- Ethereum has seen a spike in first-time pockets exercise, indicating momentum in new consumer adoption.

- ETH is going through important resistance between the $3,300 and $3,400 ranges.

- BitMine’s $200 million cope with MrBeast provides mainstream and DeFi publicity to Ethereum.

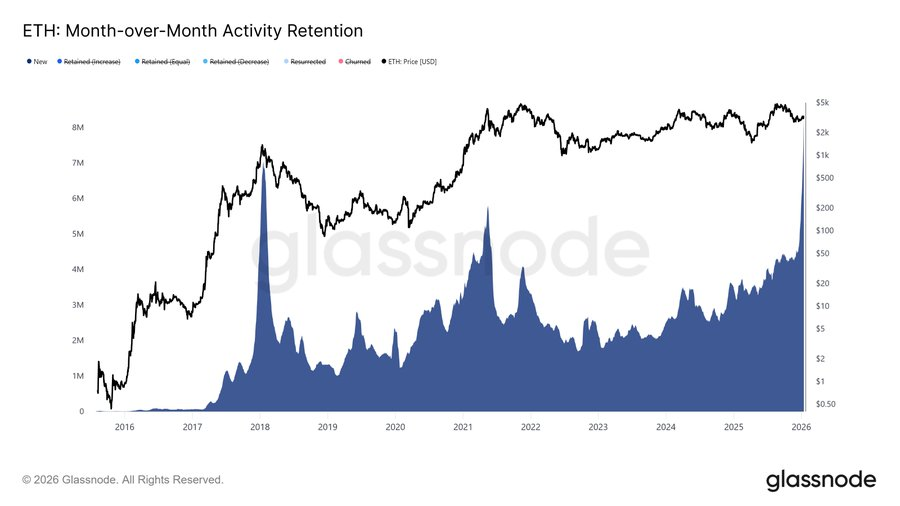

Ethereum is attracting a brand new wave of customers at the same time as its value struggles to interrupt out of a decent buying and selling vary. Glassnode’s month-over-month exercise retention information exhibits a pointy improve within the “new” cohort, indicating a pointy improve in first-time interplay addresses over the previous 30 days. This transformation means that new wallets are driving a big share of community exercise, slightly than older members doing all of the work.

Supply: Glassnode

Nevertheless, ETH continues to be buying and selling cautiously as sellers guard key resistance zones. Ethereum fell 0.02% over the previous 24 hours to round $3,313, with day by day buying and selling quantity of practically $25.7 billion. Nonetheless, the token continued to rise by nearly 6% over the previous week. The corporate’s market capitalization is sort of $399 billion, reflecting secure demand regardless of in the present day’s pullback.

New development in wallets passes essential technical assessments

Marlin the Dealer acknowledged that Ethereum has damaged its downtrend and is at the moment testing a key provide space between $3,300 and $3,400. This zone served as a ceiling in latest ascent makes an attempt. Because of this, merchants at the moment are treating it as a choice level for his or her subsequent transfer.

Marlin the Dealer urged {that a} break-and-hold above $3,400 might speed up momentum in the direction of $3,900. Along with this upside state of affairs, a rejection might push ETH again towards $3,000. Many merchants at the moment are eyeing the identical resistance zone as liquidity tightens.

Associated: Ethereum Worth Prediction: ETH Extends Breakout as Bulls Retake Brief-Time period Management

Sideways actions nonetheless outline the chart

Ash Crypto mentioned Ethereum remained sideways for 62 days, confirming its view of broad consolidation. Worth continues to respect the assist of the uptrend line from the November lows. Nevertheless, ETH continues to fail close to the $3,350 to $3,400 resistance space.

This construction usually signifies a steadiness between patrons and sellers. Moreover, volatility has additionally narrowed to inside a variety. Help is close to $3,000, however $2,850 is a deeper flooring if sellers take management.

Supply:X

Due to this fact, sentiment can change shortly if the day by day closing value is above $3,400. Ash Crypto urged that this transfer might push ETH to the psychological degree of $4,000.

BitMine backs MrBeast Empire with $200 million deal

Importantly, the story of the Ethereum ecosystem additionally acquired a mainstream perspective. Ethereum finance firm BitMine Immersion Applied sciences has agreed to take a position $200 million in MrBeast’s Beast Industries. The group oversees Feastables, MrBeast Burger, merchandise and new commerce operations.

BitMine Chairman Tom Lee tied the funding to retail distribution and cultural consciousness. Beast Industries CEO Jeff Housenbold mentioned the funding will assist development plans and DeFi integration potential. The deal is anticipated to shut round January nineteenth and can add one other catalyst as Ethereum assessments its most essential resistance within the coming weeks.

Associated: ETHGas launches GWEI governance token focusing on real-time Ethereum

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply