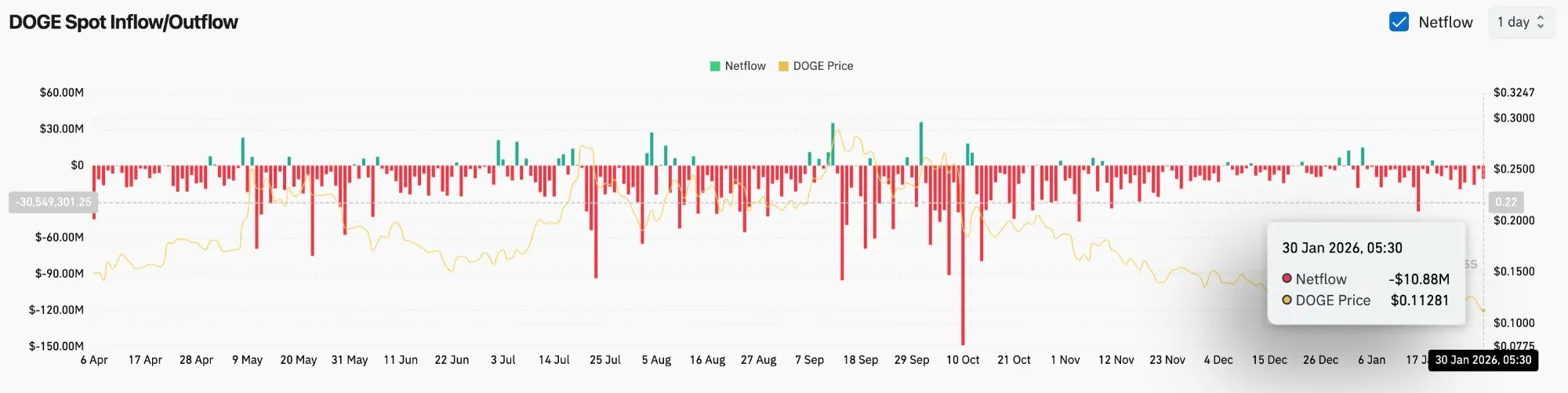

- As soon as spot outflows attain $10.88 million on January 30, Dogecoin will fall beneath $0.12 and take a look at the long-term uptrend line from 2024.

- With zero day by day inflows and whole internet belongings of simply $10.15 million, the DOGE ETF lags far behind the XRP and Solana funds.

- A restoration would require a return to $0.1268, however a detailed beneath the trendline round $0.11 would open the draw back in the direction of $0.08.

Dogecoin value is buying and selling round $0.1128 at present after falling beneath the $0.12 degree and testing an essential long-term trendline that has supported the token since mid-2024. The transfer comes as ETF flows have utterly stalled and spot outflows proceed, leaving DOGE with out a catalyst to reverse months of promoting stress.

ETF demand won’t materialize

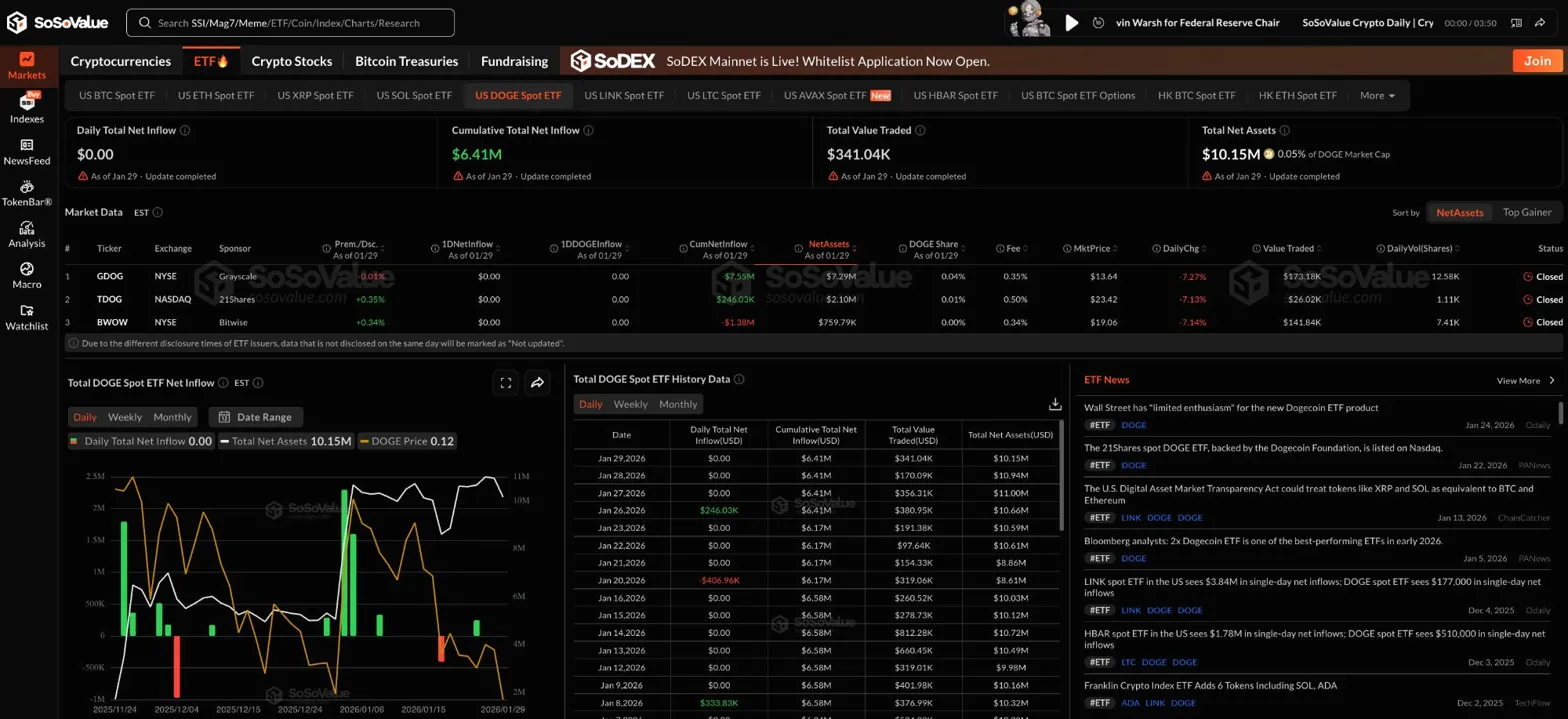

The Dogecoin ETF story failed to fulfill the demand that bulls had hoped for. As of Jan. 29, all three DOGE spot ETFs had zero inflows and whole internet belongings of simply $10.15 million, in keeping with SoSoValue information. Cumulative inflows since launch have reached $6.41 million, a fraction of the funds raised by competing altcoin funds.

For comparability, the Spot XRP ETF pulled in inflows of $1.26 billion and the Solana fund attracted $884 million. Even the smaller market, the Chainlink ETF, has $86 million in belongings underneath administration and has amassed $73 million.

This disparity displays a widespread lack of institutional curiosity in DOGE. With out new demand from the ETF channel, costs will nonetheless rely on retail sentiment and spot market flows.

Spot outflow continues as sellers distribute

Internet outflows had been $10.88 million on Jan. 30, in keeping with Coinglass information, extending a distribution sample that has lasted by way of a lot of the previous two months. Constant promoting stress means that holders will proceed to cut back their publicity fairly than accumulate at decrease ranges.

For the reason that meme coin rally fizzled out in late 2024, DOGE has lacked a significant catalyst. Elon Musk, who has traditionally made posts which have brought on speedy actions within the token, has remained silent about Dogecoin. With out such narrative impetus or the power of the broader crypto market, sellers have maintained management of value actions.

Lengthy-term trendline take a look at places construction in danger

On the day by day chart, Dogecoin stays in a bearish construction and is buying and selling beneath all 4 main EMAs. The 20-day EMA is $0.1268, the 50-day EMA is $0.1347, the 100-day EMA is $0.1498, and the 200-day EMA is $0.1708. The Supertrend indicator stays bearish at $0.1344.

The value is presently testing the uptrend line drawn from the July 2024 low round $0.09. This trendline helps DOGE by way of a number of corrections, and a decisive break beneath it’s going to shift the macro construction from consolidation to breakdown.

The downtrend line from September 2024 continues to cap the rise, forming a narrowing wedge sample. Worth is sitting close to the highest of that wedge, which means a decision in both route is anticipated inside the subsequent few classes.

Intraday momentum stays weak

On the 30-minute chart, DOGE reveals a transparent downtrend with new highs since January twenty eighth. The downtrend line rejected all bounce makes an attempt and the value fell beneath $0.1130 within the newest session.

The RSI is approaching oversold territory at 31.32, however has not but reached the extent that will usually set off a reversal. The MACD stays adverse and the histogram continues to indicate bearish momentum.

The important thing intraday resistance lies on the downtrend line close to $0.1145. Bulls want a break above that degree to point near-term stability. Assist lies at $0.1120, and the long-term trendline is the final line of protection earlier than an extra decline.

Outlook: Will Dogecoin go up?

The development stays bearish although the value is buying and selling beneath the EMA cluster and ETF demand is non-existent.

- Bullish case: A day by day shut above $0.1268 would retrace the 20-day EMA and sign the primary signal of a development reversal. That motion would require improved flows and ideally a catalyst akin to new involvement from Mr. Musk or elevated rotation of meme cash.

- Bearish case: An in depth beneath the long-term development line round $0.11 confirms the macro breakdown and exposes the $0.08 to $0.09 demand zone. Absent ETF inflows or spot accumulation, this situation stays the trail of least resistance.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply