- ETH continues to be capped beneath the downtrend line and the tight EMA cluster between $3,190 and $3,405.

- Spot flows don’t point out sustained accumulation and reinforce value motion inside a variety fairly than a breakout.

- Consumers proceed to defend the $2,900-$2,950 demand zone, limiting draw back stress for now.

Ethereum value is buying and selling round $3,030 as we speak, stabilizing after holding off the decrease finish of its latest vary. Costs stay trapped beneath the downtrend line, limiting any restoration makes an attempt since October, whereas consumers proceed to defend the $2,900 to $2,950 demand zone. The market is in equilibrium, with neither facet exhibiting any perception.

Downtrend line continues to restrict restoration makes an attempt

On the day by day chart, Ethereum stays trapped in a broad descending construction that began after the September peak. Any features since then have stalled beneath the downtrend line, reinforcing sellers’ management on increased time frames.

Value continues to commerce beneath the 20-day, 50-day, 100-day, and 200-day EMAs, all of that are concentrated between $3,190 and $3,405. This EMA stack is a dense zone of resistance fairly than dynamic help. The supertrend additionally stays within the pink close to $3,380, matching the development line and reinforcing its higher restrict.

Till ETH is ready to definitively regain this confluence, any try at an upward transfer will stay corrective. The broader construction nonetheless favors a continuation or maintain of the decline over a right away development reversal.

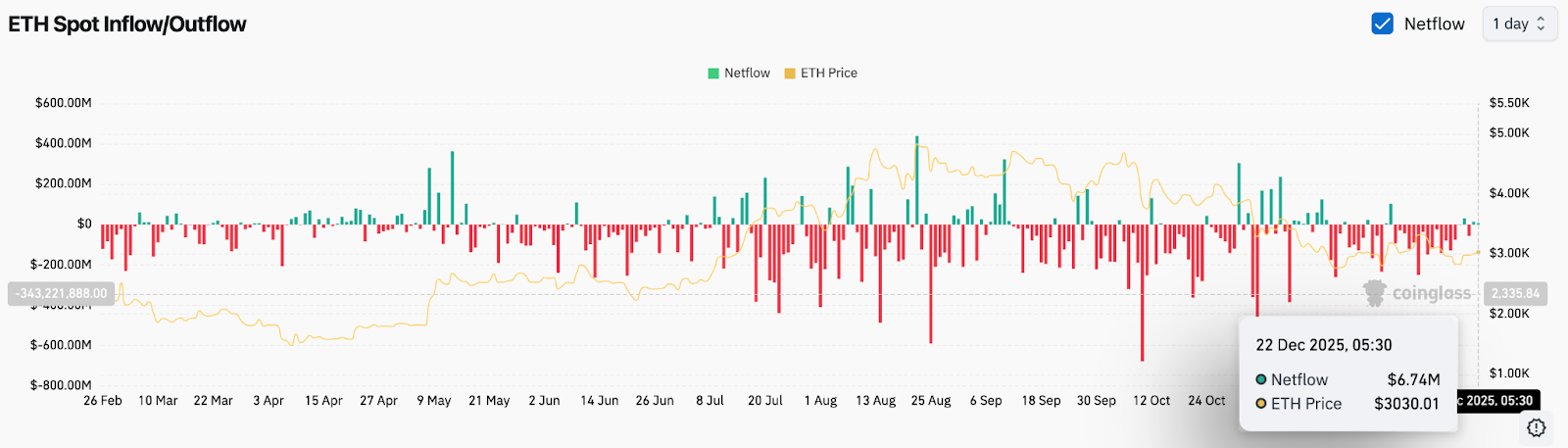

Spot flows don’t present clear accumulation tendencies.

Spot move information proceed to mirror indeterminacy. Current transactions have proven modest web inflows, together with about $6.7 million on Dec. 22, adopted by an prolonged interval of web outflows from October to November.

Associated: Late Evening Value Forecast: Spot Outflows Collide With Bullish Construction

Total, the main target stays on distribution. There aren’t any consecutive days of enormous inflows, and outflows proceed to dominate periodically. This transfer means that long-term accumulation just isn’t but aggressive sufficient to interrupt by means of technical resistance.

The intraday construction reveals managed stabilization

On the 30-minute chart, Ethereum has carved out an uptrend channel after rebounding from the $2,950 swing low. Value has damaged above short-term development help and is progressively rising, however momentum stays measured fairly than impulsive.

The RSI is holding close to the 58 stage, reflecting a balanced state of affairs fairly than overbought stress. The MACD stays optimistic however flat, signaling stabilization fairly than enlargement. That is per the broader theme of compression fairly than directional certainty.

Intraday consumers have been lively however haven’t but pressured the worth into increased time frames. Barring a break above $3,100-$3,150, this transfer stays tactical fairly than structural.

outlook. Will Ethereum go up?

Ethereum stays in a tightening vary, with rising stress on either side.

- Bullish case: A day by day shut above $3,300 will carry the development line and EMA cluster again to help, opening the door to an extension above $3,600.

- Bearish case: A lack of $2,900 would invalidate the vary and expose the draw back in the direction of $2,750.

Ethereum will proceed to consolidate till both stage breaks. Your subsequent actions will likely be decisive fairly than gradual.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply