- Dogecoin rose 2.14% to $0.1081 after rebounding 12% from session lows of $0.094, with quantity surging 30.73% as merchants check the restoration.

- Elon Musk’s “perhaps subsequent 12 months” feedback on X within the month didn’t set off a rally, highlighting the weakening affect of social catalysts on DOGE’s worth motion.

- A restoration would require a return to $0.1274, however an in depth under $0.094 would open the draw back in direction of the $0.08 demand zone.

Dogecoin worth is buying and selling round $0.1081 right now after recovering from a session low of $0.094, the bottom since mid-2024. This backlash got here regardless of Elon Musk reviving the Dogecoin moon story with X. Whereas it was the catalyst for double-digit positive aspects in earlier cycles, it’s barely registered now because the meme coin stays caught in a downward channel.

https://twitter.com/teslaownersSV/standing/2018563310309060852

On February 3, Elon Musk reignited hypothesis that he would ship a bodily Dogecoin to the moon by responding to say of the long-delayed DOGE-1 mission by saying, “Possibly subsequent 12 months.” The remark refers back to the extensively publicized 2021 pledge to place a literal Dogecoin on the literal moon.

In 2021, such a remark would have sparked a multi-day rally. This time, DOGE continued to fall after the publish, highlighting how a lot energy Musk’s narrative has misplaced in shifting the market. The meme coin is down greater than 60% from its September highs regardless of constant engagement from its most distinguished backers.

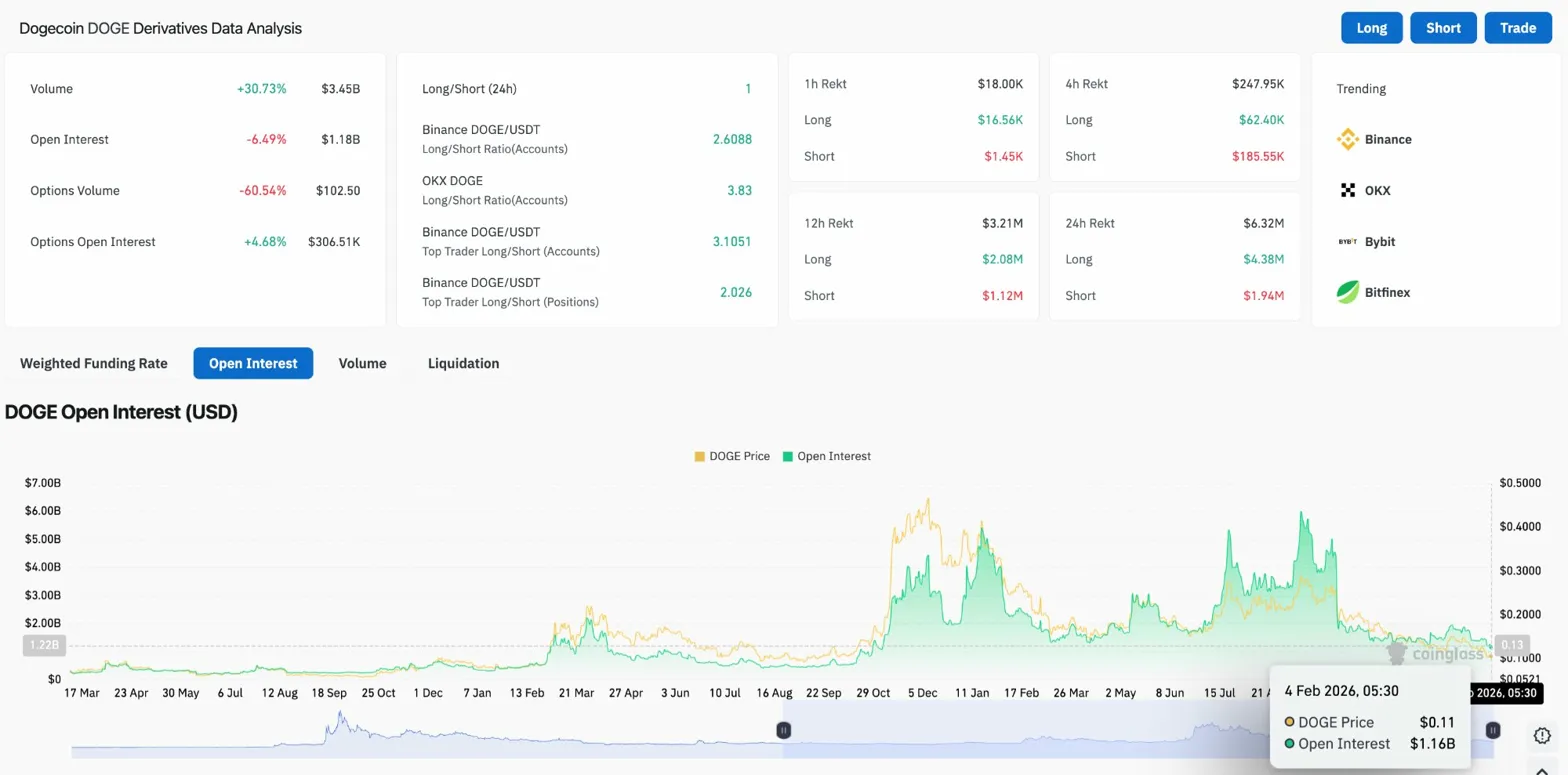

Open curiosity decreases as leverage is launched

Open curiosity fell 6.49% to $1.18 billion as leveraged positions have been flushed out within the current selloff. Quantity elevated by 30.73% to $3.45 billion, indicating elevated buying and selling exercise across the rebound at $0.094.

The lengthy/quick ratio is completely balanced at 1.0 after the current liquidation eradicated the directional bias. On Binance, prime merchants’ positions have a protracted/quick ratio of three.10 per account, indicating that some merchants are positioning for a restoration from oversold situations.

Prior to now 24 hours, $6.32 million positions have been liquidated, of which $4.38 million have been lengthy and $1.94 million have been quick. The two.2x imbalance signifies that longs proceed to be caught offside because the downtrend continues, though liquidation quantity has been slower than final week’s cascade.

Descending channels outline macro construction

On the each day chart, Dogecoin is buying and selling inside a well-defined descending channel that features worth actions since September 2025. Resistance within the channel is right down to $0.20 and assist is close to $0.08.

The supertrend indicator stays bearish at $0.1274, indicating the primary resistance stage that the bulls have to reclaim. Parabolic SAR turned bullish at $0.0945, offering instant assist for the present pullback.

Worth examined the midline of the channel in the course of the current selloff and located assist close to $0.094. A rebound to $0.108 would characterize a 12% restoration, however it’s nonetheless properly throughout the bearish channel construction. The bulls want to interrupt above $0.127 to point a significant change in momentum.

Because the market digests, a short-term triangle kinds and the market crashes.

On the 30-minute chart, Dogecoin shaped a symmetrical triangle sample as the value stabilized after the crash. This sample reveals converging pattern traces with resistance close to $0.110 and assist close to $0.106.

At 53.34, the RSI is in impartial territory with room for motion in both course. The MACD has turned constructive with the histogram bar widening, suggesting short-term momentum is within the bulls’ favor.

A break above the triangular resistance at $0.110 will goal the $0.115 zone, the place the downtrend line from January thirty first exists. A break under $0.106 would point out a failure of the triangle and a attainable retest of the $0.094 low.

Outlook: Will Dogecoin go up?

The pattern stays bearish whereas worth trades inside a descending channel, however the rebound from $0.094 signifies shopping for curiosity at decrease ranges.

- Bullish case: A each day shut above $0.1274 will reinstate the supertrend and sign a possible pattern shift. That transfer requires both a brand new narrative catalyst or a sustained enchancment in broader crypto sentiment.

- Bearish case: An in depth under $0.094 would break the parabolic SAR assist and goal the channel flooring round $0.08. With Musk’s affect waning and no new catalysts in sight, that situation stays seemingly.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply