- ETH is dealing with short-term weak spot and is buying and selling beneath all main EMAs and main resistance ranges.

- Spot outflows and diminished open curiosity point out a cautious and deleveraging market.

- Discussions about innovation improve long-term uncertainty in regards to the development of the Ethereum ecosystem.

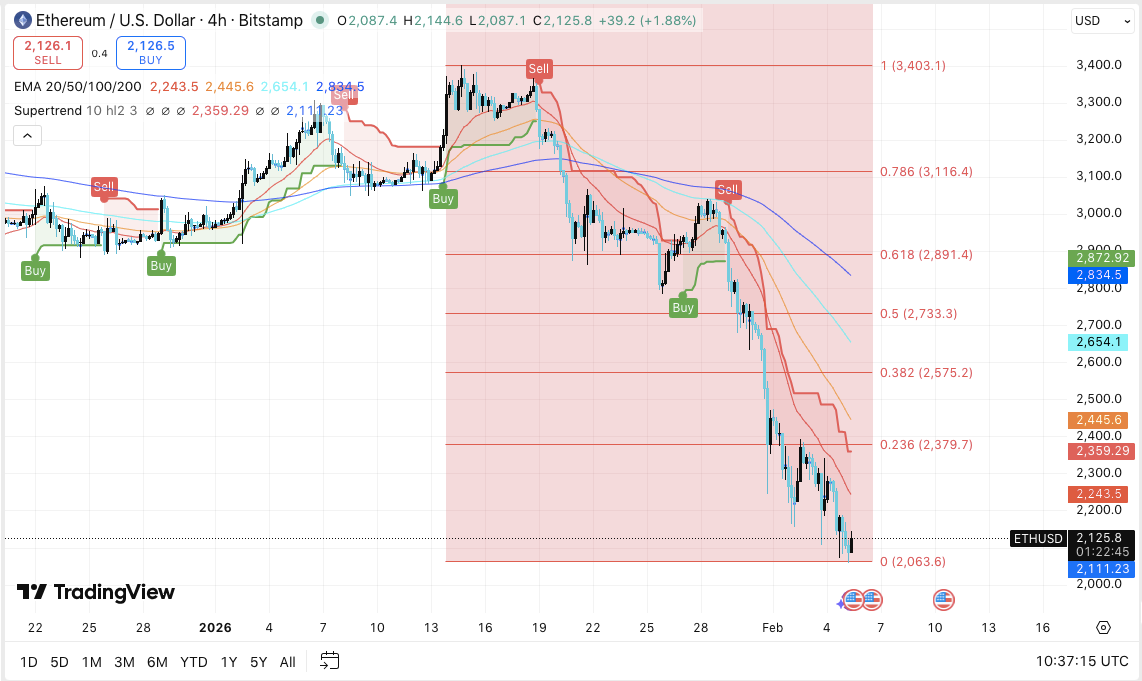

Ethereum continues to face technical pressures because the short-term value construction weakens and total market confidence stays fragile. On the 4-hour chart, ETH maintains a transparent bearish development, with decrease highs and decrease lows guiding the worth motion.

A current restoration try in the direction of the $2,125 space failed to vary this construction, reinforcing the view that the transfer lacks conviction. Due to this fact, merchants stay cautious as the worth stays beneath the important thing resistance zone.

Bearish construction dominates 4H chart

Ethereum is buying and selling beneath all main exponential transferring averages together with the 20, 50, 100, and 200 EMAs. These ranges are at the moment sloping downwards, inserting a cap on any upward makes an attempt. Moreover, development indicators proceed to favor sellers, indicating restricted momentum from patrons.

The broader decline accelerated after ETH misplaced a key Fibonacci stage, with promoting strain growing with every breakdown. Because of this, costs are at the moment hovering round the important thing demand zone between $2,063 and $2,080.

This space represents the final seen short-term assist. A transparent break beneath this vary may expose the psychological $2,000 stage. Along with its psychological significance, the zone usually causes elevated volatility.

Associated: Bitcoin (BTC) Value Prediction: BTC falls beneath key ranges as derivatives cool…

If sellers push by, there might be draw back liquidity between $1,920 and $1,880. On the optimistic aspect, ETH must regain the $2,245-$2,260 area earlier than the restoration positive factors momentum.

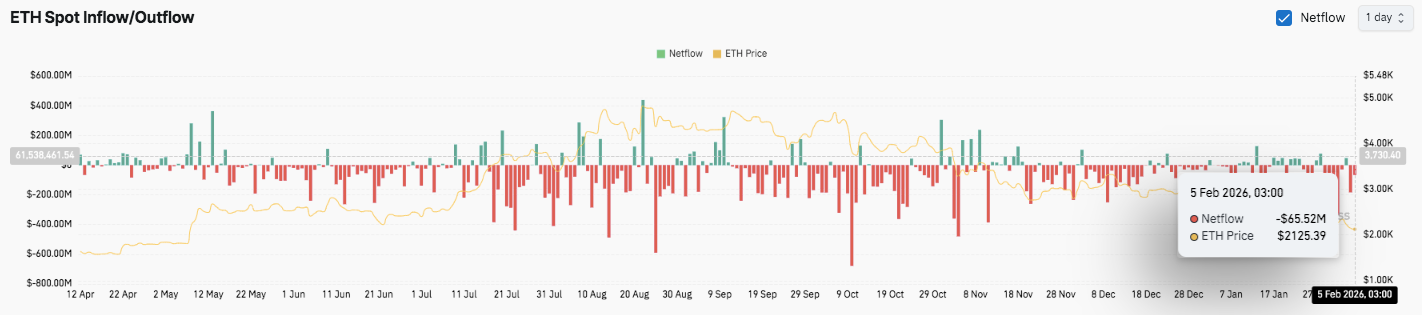

Derivatives and spot information sign market reset

The Ethereum derivatives market displays a widespread reset of speculative positions. Open curiosity expanded aggressively through the preliminary rally, peaking at over $60 billion as leverage elevated quickly.

Every financial enlargement resulted in a pointy contraction, highlighting compelled liquidations through the adjustment. Not too long ago, open curiosity has declined in the direction of the mid-$20 billion vary, suggesting widespread deleveraging. Moreover, this discount reduces short-term volatility whereas eradicating extra danger from the system.

Spot circulate information provides additional context. Ethereum has skilled a protracted interval of internet outflows, indicating continued circulation. A short lived burst of influx occurred throughout a quick rebound, however follow-through was missing.

Associated: World Cell Token (WMTX) Value Prediction 2026-2030

Importantly, current flows have proven contraction on either side, suggesting indecision and weak spot in spot demand. The market now seems to be ready for a clearer accumulation sign.

Innovation debate creates long-term uncertainty

Past value tendencies, strategic issues are additionally coming into the dialog. Ethereum co-founder Vitalik Buterin just lately appealed to builders to rethink present architectural tendencies.

He warned that repeatedly deploying related EVM chains and acquainted scaling designs dangers delaying significant progress. As an alternative, it inspired exploration of latest execution fashions, privateness programs, and low-latency architectures.

Technical outlook for Ethereum value

Ethereum’s key ranges stay well-defined as value trades close to key inflection factors for the upcoming session.

On the upside, the primary resistance cluster exists between $2,245 and $2,260. A break above this vary may open the way in which to sturdy resistance on the EMA at $2,360-$2,380 after which $2,445-$2,460. A sustained restoration above $2,575 (0.382 Fibonacci) can be wanted to sign a broader development change and restore medium-term bullish momentum.

On the draw back, quick assist lies between $2,063 and $2,080, which is performing as a short-term demand zone. Failure to maintain this space will increase draw back danger in the direction of the psychological stage of $2,000. Beneath $2,000, the subsequent pocket of liquidity is between $1,920 and $1,880, the place patrons might attempt to stabilize the worth.

The technical construction means that Ethereum stays beneath bearish management, with the worth beneath the main transferring averages. This compression alerts elevated volatility going ahead.

Will Ethereum go up?

The near-term outlook for ETH value will depend upon whether or not patrons can maintain the $2,060 space lengthy sufficient to counter the overhead resistance. Elevated inflows and elevated open curiosity will assist a restoration in the direction of above $2,360.

Nonetheless, if the present assist shouldn’t be sustained, there’s a danger that the downtrend will prolong beneath $2,000. For now, Ethereum remains to be in a decisive zone and requires affirmation earlier than its subsequent directional transfer.

Associated: XRP Value Prediction: Token crashes to post-election low $1.43 as $1 goal comes into view

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply