- Ethereum fell 0.78% to $2,926, testing the ascending channel help from December lows round $2,600.

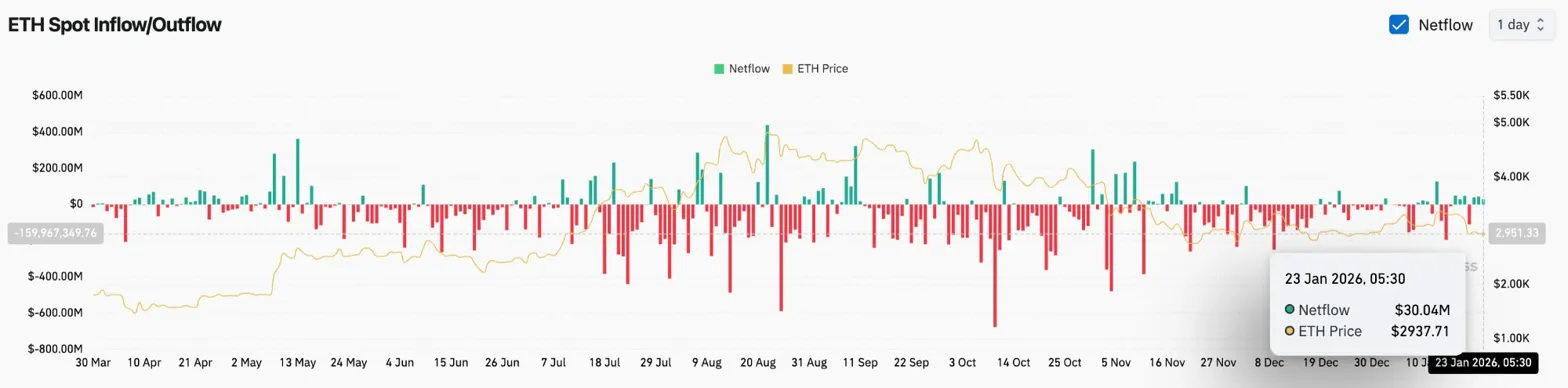

- Regardless of the value buying and selling 6% beneath its 20-day EMA, patrons proceed to pile in, with inflows from spot exchanges reaching $30.04 million.

- JP Morgan has questioned whether or not the advantages from Fusaka’s improve will maintain up amid Layer 2 competitors, including elementary uncertainty to the technical setup.

Ethereum worth is buying and selling close to $2,926.42 right now because the ascending channel help faces its third check this month. Spot flows stay constructive regardless of the correction, creating a possible flooring for costs whilst macro considerations and analyst skepticism weigh on costs.

Steady accumulation of spot influx indicators

Alternate circulate knowledge reveals that patrons stepped in throughout the downturn. Coinglass recorded web inflows of $30.04 million on January 23, extending the buildup sample that had continued throughout the correction interval.

When a coin strikes off an alternate throughout a decline, it often displays that long-term holders discover the present worth enticing. This transfer may scale back the obtainable provide on the order e book and speed up the restoration as soon as promoting strain subsides.

This buildup comes regardless of the value buying and selling 6% beneath the 20-day EMA, suggesting that patrons are proactively catching the falling knife relatively than ready for technical affirmation.

Derivatives present combined indicators

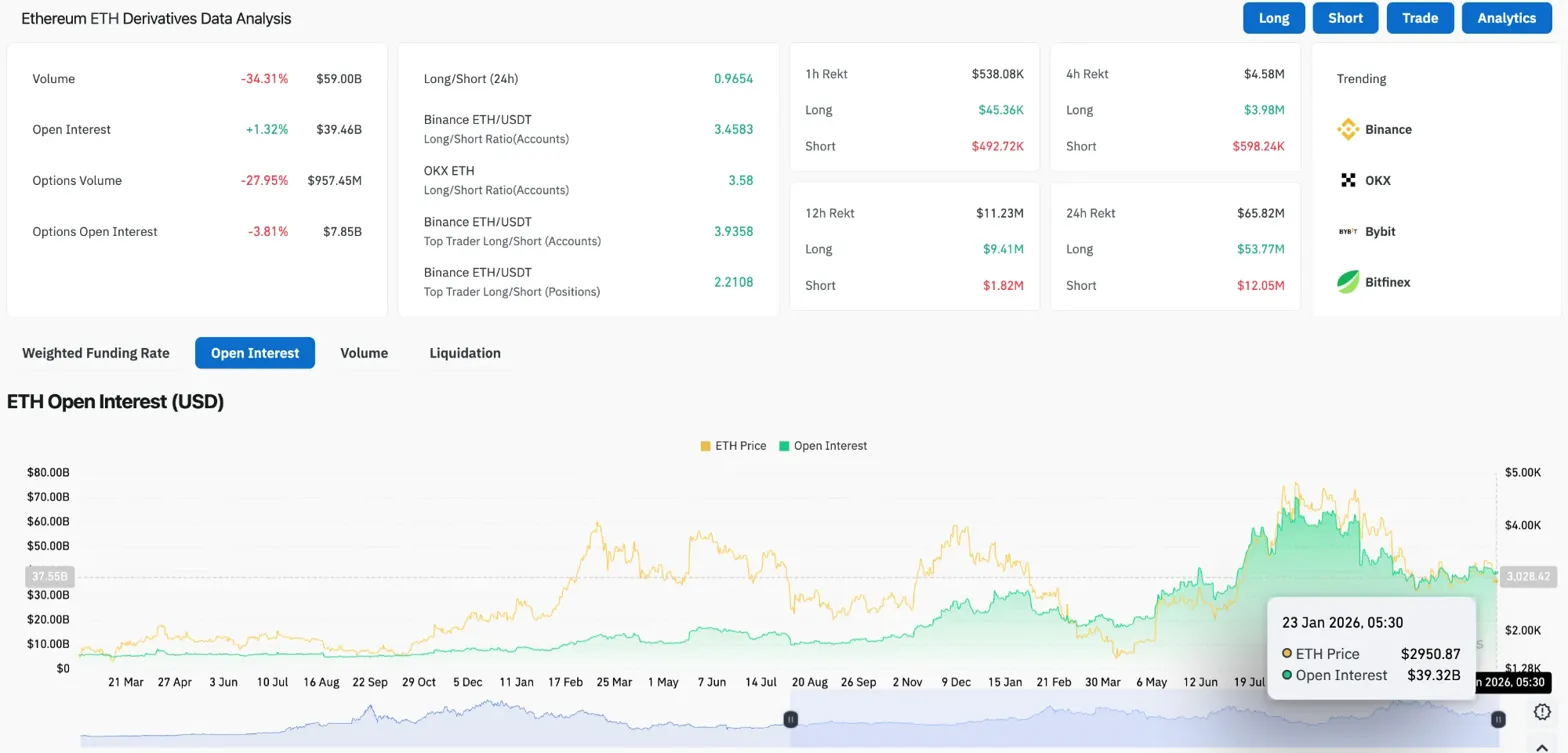

Futures markets paint a extra cautious image. Open curiosity elevated by 1.32% to $39.46 billion, however buying and selling quantity decreased by 34.31% to $59.0 billion. This divergence means that present positions are being held relatively than new bets being positioned.

Previously 24 hours, lengthy positions of $53.77 million had been liquidated, whereas brief positions of $12.05 million had been liquidated. The 4:1 ratio reveals that leveraged bulls stay caught on the fallacious facet of the vary.

The lengthy/brief ratio is 0.96, which is roughly balanced, with a slight bias towards shorts. Binance’s high merchants maintained a protracted/brief ratio of three.45, indicating that giant accounts remained web lengthy regardless of the correction.

JP Morgan asks about improve affect

The underlying background provides to the uncertainty. Analysts at JPMorgan famous that Fusaka’s improve in December lowered charges and elevated transactions, however questioned whether or not the restoration could possibly be sustained given competitors from layer-2 networks and rival blockchains.

The financial institution warned that earlier related upgrades had not been capable of maintain enhancements in community exercise. Competitors from sooner chains like Solana and a shift in exercise to Base, Arbitrum, and Optimism proceed to fragment capital away from Ethereum’s major layer.

Regardless of on-chain indicators displaying accumulation, skepticism is reinforcing the bearish outlook. Whether or not technological developments or elementary considerations prevail will decide the path of the approaching weeks.

Assist for ascending channels is on maintain for now

On the every day chart, Ethereum has been buying and selling in an uptrend channel since December lows round $2,600. This sample factors to additional lows, with worth at present testing the decrease sure for the third time this month.

Value continues to be beneath all 4 EMAs, confirming short-term weak spot.

- Rapid resistance: $3,107 (20 EMA)

- Secondary resistance: $3,132 (50 EMA)

- Key resistance: $3,260 (100 EMA)

- Supertrend resistance: $3,326

- Development resistance: $3,320 (200 EMA)

- Channel help: $2,900 to $2,920

- Breakdown aim: $2,600

This channel has contained the correction to this point, with patrons rallying to defend the sample every time it checks help. In case your beliefs weaken, you threat breaking the construction on the fourth check.

Intraday construction reveals a descending triangle

A shorter timeframe reveals short-term pressures. On the hourly chart, ETH has been forming a descending triangle because the decline on January nineteenth. Value cuts off the highs, however help stays flat round $2,920.

The RSI is in impartial territory at 43.33 with no apparent momentum. The MACD stays bearish, however the histogram is shrinking, suggesting the downtrend could also be shedding momentum.

Triangles often resolve at a breakdown, however they will additionally point out a reversal sample in the event that they type at a help degree. A break beneath $2,900 will affirm a bearish decision and goal $2,800. Above $2,980, the sample turns into invalid and the goal turns into $3,050.

Outlook: Will channel help be maintained?

The setup reveals an accumulation that withstands technical strain. Spot inflows recommend patrons are seeing worth, however the descending triangle and JPMorgan skepticism are creating headwinds. The help of the ascending channel turns into a decisive degree.

- Bullish case: Value rebounds from the $2,900 channel help and breaks the descending triangle to the upside. An in depth above $3,000 targets the 20 EMA at $3,107.

- Bearish case: Assist for the channel will probably be discontinued after the fourth check. If the value closes beneath $2,900, the breakdown will probably be confirmed and the goal will probably be $2,800, with a risk of $2,600 if the sell-off accelerates.

Ethereum is on the decrease finish of the restoration spectrum. Spot accumulation permits for a bid, however the chart requires a maintain above $2,900 to take care of the bullish construction.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply