- Coinbase has withdrawn its help for the Transparency Act, which emphasizes limits on stablecoin rewards.

- Cryptocurrency exchanges have famous growing stress from the banking trade to affect the Readability Act.

- The Senate Banking Committee postponed the deliberate improve to contemplate this suggestions.

Coinbase World Inc. (NASDAQ: COIN) has withdrawn its help for the Readability Act. Prime crypto exchanges with important political affect withdrew their help for the Cryptocurrency Market Construction Invoice lower than 24 hours earlier than the scheduled markup listening to, leading to a delay within the listening to.

Coinbase factors transparency regulation flaws

In accordance with Coinbase CEO Brian Armstrong, there are too many issues with the present crypto market construction invoice. As such, Armstrong mentioned the draft must be additional revised to make sure integrity to the crypto trade.

“I admire the laborious work of the senators to achieve a bipartisan conclusion, however this model can be considerably worse than the established order. We’re higher off with no invoice than a foul invoice. Hopefully, we are able to all provide you with a greater draft.” mentioned

A number of the points identified by Armstrong embody:

- The present draft of the Transparency Act subtly prohibits tokenized shares.

- Unrestricted entry to DeFi protocols by the US authorities violates consumer privateness.

- Strengthens the powers of the Securities and Trade Fee (SEC) to switch the Commodity Futures Buying and selling Fee (CFTC).

- Prohibiting rewards in stablecoins, a key characteristic of DeFi protocols

A number of crypto firms help market construction invoice

In the meantime, a number of crypto firms have already expressed help for the draft Readability Act. Cryptocurrency firms advocating for passage of the Readability Act in its present kind embody Ripple Labs, Kraken, a16z, Circle, Digital Chamber, and Coin Middle.

Associated: Can one invoice repair US crypto guidelines? Contained in the CLARITY Act push

huge image

Because the Transparency Act is refined within the Senate, it’s receiving important bipartisan consideration forward of the 2026 midterm elections. From the angle of the cryptocurrency trade, the Readability Act has already been hijacked by giant gamers within the conventional banking sector in search of to take care of the established order.

Moreover, conventional banks have famous that the DeFi area might destabilize their working fashions, together with group lending. Nevertheless, Coinbase has championed the empowerment of retail traders via privateness and stablecoin rewards.

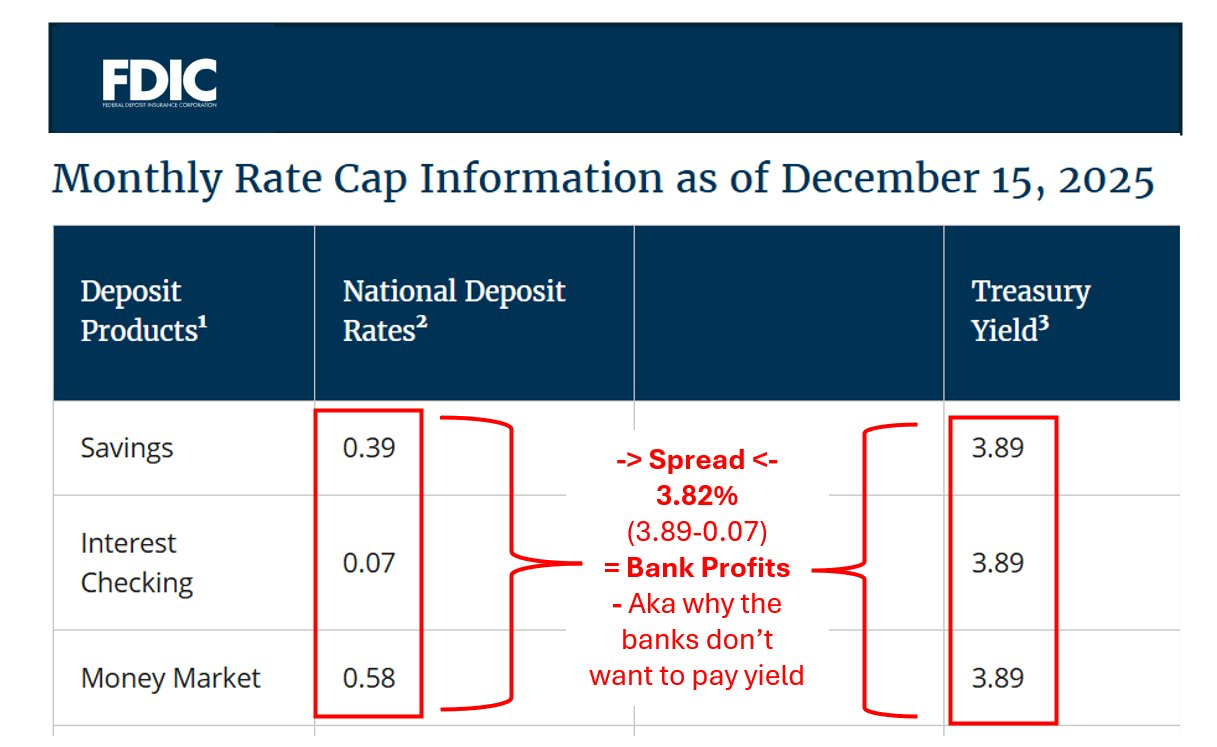

Notably, whereas conventional banks provide near-zero rates of interest on fiat deposits, stablecoins pay over 3.5%.

Supply:X

What’s subsequent?

Following disagreements over the draft transparency invoice, Sen. Tim Scott, chairman of the Senate Banking Committee, mentioned the deliberate fee will increase have been postponed. White Home Cryptocurrency and AI Czar David Sachs urged the cryptocurrency trade to resolve remaining variations on the invoice to expedite passage of the Readability Act.

Cryptocurrency markets reversed the beneficial properties of the previous few days after the Senate canceled the deliberate worth improve in response to the Transparency Act. However, the cryptocurrency group may be very optimistic in regards to the Readability Act being enacted within the close to future.

Associated: Readability Act units worth hike with Sen. Cynthia Lummis marketing campaign in search of bipartisan help

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply