- DOGE stays locked within the descending channel with supertrend resistance close to $0.140.

- Brief-term stability above $0.118 signifies safety, however the rebound lacks follow-through.

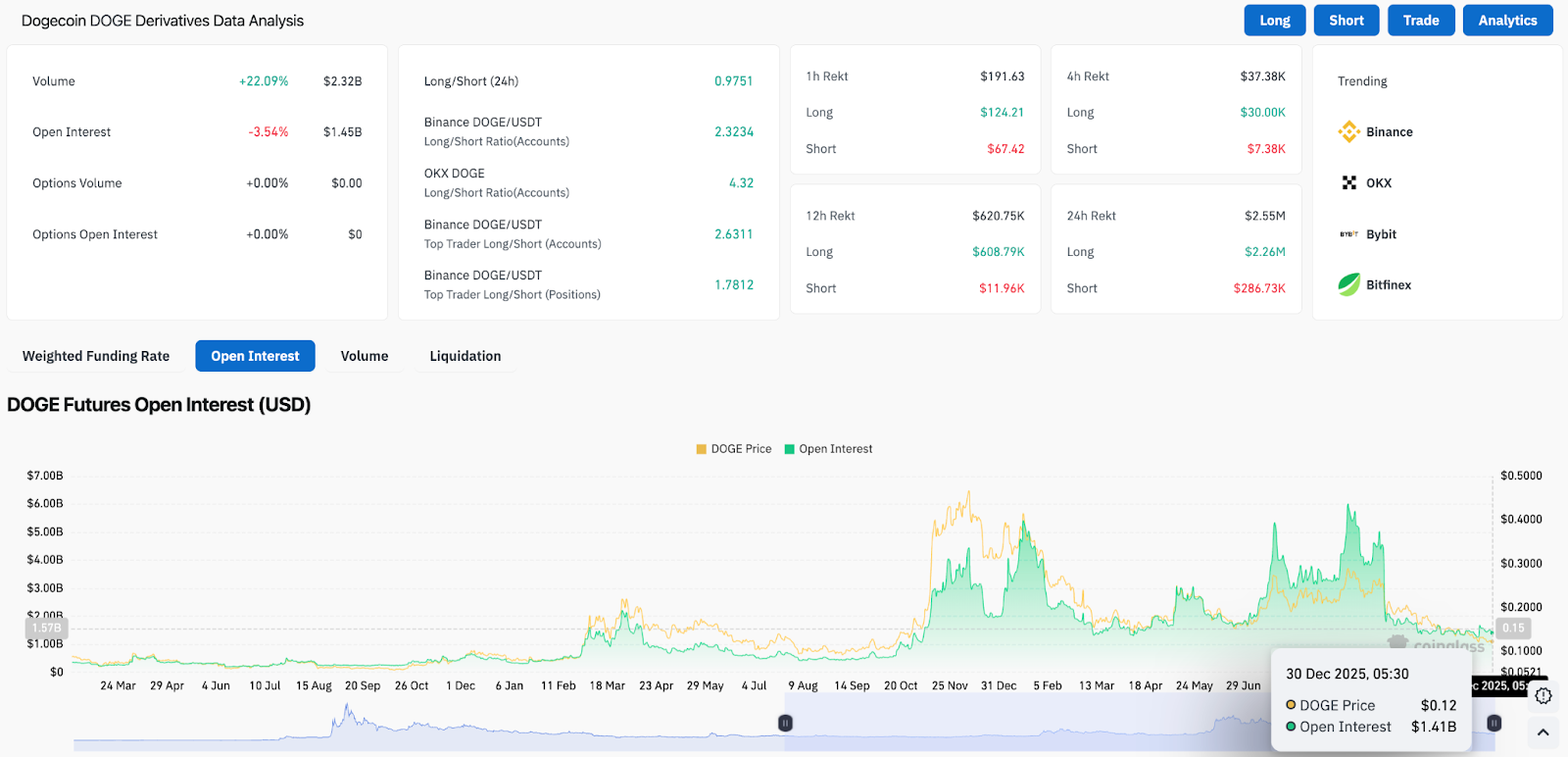

- Falling open curiosity and lengthy liquidations point out threat discount reasonably than accumulation.

Dogecoin value is buying and selling round $0.123 right now, stabilizing simply above short-term help after weeks of sustained promoting strain. On the each day chart, costs stay locked in a descending channel, with sellers in management as patrons wrestle to power a pattern reversal heading into the ultimate buying and selling day of 2025.

Descending channels outline broader construction

On the each day chart, Dogecoin stays trapped inside a well-defined descending channel, which has been driving the value decrease since October. Every restoration try has stalled beneath the channel midpoint, reinforcing the sample of falling highs and weak follow-through.

The supertrend stays bullish at round $0.140, nicely above the present value, whereas the parabolic SAR dot continues to maneuver above the candlestick. This match confirms that management of the pattern has not returned to patrons. So long as DOGE trades beneath the highest of the channel and the supertrend degree, the rally will stay corrective reasonably than pattern forming.

Quick help lies round $0.120-$0.118, a zone that has repeatedly attracted short-term bids. A clear each day shut beneath this space would reveal a decrease channel goal round $0.105 to $0.100, the place pre-demand appeared earlier this 12 months.

Brief-term charts present makes an attempt at stabilization

The decrease timeframe signifies that DOGE is making an attempt to stabilize after final week’s decline. On the 30-minute chart, the value stays above the intraday uptrend line and is buying and selling across the session VWAP of $0.123. This means short-term patrons are attempting to guard worth, however confidence continues to be restricted.

The RSI on the intraday chart has recovered in the direction of the mid-$50s, indicating a pause in downward momentum reasonably than a bullish transition. Every upward strain is in response to promoting strain round $0.125 to $0.127, holding the value beneath short-term resistance.

For the bulls to realize momentum, DOGE will want sustained acceptance above $0.128, which is per current VWAP and intraday provide. Failure to regain that zone leaves the market susceptible to renewed promoting.

Derivatives Information Alerts Threat Mitigation

Derivatives knowledge are more and more cautious. Open curiosity was down 3.5% to about $1.45 billion, indicating that leveraged merchants proceed to scale back publicity reasonably than positioning for a rebound. This regular unwinding means that the market is lowering threat reasonably than making ready for an upside breakout.

Gross sales quantity elevated by greater than 22%, however that improve didn’t translate into increased costs. This divergence sometimes displays a distribution the place exercise will increase throughout declines reasonably than throughout accumulation phases.

Liquidations stay skewed lengthy throughout a number of time frames, with over $2.5 million worn out previously 24 hours. This imbalance signifies that merchants are nonetheless leaning in the direction of bullish resistance, permitting sellers to drive the value decrease with restricted resistance.

Sentiment stays headwind

Market sentiment is including additional strain. The Concern and Greed Index is 24, indicating that there’s excessive concern throughout the crypto market. Over the previous 30 days, Dogecoin has closed inexperienced in simply 37% of classes, highlighting continued promoting strain all through December.

This setting limits aggressive spot shopping for. When concern reigns and the rally fails to regain key technical ranges, markets typically fall or stay range-bound till a transparent catalyst seems.

outlook. Will Dogecoin go up?

Dogecoin will proceed to keep up a defensive posture heading into December thirty first.

- Bullish case: DOGE held above $0.118, regained $0.128, and has since closed each day above $0.140. It will mark a break from the descending channel and open room for $0.155.

- Bearish case: A each day shut beneath $0.118 confirms a continued decline and $0.105 and $0.100 emerge as the subsequent draw back targets.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply