- ETH stays underneath stress, holding close to $2,050 with restricted short-term upside potential.

- The bears are accountable for the momentum as the worth stalls under $2,150 and the correctional pullback fades.

- Whereas deleveraging reduces liquidation threat, spot flows point out a cautious maintain fairly than a purchase.

Ethereum’s near-term outlook stays fragile as merchants weigh technical pressures towards bettering on-chain balances. On the 4-hour chart, ETH continues to keep up its draw back construction after falling sharply from the $3,400 space. The value is at the moment buying and selling round $2,050, and contributors appear extra cautious than assured.

Current market tendencies recommend consolidation fairly than restoration as sellers proceed to guard overhead ranges. In consequence, analysts see restricted upside except ETH proves energy above close by resistance zones.

Management the bears with short-term construction

Ethereum’s 4-hour construction exhibits a managed downtrend with value holding under the key channel band. The bounce off the $1,860 low lacks sturdy follow-through and resembles a correctional transfer.

Moreover, ETH continues to stall under the mid-channel zone, indicating weak demand through the rally. This motion means that merchants are nonetheless promoting on energy fairly than chasing a breakout. So whereas the worth cap is stored under $2,150, the broader construction is advantageous to sellers.

Resistance ranges are nonetheless nicely outlined and technically necessary. The $2,135 to $2,150 space continues to function an on the spot rejection zone. Moreover, the 0.382 Fibonacci degree close to $2,377 represents the primary significant barrier to momentum enchancment.

Above that, $2,573 matches the 0.5 retracement and former provide. Importantly, the 0.618 retracement round $2,768 stays a key degree the place the bears have to lose shift management.

Associated: Bitcoin value prediction: BTC falls into correction regardless of indicators of bullish shopping for

On the draw back, ETH maintains short-term help within the $2,000 to $2,020 vary. This zone has psychological significance and daytime relevance. A failure right here might expose the latest swing low close to $1,863.

Moreover, $1,740 is the final main demand zone from this decline. An increase in the direction of this degree would affirm the continuation of the pattern.

Momentum indicators proceed to help the bearish image. DMI information exhibits ADX close to 31, reflecting a robust trending surroundings.

Nonetheless, the unfavourable directional index remains to be above the constructive line. In consequence, regardless of latest sideways value actions, sellers are nonetheless accountable for momentum.

Including context with derivatives and spot flows

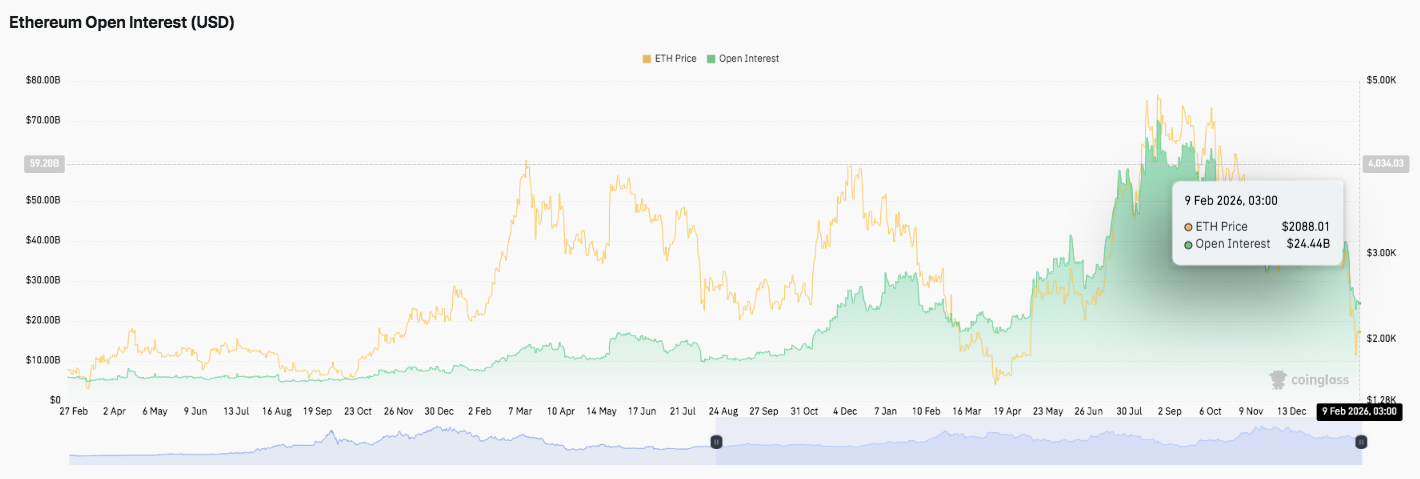

Ethereum’s open curiosity information exhibits a well-known cycle of enlargement and reset. Open curiosity expanded through the rally, reflecting elevated leverage. The sharp decline pressured liquidations and speedy unwinding of positions.

Associated: Cardano value prediction: ADA holds $0.27 as Hoskinson’s $3 billion loss highlights cycle stress

Just lately, open curiosity has fallen sharply from a excessive degree. This decline suggests a broader deleveraging part fairly than a panic. Subsequently, liquidation threat seems to be low within the brief time period.

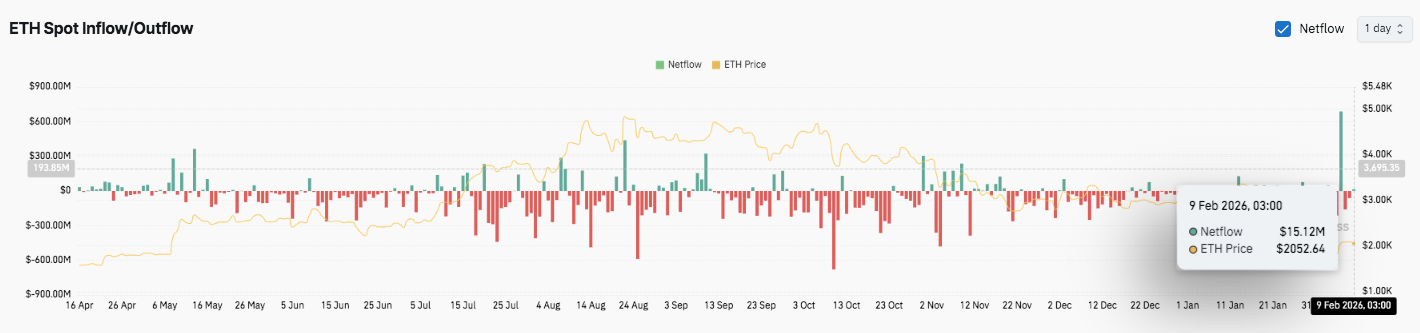

Spot circulation information provides a layer of distinction. Sustained forex outflows dominated a lot of the interval. These withdrawals point out tightness in holding habits and circulating provide. Nonetheless, web flows have just lately compressed to close neutrality. This modification suggests stability fairly than energetic accumulation. Moreover, latest capital inflows stay modest, indicating warning relating to present costs.

Technical outlook for Ethereum value

Ethereum’s key ranges stay well-defined because the market strikes by way of a fragile restoration part.

Rapid hurdles for the upside are at $2,135 and $2,150. If confirmed above this zone, it might open room for $2,377, which might proceed to $2,573 if momentum improves. The higher restrict of key resistance stays at $2,768, and a reversal could be wanted to sign a broader pattern change.

On the draw back, $2,000-$2,020 serves as short-term help and a key psychological zone. A lack of this space might ship ETH again in the direction of $1,863. Under that, $1,740 is the final main demand zone for this leg.

The technical construction means that Ethereum remains to be in a correction part inside a broader downtrend. Worth stays under key Fibonacci ranges and descending channel resistance, leaving any makes an attempt at upside weak. Though latest consolidation suggests downward stress is slowing, momentum indicators stay in favor of sellers.

Will Ethereum go up?

Ethereum’s near-term course will rely upon whether or not consumers can confidently defend the $2,000 zone and recuperate $2,150. A profitable breakout might set off a transfer in the direction of $2,377 as volatility will increase.

Nonetheless, if the help isn’t maintained, there’s a threat that the worth will as soon as once more be headed in the direction of the $1,860-$1,740 vary. For now, ETH is at a degree the place affirmation, not expectations, is essential to figuring out the following transfer.

Associated: ASTER Worth Prediction: ASTER Rebound Aligns with Provide Zone as Leverage Continues to Fall

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply