- Ethereum is buying and selling at $3,136 as Bitmine holds $4 billion of ETH and owns 3.45% of the overall provide with a goal of 5%.

- Tom Lee declares the mini-crypto winter is over, predicting $250,000 per ETH in the long run, whereas Normal Chartered predicts $40,000 by 2030.

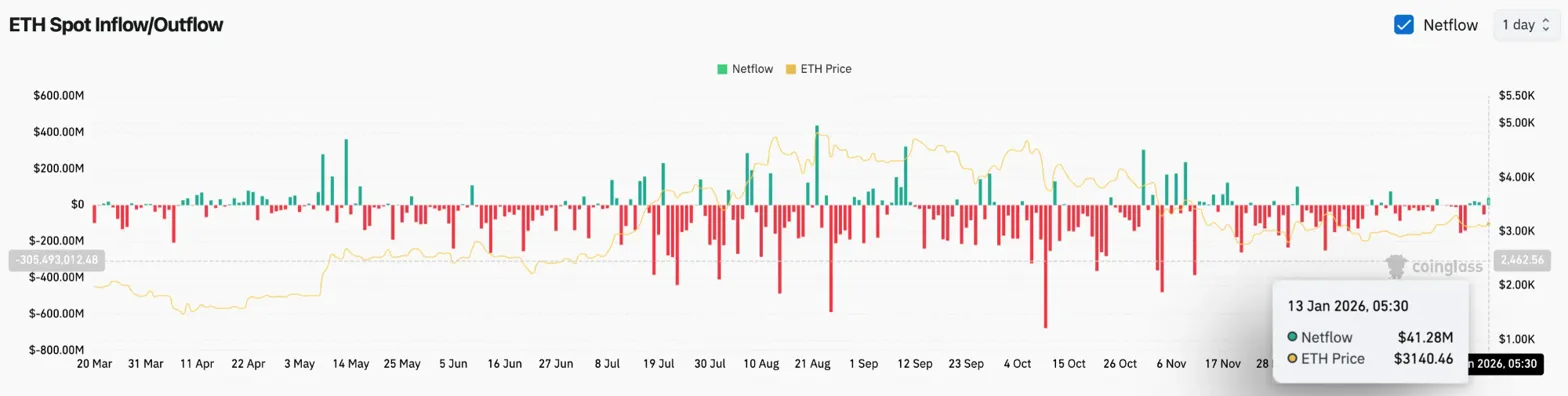

- On the hourly chart, the RSI signifies a triangle breakout try at 58.89, and spot inflows reached $41.28 million on January thirteenth.

Ethereum worth is buying and selling round $3,136 immediately following the information that Bitmine holds $4 billion value of ETH, one-third of its complete holdings of $13 billion. Chairman Tom Lee declares the “mini-crypto winter” is over and predicts annual staking income of $374 million, whereas ETH checks triangular resistance on the hourly chart as technical momentum improves.

Bitmine turns into the most important Ethereum staking supplier

Bitmine introduced on Monday that the corporate will “develop into the most important staking supplier in the complete crypto ecosystem,” with annual income anticipated to exceed $1 million day-after-day. The corporate is backed by Peter Thiel’s Founders Fund and Cathie Wooden’s ARK Make investments, and holds 3.45% of the overall ETH provide with a goal of 5%.

Lee mentioned Bitmine “stakes extra Ethereum than every other entity on this planet,” positioning the corporate because the main institutional investor in ETH staking. The transfer comes after the corporate bought an extra $76 million value of Ethereum within the second week of January, demonstrating continued confidence whilst the value trades 37 p.c beneath August’s all-time excessive.

The staking announcement supplies elementary help because it ensures substantial provide and generates yield for institutional holders. Since Bitmine is focusing on 5% of complete provide, the corporate might want to purchase extra ETH at present ranges, creating potential shopping for strain.

Lee predicts $250,000 purpose as establishments enter

Tom Lee has lengthy been some of the bullish Ethereum analysts, charting a path to $250,000 per token, equal to a $30 trillion valuation. Lee argues that by 2026, stablecoin adoption and tokenization will make blockchain the funds layer for Wall Avenue, favoring Ethereum particularly.

Associated: Shiba Inu Value Prediction: SHIB is in a cooling section after a rally at the start of the month

Normal Chartered echoed the bullish view, predicting that ETH would attain $40,000 by 2030 because of institutional adoption. “Identical to 2021, 2026 would be the yr of Ethereum,” mentioned Jeffrey Kendrick, the financial institution’s international head of digital asset analysis.

The institutional argument gained momentum after JPMorgan chosen Ethereum for its first-ever tokenized cash market fund, an asset class value $9 trillion. Morgan Stanley filed for an Ethereum ETF earlier this month, becoming a member of a rising checklist of conventional monetary firms constructing on or investing in ETH infrastructure.

Triangular sample checks resistance when circulation turns constructive

Alternate circulation knowledge confirmed spot inflows of $41.28 million as of January 13, indicating accumulation after an extended interval of blended flows all through 2025. When institutional traders like Bitmine purchase with constructive retail flows, it often precedes a sustained transfer reasonably than a brief pullback.

Spot circulation patterns all through 2025 confirmed volatility with giant outflows throughout occasions of market stress and sporadic inflows throughout upswings. The present $41.28 million influx, mixed with Bitmine’s $76 million acquisition, suggests rising confidence at present ranges.

Hourly chart exhibits triangle breakout try

The hourly timeframe exhibits Ethereum breaking above the triangle sample resistance close to $3,140. The RSI is at 58.89, a impartial to barely bullish stage after recovering from oversold circumstances at the start of the week. The MACD is exhibiting a bullish crossover at 3.90, which generally precedes upside worth actions on shorter time frames.

Costs are testing resistance on the downtrend line that has capped positive factors since October. A clear break above $3,160 with quantity would verify the triangle breakout and set the preliminary goal at $3,280. This sample means that compression has ended and directional motion is on the way in which.

Associated: Chiliz Value Prediction 2026: FIFA World Cup and $100M US Re-Entry Goal $0.10-$0.15

Assist lies on the decrease finish of the triangle close to $3,080. Holding this stage will maintain the breakout setup intact, however dropping this stage will invalidate the sample and expose $3,000 help.

Day by day construction exhibiting all EMAs clustered

The every day chart exhibits Ethereum buying and selling inside a decent cluster of exponential transferring averages between $3,087 and $3,337. The most important ranges are:

- 20-day EMA: $3,087

- 50-day EMA: $3,123

- 100-day EMA: $3,282

- 200-day EMA: $3,337

- Parabolic SAR: $3,302

Value is barely above the 20-day and 50-day EMA, however beneath the 100-day and 200-day common. This compression of the EMA creates a impartial zone the place both the bulls or bears must confidently take management. The parabolic SAR at $3,302 marks the primary main resistance stage that must be damaged for the momentum to firmly flip bullish.

The downtrend line from the October excessive is situated overhead close to $3,200. A breakout of this stage together with SAR will full the reversal sample and pave the way in which to $3,500.

Outlook: Will Ethereum Rise?

The mix of Bitmine’s $4 billion fairness, enhancing institutional adoption, and constructive spot flows creates a bullish elementary backdrop. If ETH rises above $3,200 and retakes the $3,302 parabolic SAR, a triangle breakout will probably be confirmed, initially focusing on $3,500 and additional rising in the direction of $3,800 if it positive factors momentum.

If the value loses the triangle help at $3,080, the breakout will probably be a false transfer. This is able to expose the help at $3,000, but when the promoting accelerates and the Bitmine shareholder vote on January 15 is disappointing, there may be additional draw back potential in the direction of $2,900.

A triangle will probably be confirmed if the value breaks above $3,200. In the event you lose $3,080, your setup will probably be disabled.

Associated: Cardano Value Prediction: ADA trades sideways as Cardano faces post-cycle actuality test

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply