- If the value is buying and selling under STH’s realized value, it often signifies that latest consumers are taking a loss and a earlier help degree has become resistance.

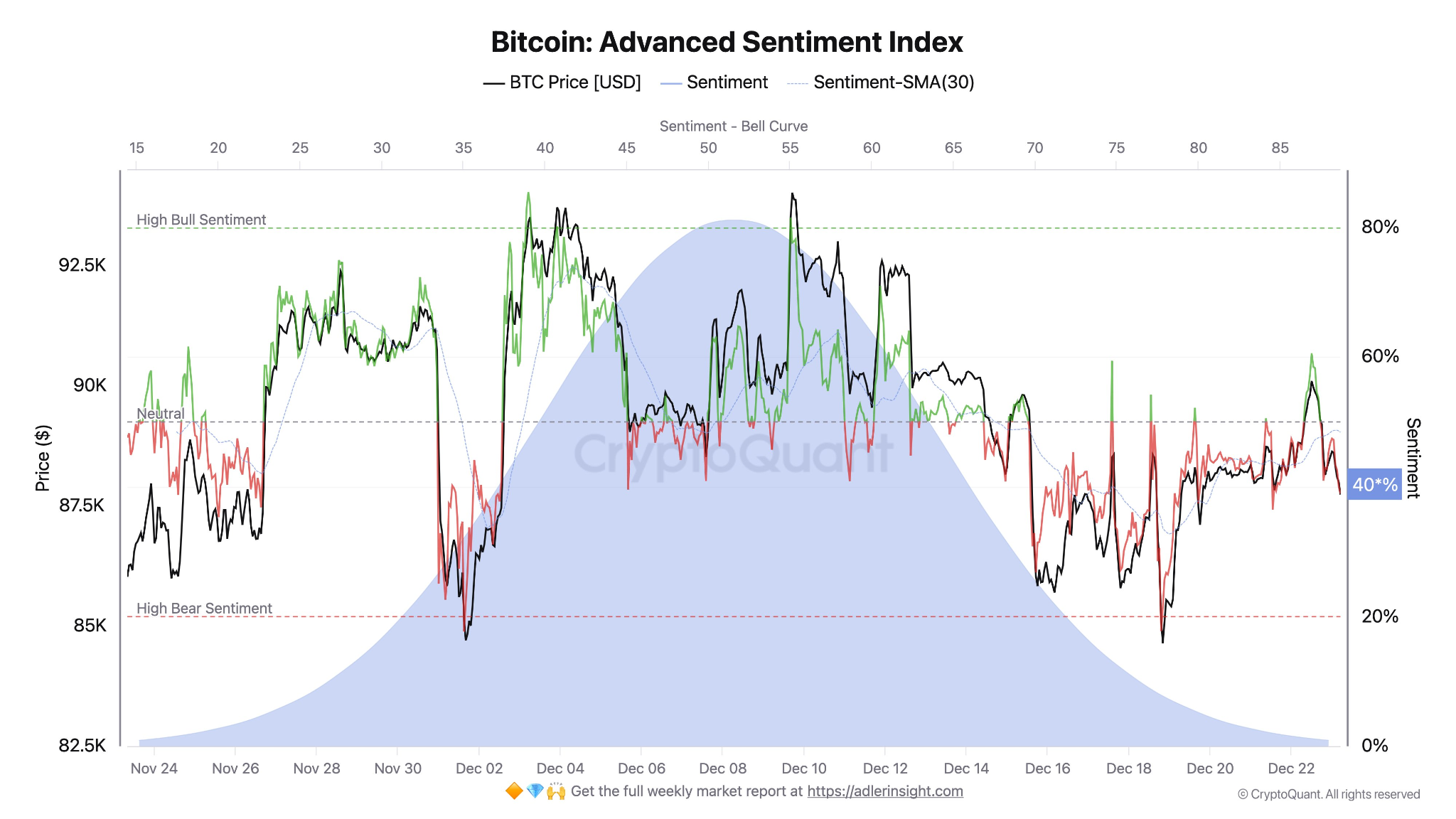

- Adler factors out that the drop in Bitcoin’s Superior Sentiment Index to round 40 means we’re firmly within the circulation zone and any try to lift the value will fail until new demand is available in.

- The analyst additionally cited a complete realized value of $56,300, which he views as an necessary long-term help line.

CryptoQuant analyst Axel Adler Jr. shared his view on the everyday short-term decline in Bitcoin brought on by short-term holders (STH) being submerged and the sentiment turning decisively risk-off.

When the value is under the realized value of STH, it often means:

- Fashionable consumers are at a loss

- Worth will increase are prone to be bought off, so these merchants might break even

- Former help degree turns into resistance

This creates a state of affairs the place folks promote as costs rise, reasonably than permitting the rally to construct on itself.

Adler factors out that it is value noting that Bitcoin’s Superior Sentiment Index has fallen to round 40. Which means that until new demand enters, Bitcoin’s Superior Sentiment Index is firmly in circulation territory and any try to maneuver increased will fail.

At round $87,400, Bitcoin is under all significant short-term price metrics, which explains the weak point in its construction.

Traditionally, bull markets solely restart after STH provides up and sells or the value returns to the extent it was at when it was purchased. Adler’s view that the value must stabilize above $90,000 is according to earlier bull cycles.

The analyst additionally talked about a complete realized value of $56,300, which he believes is a vital long-term help degree. This value is the typical price paid for the coin by all Bitcoin holders. In previous cycles, above this common value has sustained the general bull market, however under this common value, most holders, not simply latest consumers, will undergo losses.

In the mean time, the value remains to be properly above this degree, suggesting that it is a regular pullback in a bigger uptrend and never the top of a bull market.

Latest developments help Adler’s view

A number of latest market adjustments help Adler’s view that traders have gotten extra cautious. For instance, the Financial institution of Japan’s rate of interest hike and uncertainty surrounding world rates of interest are negatively impacting dangerous investments like cryptocurrencies. Moreover, digital currencies have just lately change into extra delicate to trade price and yield fluctuations.

Spot Bitcoin ETF inflows have slowed since their peak, making it troublesome for the market to soak up promoting with out robust shopping for from massive establishments.

The overall quantity of open futures contracts additionally fell. This reveals merchants are taking much less threat and is according to Adler’s perception that the market is cautious however not in a full-blown panic.

Associated: Bitcoin enters a quiet accumulation section. Analysts predict 2026 lows

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply