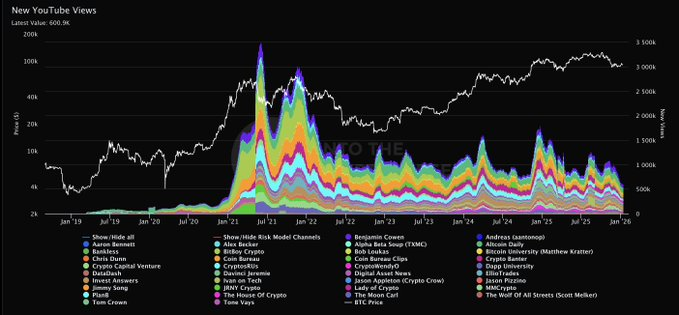

- The variety of views on the digital forex YouTube has reached its lowest stage since January 2021, following a big decline for the primary time in three months.

- Benjamin Cowen mentioned the decline mirrored a collapse in broader societal pursuits, not algorithms.

- The October 2025 crash was a turning level and shook confidence in your complete crypto market.

Cryptocurrency YouTube viewership has fallen to its lowest stage in additional than 4 years, underscoring rising fatigue amongst retail buyers and a pointy decline in on-line curiosity.

In line with information shared by market analyst Benjamin Cowen, views throughout main crypto YouTube channels have fallen sharply over the previous three months. Though Bitcoin rose by way of 2024 and most of 2025, general cryptocurrency viewership didn’t get better. These views have declined sharply in latest months, dropping to ranges seen in January 2021, earlier than the beginning of the final bull market.

Cowen mentioned this decline isn’t restricted to YouTube and isn’t as a consequence of algorithm adjustments. Reasonably, it exhibits a big decline in consideration throughout social platforms. Cowen added that “viewers for cryptocurrencies is declining all over the place.”

When requested if crypto content material may return to 2021 ranges of recognition, Cowen mentioned he thinks it’ll finally, however not this 12 months.

An extended bear market to look at

One other professional, Tom Crown, mentioned the slowdown was notably noticeable in October 2025, when engagement plummeted throughout the platform. He argued that public curiosity in cryptocurrencies has been in a digital bear market since 2021 and has not recovered to all-time highs.

Different analysts described the present state of affairs as “a bearish market stage of social curiosity,” particularly concerning altcoins.

October’s crash shook confidence

The decline in viewer rankings occurred in response to the extreme market fluctuations in October. On October 10, costs fell in what analysts described as a “linear decline” with no bailout rebound.

Throughout this era, Bitcoin plummeted from a peak round $126,000 to round $102,000, after which fell additional. Whereas political headlines and massive merchants have been blamed on the time, many now say the crash uncovered deeper weaknesses that have been already build up behind the scenes.

again aspect

Nonetheless, one crypto sentiment analyst says the present decline in social media curiosity in Ethereum is much like the temper seen earlier than the value’s large rebound final 12 months. Brian Quinlivan, an analyst at Santiment, mentioned sentiment round Ethereum has traditionally fallen to ranges simply earlier than the Nice Restoration, when many buyers had all however given up on the asset.

Quinlivan mentioned the same sample occurred in 2025, with Ether surging after detrimental situations prevailed and finally rallying in the direction of 2021 highs.

YouTube’s new insurance policies

YouTube started implementing stricter guidelines for cryptocurrency and NFT content material beginning November 17, 2025. Content material exhibiting actions resembling staking, betting, and token buying and selling, particularly movies linked to blockchain video games, NFTs, and Web3 initiatives, could also be topic to age restrictions or removing.

“Recreation-acquired content material by creators of online game skins and cosmetics, in addition to common dialogue of things with real-world financial worth, resembling NFTs, usually are not affected by this replace,” YouTube instructed Decrypt.

Associated: Elon Musk’s X unveils good money tag that shows reside crypto costs

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply