- Presently, ETH maintains a bullish construction within the brief time period as leverage cools after the breakout section

- Derivatives reset alerts consolidation danger, ETH cycle pattern exhaustion not but

- ZK-EVM and information improve strengthen prospects for Ethereum’s long-term scaling principle

Ethereum is receiving renewed market consideration because of value tendencies, derivatives information, and protocol upgrades scheduled for early 2026. The asset continues to commerce in a constructive short-term construction whereas merchants assess leverage actions and spot move tendencies.

On the identical time, new technical milestones outlined by co-founder Vitalik Buterin add to the long-term story that extends past the value chart. Taken collectively, these elements body Ethereum as a market with a stability of momentum, warning, and structural evolution.

Value construction exhibits short-term energy

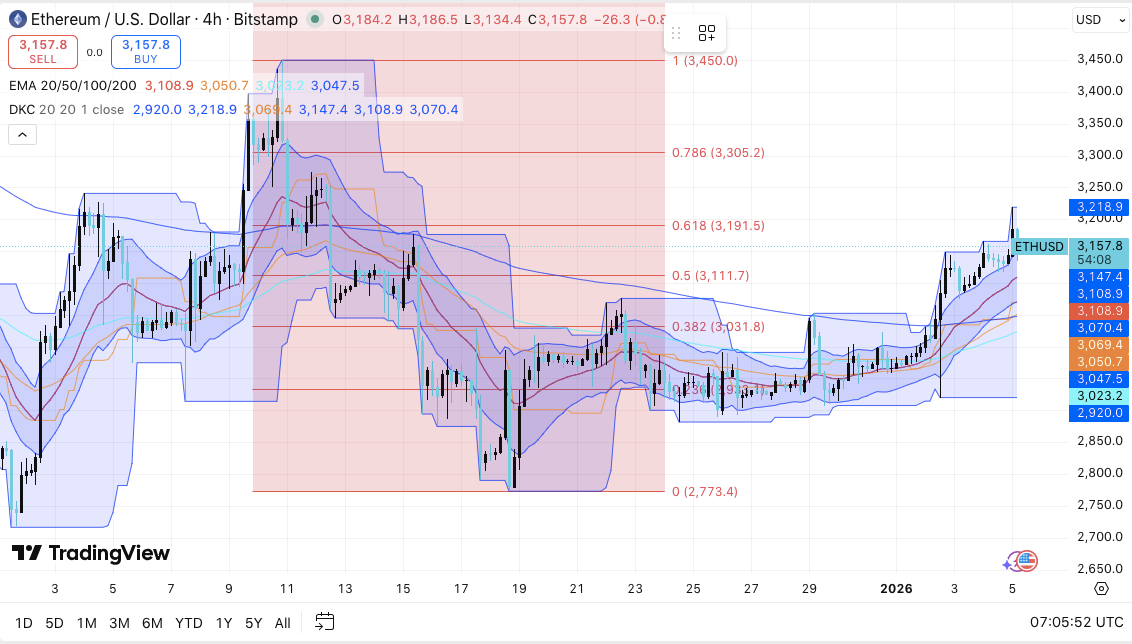

Ethereum’s 4-hour chart exhibits a transparent upward bias, supported by rising highs and rising lows. Costs are above the rising short-term shifting common, confirming energetic purchaser management. Including to the pattern construction, elevated volatility adopted a clear breakout above the $3,000 stage. This transfer suggests participation in momentum relatively than a pointy spike in liquidity.

View submit ↗

Nevertheless, resistance overhead continues to form short-term expectations. The $3,220 to $3,250 zone marks the primary main take a look at after the current rally.

Because of this, a sustained transfer above that vary would expose $3,305, coinciding with a key Fibonacci retracement. If momentum accelerates additional, $3,450 turns into a better enlargement goal.

On the draw back, the assist response remains to be vital. The $3,190 space acts as the primary protection and is positioned close to the vital Fibonacci stage.

Associated: Chainlink 2026 Predictions: Institutional RWA Promotion and CCIP v1.5 Targets $45-75

Moreover, the $3,110 to $3,070 space combines shifting common assist with earlier demand. An extra decline in direction of $3,030 will weaken the construction and focus will shift to the consolidated base at $2,920.

Futures information signifies leverage reset

Ethereum futures open curiosity expanded sharply throughout the current breakout, reflecting a rise in derivatives individuals. Open curiosity peaked close to the earlier cycle’s excessive as value momentum strengthened. Importantly, the following decline in direction of the mid-$40 billion mark suggests place discount relatively than widespread danger abandonment.

Due to this fact, merchants seem to cut back publicity after enlargement whereas sustaining general engagement. Open curiosity stays elevated in comparison with earlier cycles, suggesting that rates of interest on derivatives stay structurally excessive. This sample usually precedes a consolidation section relatively than a pattern reversal.

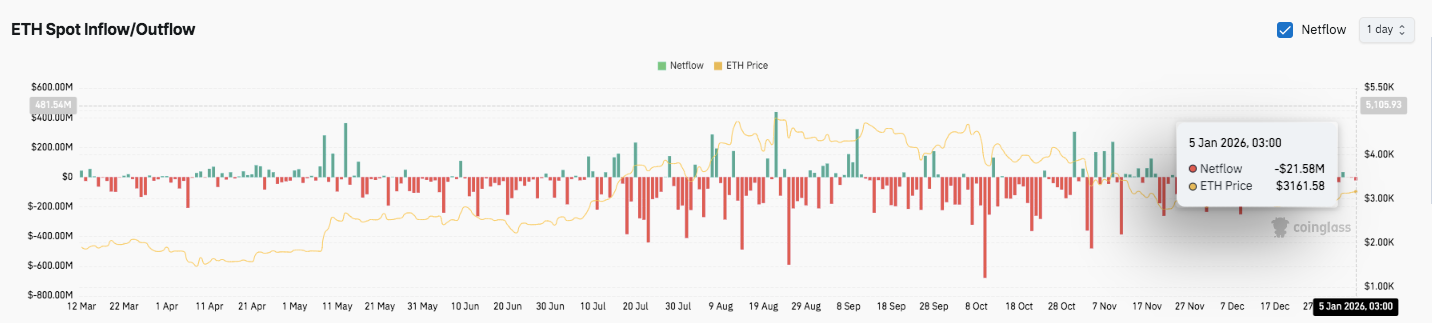

Spot flows mirror energetic rotation

Spot alternate flows inform a extra cautious story. Outflows have been dominant throughout current periods, indicating continued distribution whereas costs stay strong. Moreover, the short-term surge in inflows has not been sustained, reinforcing the view of short-term buying and selling exercise relatively than long-term accumulation. As costs pattern upward, provide rotation will proceed with out tightness.

Community upgrades add long-term context

Past the market, Ethereum’s growth roadmap continues to evolve. Mr. Buterin not too long ago outlined the progress made in bettering ZK-EVM readiness and information availability. These advances goal to extend throughput whereas sustaining decentralization.

Moreover, extra widespread ZK-based validation is anticipated later this decade, positioning Ethereum for structural scaling. As short-term value competitors performs out, this story might affect long-term confidence.

Technical outlook for Ethereum (ETH) value

Ethereum trades inside a short-term bullish construction on decrease time frames, so key ranges stay well-defined. Ethereum stays above the rising shifting common and maintains momentum regardless of overhead resistance.

- Prime stage: Fast resistance lies between $3,220 and $3,250, marking the current swing excessive zone. A affirmation above this vary might pave the way in which to $3,305, which is in step with the 0.786 Fibonacci stage. Past that, continued momentum might prolong to an upside enlargement goal of $3,450.

- Cheaper price stage: Preliminary assist is positioned close to $3,190, an vital retracement space for patrons to guard. Under that, the $3,110 to $3,070 zone acts as a confluence of shifting averages and midrange Fibonacci assist. A deeper pullback would deal with $3,030, adopted by stronger structural assist between $2,920 and $2,950.

- Higher restrict of resistance: The $3,250 space stays a key stage to show round for a sustained rally. A strong break above this space would strengthen the bullish pattern over the medium time period.

Will Ethereum go up?

Ethereum’s value outlook is determined by whether or not patrons can defend the $3,070 to $3,190 assist band. Technical compression after the current breakout suggests volatility might decide up once more.

Associated: Bitcoin Money 2026 predictions: Could improve brings quantum safety and good contracts

If momentum rebuilds with a follow-through above $3,250, ETH might retest $3,305 and even $3,450. Nevertheless, failure to maintain $3,030 will weaken the construction and focus will shift to the $2,920 benchmark. For now, Ethereum is buying and selling in a decisive zone the place assist response will decide the subsequent transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply