- Ethereum stays range-bound round $2,980 after pulling again from the $3,300 excessive.

- Futures open curiosity stays above $38 billion, suggesting elevated positioning and potential volatility.

- Bitmine will increase your Ethereum holdings and powers long-term accumulation and staking development.

Ethereum entered a moratorium after a risky month as merchants weighed technical pressures in opposition to regular curiosity from institutional buyers. Following a pointy pullback from late-cycle highs, value motion has settled right into a slim vary on the 4-hour chart.

Market contributors at the moment are monitoring whether or not consolidation continues or turns right into a deeper correction. Along with value traits, derivatives knowledge and company accumulation proceed to form near-term expectations.

Ethereum value maintains vary after sharp rebound

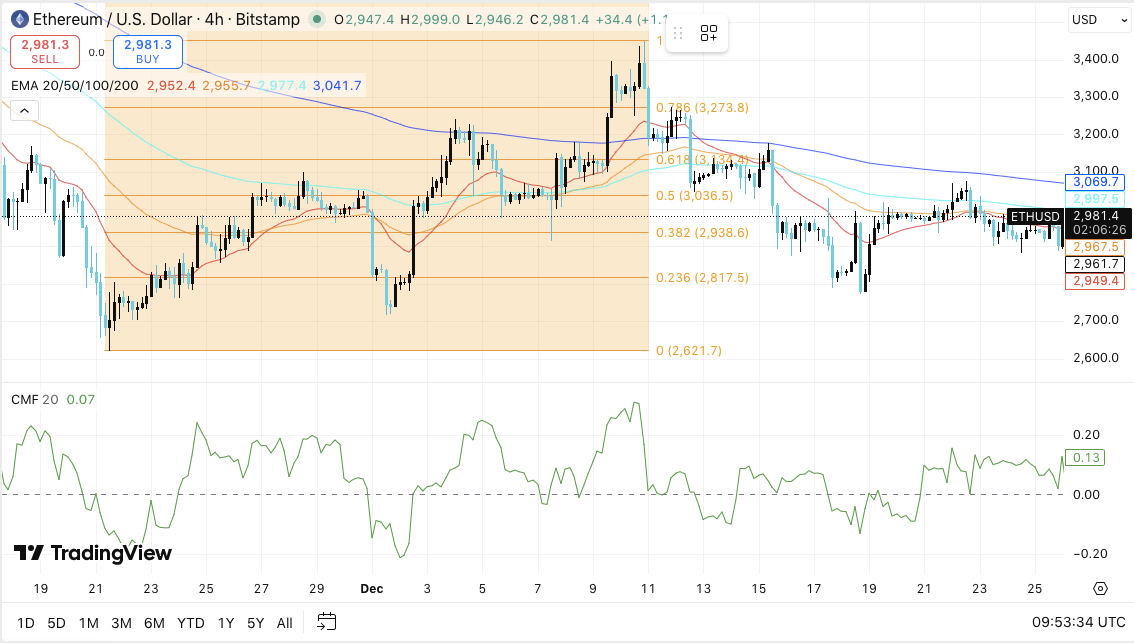

Ethereum retreated from the $3,270-$3,300 zone and moved sideways round $2,980. This construction displays a consolidation quite than a change in a confirmed development. Volatility decreased as costs remained beneath main shifting averages.

The 100-EMA close to $3,070 and the 200-EMA close to $3,040 restricted any upside makes an attempt. However, the 20-EMA and 50-EMA remained flat round $2,960-$2,980, displaying indecision.

Key resistance ranges are situated close to $3,036 and $3,134, which coincide with the Fibonacci retracement degree. A break above $3,135 will reactivate the earlier provide zone round $3,300. Nevertheless, the vendor had beforehand defended the realm.

On the draw back, speedy help lies between $2,965 and $2,950. Extra demand is seen close to $2,938 and $2,817. Due to this fact, a break beneath $2,940 would expose the $2,820 to $2,780 vary.

Associated: XRP Worth Prediction: Sellers will shield EMA cap as trade influx restores EMA cap

Momentum indicators counsel restricted confidence. CMF readings stay barely constructive, indicating a gentle inflow. However consumers aren’t bidding any greater. Due to this fact, Ethereum stays range-bound whereas merchants look forward to affirmation.

Derivatives and spot flows level positioning

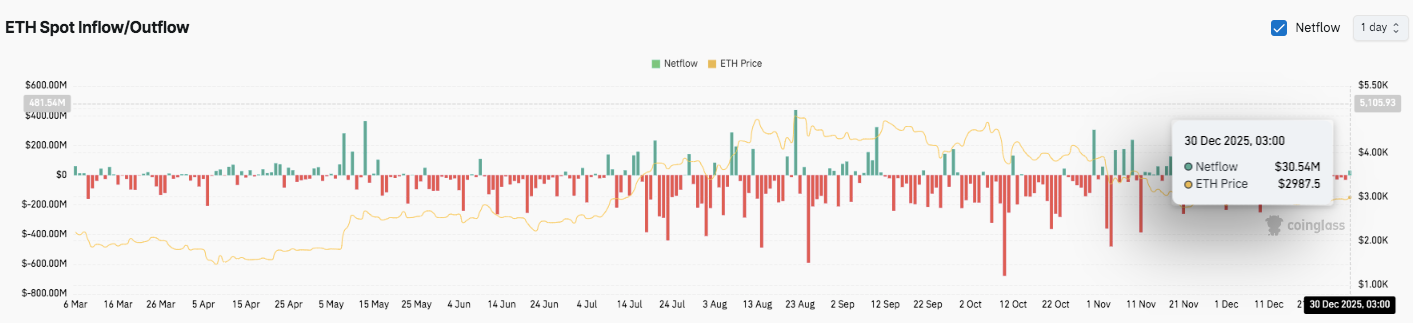

Regardless of current value hesitation, Ethereum futures exercise continues to develop. Open curiosity elevated steadily all year long, reflecting elevated participation in derivatives. In the course of the uptrend up to now, open curiosity has surged as costs have risen. Importantly, the pullback precipitated solely a shallow discount in open curiosity.

Latest knowledge exhibits futures publicity is over $38 billion. This divergence means that merchants are holding onto their positions regardless of consolidation. Moreover, leverage stays elevated, rising sensitivity to directional actions. Consequently, the futures market seems to be in a state of affairs of accelerating volatility quite than capitulation.

Web flows fluctuated quickly all through 2025, reflecting lively positioning. On December thirtieth, Ethereum recorded web inflows of $30.54 million, with the worth hovering round $2,975. Importantly, capital inflows typically coincide with value energy, reinforcing accumulation alerts.

Institutional accumulation that helps long-term narratives

Company accumulation added one other layer to Ethereum’s prospects. Bitmine elevated its Ethereum holdings by 44,463 tokens by means of a $130 million buy. With this transfer, the full quantity held elevated to roughly 4.11 million ETH. The corporate presently controls roughly 3.41% of Ethereum’s whole provide.

Associated: Solana Worth Prediction: SOL consolidates after rebound as a dealer…

Bitmine has additionally expanded its staking operations. We presently have over 408,000 ETH staked and are planning additional growth by means of the MAVAN validator community in 2026.

Technical outlook for Ethereum value

As Ethereum trades inside a tightening vary for the subsequent part, key ranges stay clearly outlined.

On the upside, the primary resistance hurdles lie at $3,036 and $3,135. A confirmed breakout above $3,135 might pave the way in which for the $3,270-$3,300 provide zone the place sellers had beforehand capped the rally.

On the draw back, speedy help stays between $2,965 and $2,950. Under that, we see sturdy demand close to $2,938, adopted by a deeper help band close to $2,820. A break beneath $2,940 would weaken the present construction and improve draw back danger to low demand territory.

The broader technical image exhibits Ethereum buying and selling beneath main shifting averages, reflecting short-term indecision quite than development exhaustion. This correction part typically precedes a rise in volatility in both route.

Will Ethereum rise additional?

Ethereum’s near-term prospects rely on whether or not consumers can comply with by means of and regain the $3,135 degree. Stronger capital inflows and sustained buying and selling volumes might help a push again in the direction of current highs.

Nevertheless, failure to defend the $2,950-$2,940 zone will shift focus to decrease help. For now, Ethereum stays at a vital inflection level and requires affirmation to outline its subsequent route.

Associated: Bitcoin Worth Prediction: BTC Holds $84,000 Help, However ETF Inflows Forestall Breakout

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply