- ETH stays below strain, with $1,742 serving as a significant assist amid an prolonged downtrend.

- Spinoff unwinding and destructive web flows counsel that merchants are lowering leverage publicity.

- Robinhood’s Layer 2 testnet highlights Ethereum’s transition to specialised functions.

Ethereum is buying and selling close to key assist after months of regular promoting strain. The 4-hour chart exhibits a stable downtrend with decrease highs and decrease lows. Value rejected the 0.786 Fibonacci degree close to $3,047 and by no means regained momentum.

In consequence, sellers tightened their management after ETH misplaced the 0.618 degree at $2,768. This breakdown accelerated the decline in the direction of $1,742, which now gives main structural assist.

Technical construction stays bearish beneath $2,050

ETH lately rebounded from $1,742 however stays beneath a significant resistance cluster. At present, the $1,900 to $1,850 zone is serving because the quick short-term demand.

Nevertheless, failure to maintain this space will increase the danger of a retest of $1,742. A full break beneath that degree may expose $1,650 and even $1,600.

On the upside, $2,036 to $2,050 kinds the primary resistance zone. Moreover, $2,134 marks a small Fibonacci resistance close to the 0.236 retracement.

If the restoration continues, the following barrier would be the 0.382 degree at $2,377. Moreover, the 0.5 retracement at $2,572 represents a significant development shift zone.

Associated: Bitcoin Value Prediction: BTC Open Curiosity Falls as Bears Take Management

The Ichimoku cloud stays overhead, reinforcing consolidation inside a broader bearish construction. The DMI indicator is exhibiting strain cooling promoting. Nevertheless, patrons nonetheless lack decisive momentum.

Spinoff reset indicators: prudent positioning

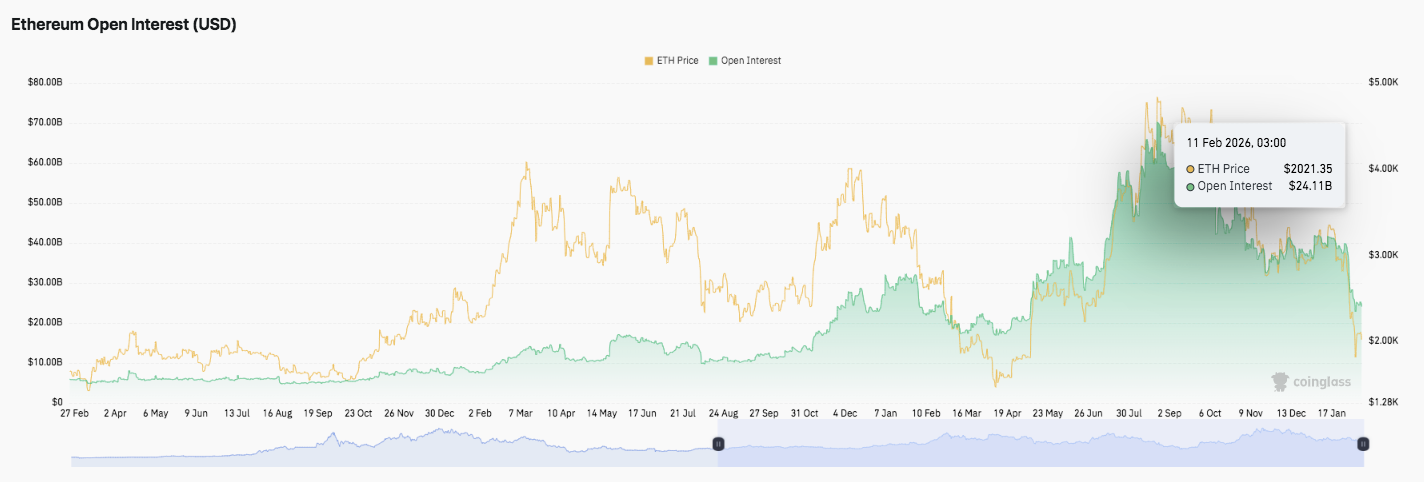

Ethereum’s open curiosity expanded aggressively via mid-year, peaking at practically $60 billion. The surge mirrored rising leverage and powerful speculative urge for food. Importantly, current knowledge exhibits that open curiosity is shrinking in the direction of $24 billion. This unwinding suggests liquidation, trimming positions, and lowering leverage publicity.

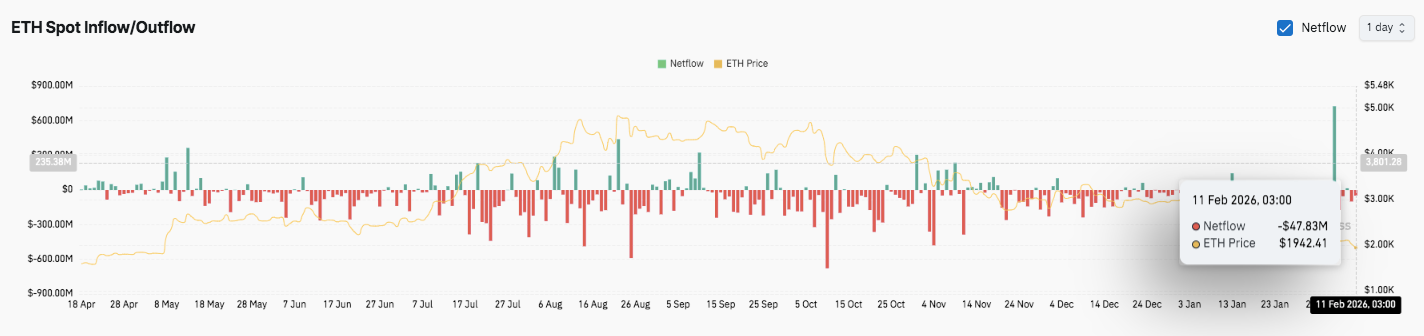

Spot circulate knowledge additionally spotlight persistent distribution traits. Pink web flowers dominated a large space from mid-year to early winter. A spike in a number of massive outflows has coincided with a drop in costs, indicating indicators of change deposits. As well as, occasional inexperienced spikes counsel selective accumulation on the native backside.

Associated: LayerZero (ZRO) Value Prediction: Can LayerZero Clear $2.46 and Prolong Rally?

Latest web inflows stay barely destructive, with new outflows at practically $47 million. Subsequently, merchants seem like cautious concerning key technical ranges.

Robinhood expands Ethereum utility with Layer 2 testnet

In opposition to this backdrop, Robinhood has launched a public testnet of an Ethereum-based Layer 2 chain constructed on Arbitrum. The community goals to assist tokenized shares, ETFs, and different real-world property. Moreover, builders can now construct publicly forward of the mainnet launch, scheduled for later this 12 months.

Robinhood goals to allow 24/7 buying and selling and self-custody via its cryptocurrency pockets. Moreover, customers can bridge property throughout chains and entry DeFi functions on Ethereum.

Ethereum base layer upgrades proceed to extend capability and cut back prices. In consequence, Layer 2 networks are more and more targeted on specialised functions relatively than pure scaling. Robinhood’s transfer displays this alteration and highlights the evolution of the Ethereum ecosystem.

Technical outlook for Ethereum value

The important thing ranges stay well-defined as Ethereum trades inside a broader bearish construction. Value continues to respect the swing low of $1,742, which represents essential structural assist.

Prime degree: The quick resistance degree is between $2,036 and $2,050, which coincides with the Ichimoku decrease boundary. A break above $2,134 (0.236 fib) would point out enhancing momentum. If the bulls keep their power, ETH may increase in the direction of $2,377 (0.382 fib) after which $2,572 (0.5 fib), which might point out a significant development shift degree.

Cheaper price degree: $1,900 to $1,850 stays the primary demand zone to guard. Under that, $1,742 is the principle structural assist. Should you take a look at the breakdown, it might be $1,650 and even $1,600.

Technical situations present that Ethereum is consolidating beneath the cloud after a pointy retracement from the $3,047 rejection zone. Momentum indicators mirror waning promoting strain, however bulls lack certainty. This construction is just like a compression section inside a broader downtrend, and volatility can improve quickly in both path.

Will Ethereum rebound?

Ethereum’s near-term outlook depends upon whether or not patrons defend $1,900 and resolutely get better $2,050. A sustained transfer above $2,134 would change short-term sentiment and pave the way in which for $2,377. Nevertheless, in the event you fail to carry $1,900, an extra $1,742 sweep is probably going.

For now, ETH is situated inside an important vary. Derivatives positioning has cooled and spot flows stay cautious. Subsequently, affirmation from sturdy volumes and inflows will decide whether or not Ethereum builds a restoration basis or extends the correction section.

Associated: Cardano Value Prediction: ADA Exams Multi-Month Lows As Open Curiosity Falls and Outflows Proceed

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply