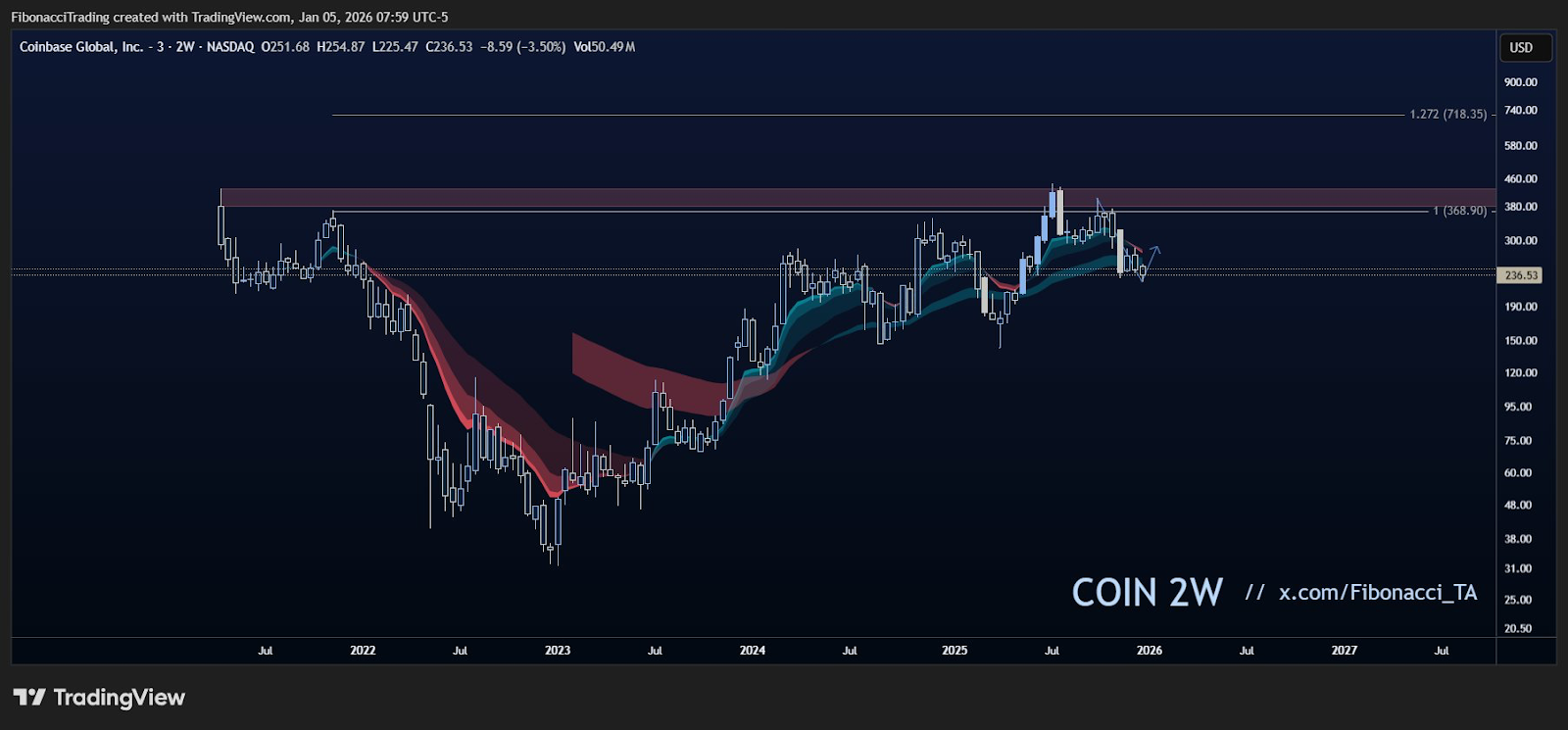

- The two-week EMA cloud exhibits that COIN worth is nicely positioned to surge exponentially quickly.

Coinbase International Inc. (NASDAQ: COIN) inventory alerts a possible market reversal. COIN worth has elevated by roughly 8% over the previous 24 hours and is buying and selling at roughly $255 on the time of writing, indicating a noticeable drop in promoting strain and a possible resurgence of curiosity in crypto-related shares.

Coinbase inventory rises after ranking improve from Goldman Sachs

The primary cause for the bullish momentum in Coinbase inventory is the renewed curiosity in cryptocurrencies from each retail and institutional traders. After a hemorrhaging fourth quarter of 2025, the crypto market entered 2026 on a bullish word supported by the macroeconomic backdrop.

Consequently, Goldman Sachs upgraded COIN inventory from Impartial to Purchase. The financial institution has turned different Wall Avenue traders bullish on COIN, citing the corporate’s structural development amid enlargement of its infrastructure enterprise.

In keeping with a report from Goldman Sachs, Coinbase inventory worth will proceed its bullish development as the corporate permits mainstream adoption of tokenized real-world belongings. Moreover, Coinbase is backing base layer 2 scaling options on the Ethereum (ETH) community, which the financial institution mentioned can have new merchandise that can develop over time, together with prediction markets.

Intensifying competitors

Coinbase is dedicated to enhancing its merchandise by the Base chain, which gives each conventional and cryptographic providers to clients all over the world. As such, Goldman Sachs is bullish on COIN in comparison with friends comparable to Robinhood Markets, Inc. (NASDAQ: HOOD) and Interactive Brokers Group, Inc. (NASDAQ: IBKR).

The corporate faces stiff competitors from different crypto exchanges comparable to Binance, Bybit, Crypto.com, and Kraken. Nevertheless, Coinbase CEO Brian Armstrong identified that traders utilizing the corporate’s product have a bonus as a result of they’ve entry to institutional-grade monetary merchandise on the blockchain. For instance, by Coinbase, COIN holders can acquire aggressive mortgage rates of interest.

What’s subsequent for COIN?

Stable fundamentals and technical outlook are supporting the latest restoration in COIN costs. The continued rise in Bitcoin (BTC) and Ethereum (ETH) will gas an additional bullish outlook for Coinbase, as COIN inventory is carefully tied to the broader crypto market.

In keeping with market analyst FibonacciTrading, COIN inventory has the potential for additional upside within the quick time period. The analyst notes {that a} bull market just like the 2025 bull market is imminent if COIN worth on the two-week chart recovers the EMA cloud as assist.

Associated: Coinbase quickly suspends peso service in Argentina on account of overview of fiat foreign money enterprise

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply