- The entry queue for ETH staking has reached $5.5 billion, making it the longest wait since August 2023.

- The variety of validator exits spikes after which subsides, however entry demand recovers to 1,800.

- ETH worth is steady at $3,088 as RSI and MACD point out a gradual momentum restoration.

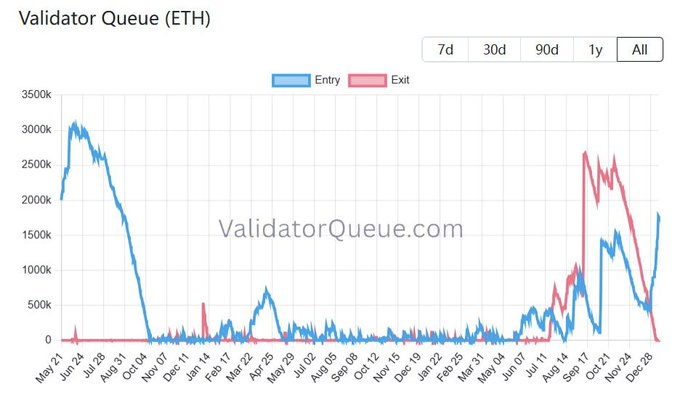

The Ethereum Beacon Chain’s staking queue has reached its largest backlog in over a 12 months, displaying new participation within the community regardless of lowering worth volatility. Based on ValidatorQueue information, 1.759 million ETH price roughly $5.5 billion is at the moment awaiting activation, the very best quantity since August 2023.

These contemplating turning into a validator could have an estimated wait time of 30 days and 13 hours for his or her deposit to be processed. Conversely, the exit queue drops to zero, indicating that withdrawal requests have been utterly cleared.

Current validator information signifies a rebalancing of Ethereum’s staking setting. Early within the statement interval, the entry queue has surged to over 3,000 pending validators, suggesting a powerful inflow of latest contributors. The wave then subsided in the direction of the tip of 2024 because the backlog largely disappeared, indicating a decline in staking demand or an acceleration of validator onboarding.

Associated article: Ethereum stays beneath strain as $560 million ETF outflows weigh on market

All through the mid-period months, each entry and exit exercise remained low, suggesting that there was a brief equilibrium between validator participation and exit. This part means constant processing speeds and steady staking sentiment throughout the community.

Nonetheless, the pattern modified once more within the final phase of the chart. Defection exercise spiked to over 2,500 validators, and we noticed a short-term wave of withdrawals. This coincided with a return to volatility within the entry queue, which resumed, albeit at a slower tempo.

By the tip of the dataset, exit strain had weakened to zero, whereas entry demand had elevated to roughly 1,500-1,800 validators. This means a renewed curiosity in community participation after a quick withdrawal part.

Associated: Ethereum prompts BPO #2 improve to extend blob capability

ETH market and know-how tendencies

On the time of this writing, Ethereum is buying and selling at $3,088.30, representing a every day decline of 0.17%. The intraday chart exhibits the value stabilizing above $3,080 after falling round $3,060. Ethereum’s market capitalization was $372.74 billion.

Technical measurements present restricted stability. The RSI hit 51.33, trending upward from the earlier sub-40 stage, suggesting a gradual restoration.

In the meantime, the MACD stays in constructive territory at 28.90, the sign line is constructive round 17.90, and the histogram is constructive round 11.00, indicating that bullish momentum is slowly constructing.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply