- Since mid-December, almost $854 million in ETH ETFs have been outflows, persevering with to lose upward momentum.

- Worth stays trapped under the downtrend line and powerful resistance on the EMA close to $3,000-$3,150.

- Derivatives information exhibits deleveraging and hedging, not new accumulation or breakout positioning.

Ethereum worth is buying and selling round $2,930 at present as patrons battle to regain management after weeks of institutional promoting. The market is calming down after a pointy selloff in November, however costs stay under main transferring averages as ETF outflows proceed to cut back demand.

ETF outflows proceed to weigh on sentiment

Institutional currents stay the dominant headwind. Since December 11, the Ethereum Spot ETF has recorded web outflows of $853.9 million, in accordance with Pharcyde Buyers. Just one session broke the pattern. On December 22, the fund briefly recorded inflows of $84.6 million earlier than promoting resumed.

Based on the most recent information on Dec. 27, an extra $16.6 million exited Grayscale’s ETHE, whereas BlackRock’s ETHA unexpectedly led the current redemptions. That shift is essential. If the biggest allocator reduces its publicity throughout consolidation, it signifies threat discount relatively than rotation.

This continued withdrawal of capital explains why ETH has been unable to construct momentum regardless of a number of makes an attempt to stabilize. With out institutional participation, upward motion stays fragile.

Development traces and EMA clusters cap all good points

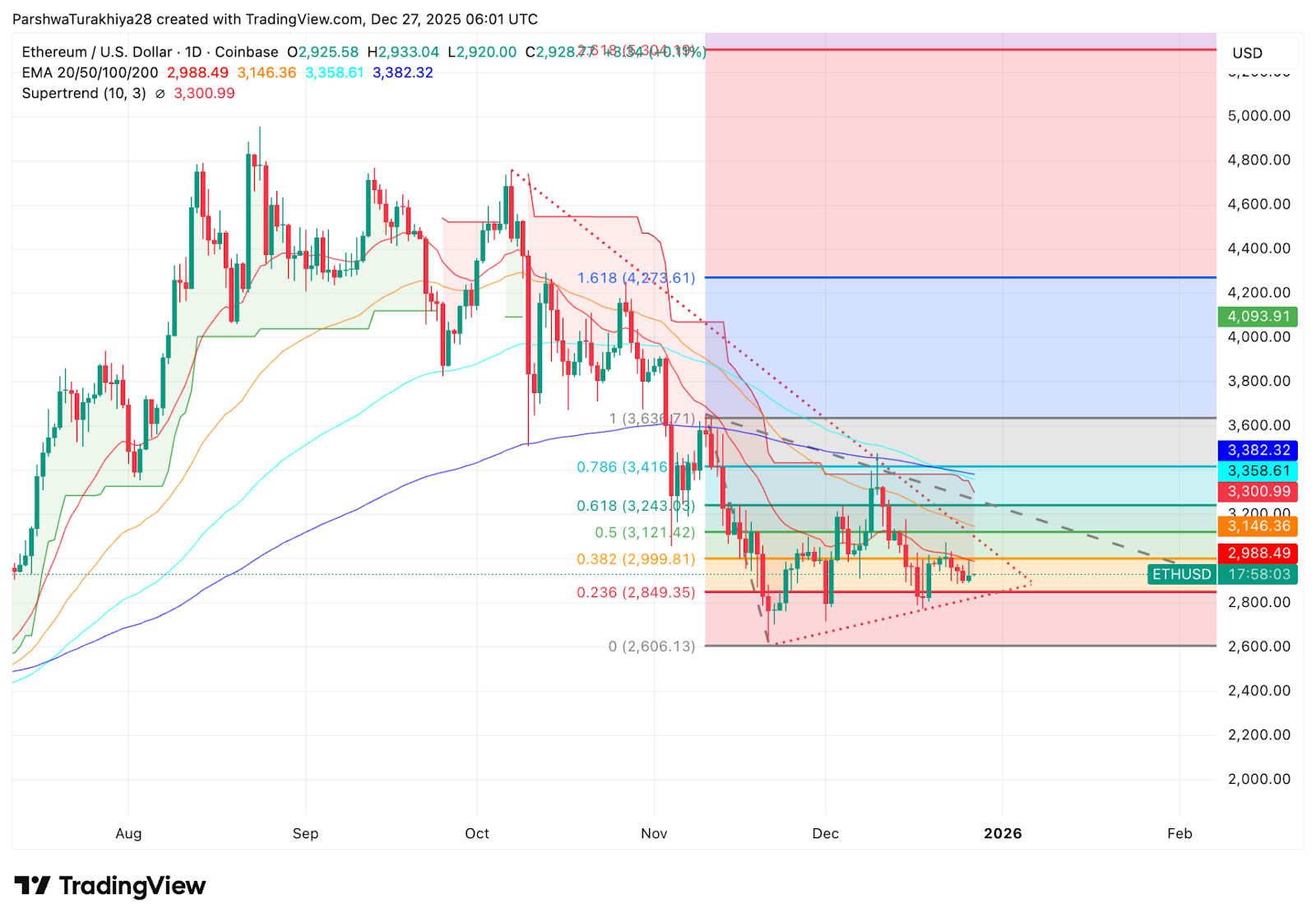

On the each day chart, Ethereum continues to stay under the downtrend line that has outlined its lowest worth since early November. Costs are additionally compressed under a dense EMA cluster that strengthens resistance.

The 20-day EMA is close to $2,988 and the 50-day EMA is close to $3,146. Above that, the 100-day EMA and 200-day EMA close to $3,358 and $3,382 kind wider ceilings. ETH has repeatedly examined the decrease finish of this zone and failed, confirming that sellers stay lively on the uptrend.

The supertrend indicator turned bearish close to $3,301 however has not reversed. So long as ETH stays under that stage, the broader construction favors continuation over restoration.

Fibonacci ranges spotlight stalled retracement

The Fibonacci retracement stage from the October excessive to the November low exhibits that ETH is struggling under the 0.382 retracement close to $3,000. This stage acted as a pivot all through December, repeatedly refusing to permit costs to return to the $2,900 stage.

Beneath present ranges, the 0.236 retracement close to $2,850 can be an essential assist to defend towards. A full breakout of this zone would expose the November lows close to $2,600, the place patrons final aggressively stepped in.

On the upside, retracement of the 0.5 and 0.618 retracement ranges close to $3,120 and $3,240 would point out a significant change in momentum. Till then, the retracement will stay incomplete.

Derivatives characterize deleveraging, not accumulation.

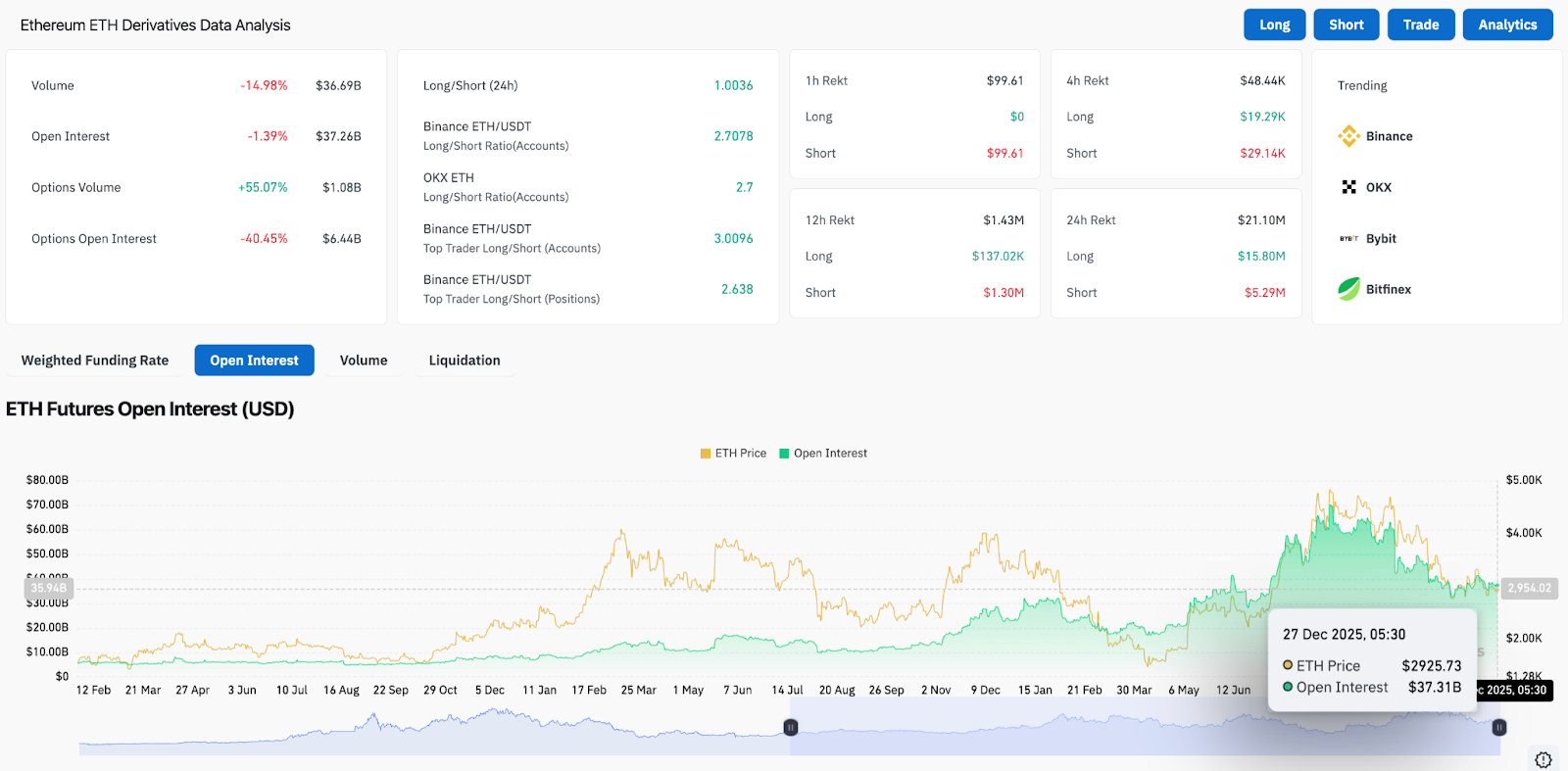

Derivatives information helps a cautious view. Ethereum futures open curiosity was down about 1.4% on the day to almost $37.3 billion. This decline displays place trimming relatively than new leverage coming into the market.

Quantity fell almost 15%, however choices buying and selling soared. Choices quantity has elevated by greater than 55% though choices open curiosity has decreased considerably. This mix means that merchants are hedging their publicity by altering positions relatively than expressing confidence within the route.

Liquidation information exhibits restricted stress. Prior to now 24 hours, the market has seen about $21 million in liquidations, principally by longs. The absence of huge liquidation cascades signifies that leverage has already declined.

Intraday construction exhibits compression close to assist

On the hourly chart, ETH is shrinking inside a spread of $2,900 to $2,980. The parabolic SAR dot stays above worth, sustaining near-term strain, however the RSI stays within the mid-40s, reflecting impartial momentum.

This development usually precedes growth, however the route stays unclear. Consumers are holding on to the push, however they don’t seem to be pushing the value previous resistance with sufficient pressure to set off a follow-through.

outlook. Will Ethereum go up?

Ethereum continues to be in a correction section and there’s no confirmed reversal of the downtrend.

- Bullish Case: A each day shut above $3,150 that retakes the 50-day EMA and breaks out of the downtrend line signifies that patrons are regaining management. This transfer opens the door to $3,350 and the higher band of the EMA.

- Bearish case: A lack of $2,850 would verify additional decline and expose $2,600 as the subsequent main assist. If it fails there, the adjustment will deepen till early 2026.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply