- Ethereum has fallen under the 20/50/100/200-day EMA and is buying and selling close to $2,103 though ETF inflows have returned after 3 days of redemption.

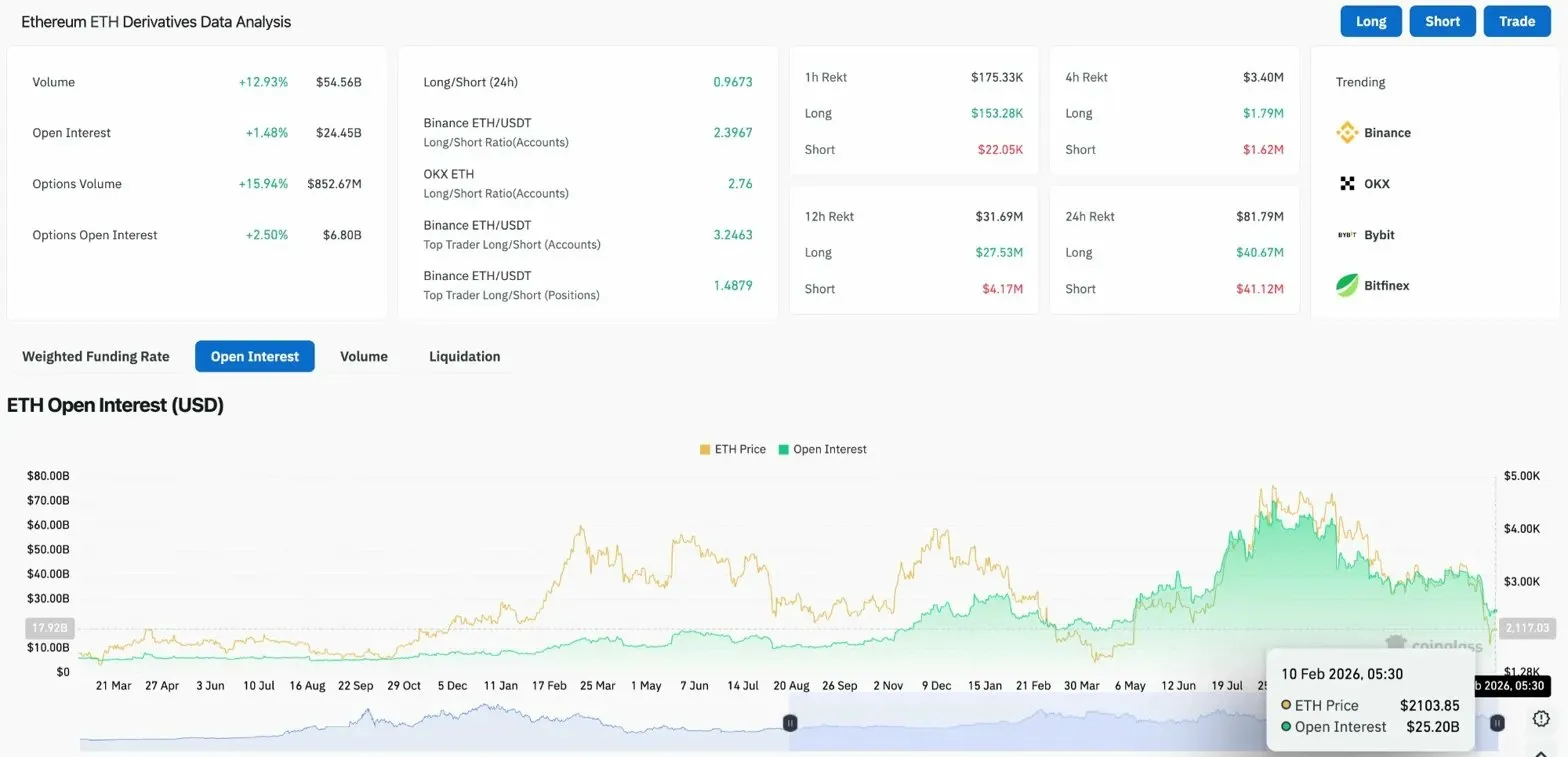

- Regardless of $57 million inflows from institutional traders, the breakdown couldn’t be stopped as open curiosity rose 1.48% and lengthy/quick ratio remained excessive at 2.39.

- Sellers are concentrating on $2,000 for psychological help, and the following demand zone stays at $1,900-$1,850 if the decrease restrict is damaged.

Ethereum value in the present day is buying and selling round $2,103, down greater than 4% prior to now 24 hours after falling under key help that has held since late January. Regardless of bettering institutional flows, this transfer places technical strain on patrons, suggesting that chart construction quite than basic positioning is driving the promoting program.

ETF inflows return, however not sufficient to reverse value fluctuations

The Ethereum Spot ETF recorded web inflows of $57.05 million on February 9, in line with SoSoValue knowledge. The reversal marked the primary optimistic circulation session after three consecutive days of outflows totaling greater than $176 million.

BlackRock’s ETHA led the best way with $12.04 million in new capital, whereas Grayscale’s merchandise have been flat to modestly energetic.

Derivatives positioning exhibits rise in leverage to breakdown

Open curiosity rose 1.48% to $24.45 billion as Ethereum broke help, suggesting merchants have been including to the volatility quite than closing out their positions. The transaction quantity elevated by 12.93% to $54.56 billion, confirming the energetic participation of each events.

Binance’s lengthy/quick ratio is 2.39 for accounts and three.24 for prime merchants, that means leverage continues to be closely skewed in the direction of longs. If the positioning is unbalanced on this means and the value breaks under the key help, the cease losses might be triggered one after the opposite, thus accelerating the transfer. As Ethereum assessments deeper zones, its dynamics will play out throughout the derivatives complicated.

Choices quantity elevated by 15.94% to $852.67 million, and choice open curiosity elevated by 2.50% to $6.8 billion. The surge in choices buying and selling displays merchants both hedging draw back danger or betting on a reversal from an oversold scenario.

After weeks of decline, all EMAs flip to resistance

Ethereum value in the present day is under all 4 main transferring averages for the primary time since early January. The 20-day EMA is $2,407, the 50-day EMA is $2,738, the 100-day EMA is $3,000, and the 200-day EMA is $3,172, presently forming a stacked resistance ceiling that patrons must reclaim to vary momentum.

The each day chart exhibits a transparent break under the multi-week consolidation, indicating that the development line help that led to the value rally for the reason that starting of the 12 months has been misplaced. After defending $2,500 repeatedly over the previous week, sellers have been compelled right into a decisive shut under it, opening the door to the draw back of the present leg.

Present main stage:

- Prompt help: $2,000

- Main demand zone: $1,900 to $1,850

- Preliminary resistance: $2,407 (20-day EMA)

- Main Resistance Cluster: $2,738 to $3,000

The Supertrend indicator flipped to purple at $2,597 on the each day timeframe, confirming a short-term bearish shift within the development. Till Ethereum regains that stage in quantity, all pullbacks will stay reactionary quite than development altering.

Intraday chart exhibits stabilization try at $2,000

On the 30-minute chart, Ethereum is making an attempt to keep up the $2,000 to $2,019 zone. The RSI recovered from 31 to 35 after the preliminary flush, indicating some aid from the oversold scenario. Nevertheless, the parabolic SAR continues to be above the value at $2,019, sustaining downward strain.

The bulls want a detailed above $2,050 to reverse the near-term bearish construction on the decrease timeframe. This transfer will change the supertrend and provides patrons room to check the resistance at $2,100. With out follow-through past that stage, the bounce stays technical quite than directional.

The stress between bettering ETF flows and deteriorating technicals creates determination factors. Both institutional demand accelerates and absorbs the promoting strain, or technical sellers break by means of $2,000 and power a deeper reset earlier than patrons return.

Outlook: Will Ethereum Rise?

The following transfer will rely on whether or not Ethereum can maintain onto $2,000, the psychological stage that served as an pivot in the course of the earlier correction.

- Bullish case: Ethereum defended the $2,000 stage and closed above $2,407 on elevated quantity. This represents step one in the direction of regaining the 20-day EMA and reversing the breakdown.

- Bearish case: A break is confirmed when the each day shut is under $2,000, rising the chance of $1,900 to $1,850. Dropping that zone opens the door to $1,750.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply