- Practically $560 million was misplaced from crypto ETFs, with Ethereum and Bitcoin the toughest hit.

- BlackRock’s ETHA led the selloff, adopted by Grayscale and Constancy funds.

- Ethereum has been unable to interrupt above $3,300 and continues to commerce sideways.

Ethereum costs remained beneath stress, with each Ethereum and Bitcoin remaining in a slim vary under their current highs, as a big decline in crypto change traded funds (ETFs) weighed on the general market.

In line with the information, crypto ETFs have recorded round $560 million in outflows in a single day, and each Bitcoin and Ethereum merchandise have seen heavy promoting from main asset managers.

ETF outflows hit Ethereum and Bitcoin

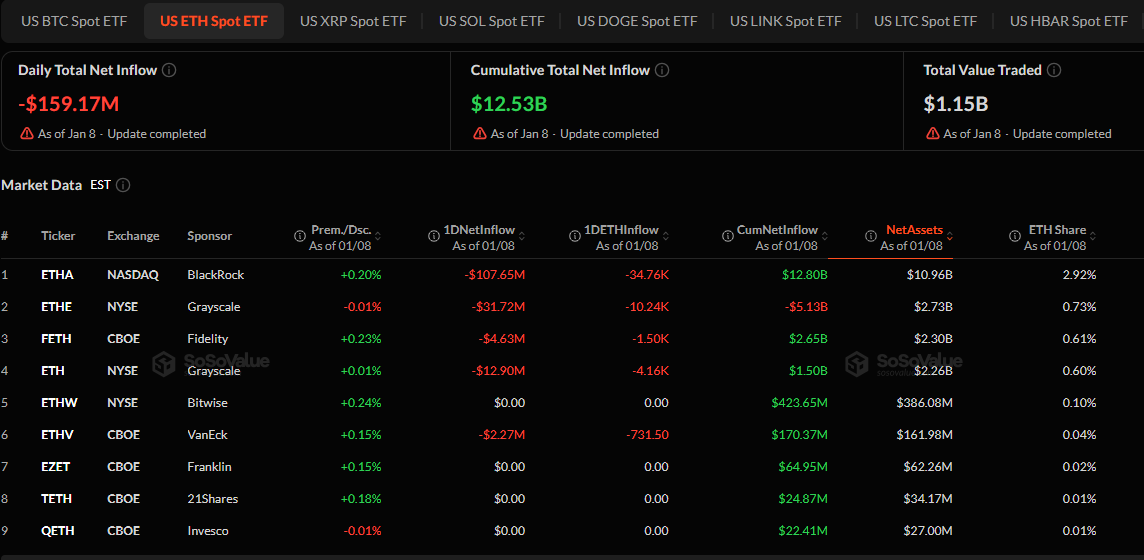

The Spot Ether ETF recorded roughly $159.17 million in withdrawals, whereas the Bitcoin ETF offered roughly $398.95 million value of holdings. Collectively, these outflows symbolize one of many largest single-day declines in ETF publicity in current weeks.

The sell-off comes as the worth struggles to interrupt above resistance, with Ethereum failing to maintain beneficial properties above the $3,300 space and Bitcoin buying and selling under the $90,000 to $95,000 vary.

BlackRock leads gross sales

Funds managed by BlackRock recorded the largest outflows in the course of the session. In its iShares Ethereum Belief (ETHA), roughly $107.65 million was outflowed from the fund. Grayscale Ethereum Belief (ETHE) adopted with $31.72 million in outflows.

The Grayscale Ethereum Mini Belief (ETH) additionally recorded roughly $12.9 million in outflows, whereas Constancy’s FETH noticed $4.63 million in withdrawals.

Ethereum trades sideways after rejection

Ethereum has moved sideways on the day by day chart after being rejected at excessive ranges earlier this week. The worth has not decisively damaged above the resistance stage, and the current decline stays inside a broader vary.

Costs have been rejected round $3,300 earlier this week and have since fallen, indicating patrons are struggling to push the market larger. Additional beneficial properties will proceed to place stress on the $3,150-$3,250 zone. Ethereum has been rejected from this area a number of instances and is at present a robust cap.

On the draw back, Ethereum stays above its current lows, however general stress continues to development downward. If the worth falls additional, analysts consider Ethereum has room to go in direction of the $2,600 to $2,250 vary, the place shopping for curiosity might return.

Associated: Vitalik Buterin particulars Ethereum’s bandwidth-first scaling technique

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply