- Ethereum is above $3,200, indicating a near-term bullish construction and gaining momentum.

- Derivatives and spot flows point out selective risk-taking slightly than widespread market exit.

- Purchases by institutional traders strengthen ETH’s long-term function in company cryptocurrency methods.

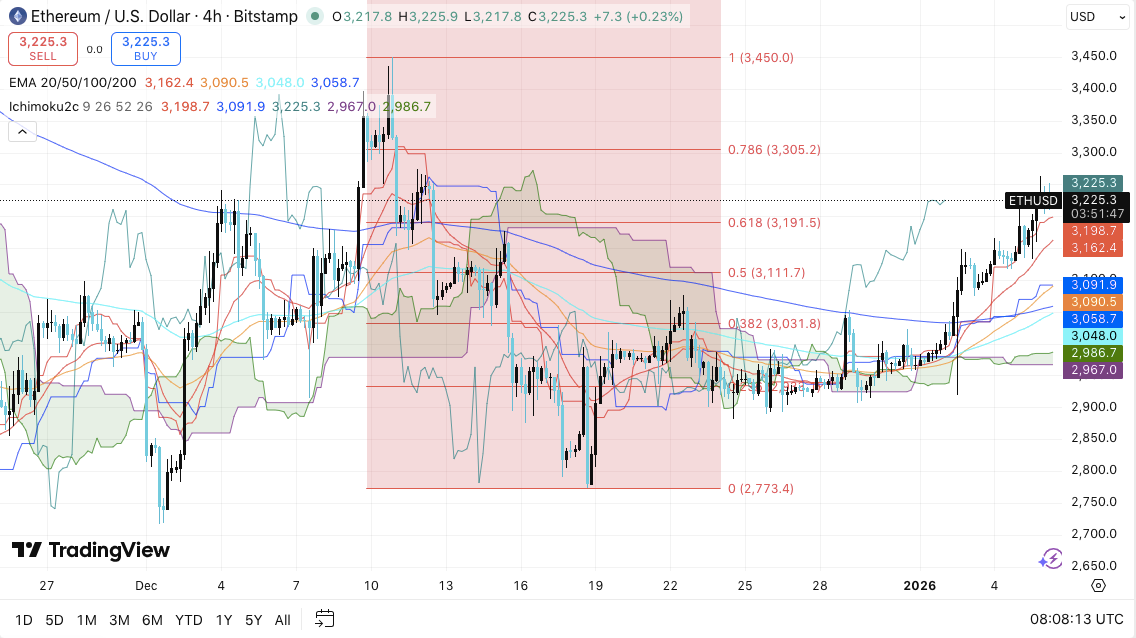

Ethereum worth development on the 4-hour chart has acquired renewed consideration as its technical energy coincides with notable institutional accumulation. Market individuals have noticed ETH stabilizing above $3,200 after recovering from its late December lows, with derivatives exercise and spot flows reflecting a extra cautious however enthusiastic buying and selling surroundings. Collectively, these elements have formed expectations for Ethereum’s near-term course and broader positioning into 2026.

Ethereum worth maintains construction as momentum improves

Ethereum maintained its near-term bullish construction on the 4-hour timeframe, supported by greater lows and constant closes above main shifting averages. Along with reclaiming the 20, 50, and 100 EMAs, ETH additionally broke out above the downtrend line, which merchants usually view as a short-term momentum change.

The value development remained above the apparent cloud, however the cloud has flattened and turned in a supportive course. In consequence, analysts interpreted this construction as stabilization slightly than speculative growth.

The resistance zone is centered round $3,305 to $3,330, and this space coincides with the Fibonacci retracement degree and former provide. A transfer via this vary may pave the best way for the earlier swing excessive of $3,450.

Associated: 2026 Cronos Value Prediction: Trump Media $6.4 Billion Treasury and Tokenization…

Moreover, a sustained breakout above $3,450 may facilitate positioning in direction of the $3,600 space based mostly on momentum. On the draw back, market individuals emphasised that the vital degree is $3,100, which beforehand served because the higher restrict of worth motion throughout a consolidation part.

Derivatives and spot flows current selective danger

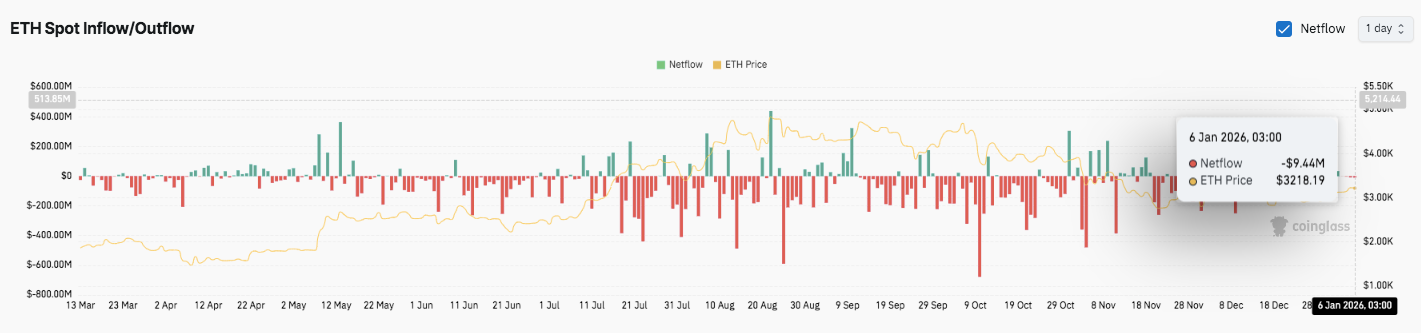

Ethereum futures open curiosity expanded steadily all through most of 2025, reflecting a rise in derivatives individuals as costs rose. Importantly, open curiosity peaked at over $60 billion throughout the bull market in late 2025 and has since fallen to almost $42 billion.

This easing implied partial deleveraging slightly than a broad danger exit. Subsequently, merchants look like sustaining their publicity whereas managing leverage extra fastidiously.

Spot circulation knowledge advised a extra cautious story. Sustained web outflows have dominated a lot of the interval, indicating continued distribution pressures.

Nevertheless, intermittent surges in inflows coincide with worth restoration, indicating selective accumulation throughout the decline. Moreover, current periods have proven barely unfavourable web flows, suggesting restraint slightly than aggressive shopping for round $3,200.

Institutional accumulation provides long-term context

Past the charts, company monetary exercise has added a long-term dimension to Ethereum’s outlook. BitMine Immersion Applied sciences revealed further purchases of Ethereum in late 2025, growing its holdings by roughly $104 million. After the announcement, Bitmine’s inventory worth rose, reflecting traders’ approval of the technique.

Chairman Tom Lee linked continued accumulation to supportive coverage indicators, institutional curiosity in tokenization, and elevated adoption of digital belongings amongst younger folks.

Associated: 2026 Sui Value Prediction: Protocol Privateness and $441M Treasury Allocation Goal is $5-8

The corporate additionally described its method as one in every of long-term accumulation slightly than aggressive buying and selling. In consequence, analysts famous that such a positioning would strengthen Ethereum’s function as a core asset in institutional traders’ crypto methods heading into 2026.

Technical outlook for Ethereum worth

Ethereum’s key ranges stay nicely outlined as the worth consolidates round $3,200 on the 4-hour chart.

Upside ranges embody $3,305 to $3,330 as the primary resistance cluster, adopted by an enormous swing excessive at $3,450. If a breakout above $3,450 is confirmed, there may very well be room for a transfer above $3,600.

On the draw back, quick help lies according to the Fibonacci 0.618 zone between $3,190 and $3,170. Beneath that, $3,110 to $3,100 serves as an vital psychological and structural degree. A deeper help band lies between $3,050 and $3,000, the place the key shifting averages and cloud help converge.

The broader technical image means that ETH is stabilizing after retrieving a significant EMA and breaking out of the earlier downtrend line. Value motion above the Ichimoku cloud confirms a bullish-to-neutral bias, and compression in volatility suggests a pending growth.

Will Ethereum go up?

The near-term outlook is dependent upon whether or not consumers can defend $3,100 and construct momentum in direction of the $3,305-$3,330 resistance zone. If it maintains its energy, a problem to $3,450 may very well be doable.

Nevertheless, if we fail to carry $3,050, there’s a danger that ETH will fall again into the vary and drop beneath $3,000. For now, Ethereum stays at an vital inflection level.

Associated: Cardano Value Prediction: ADA Restoration Continues, However Bulls Nonetheless No Affirmation

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply