- Ethereum fell 2.25% to $3,208, however with its symmetrical triangular construction intact, it stays above the 20/50 EMA cluster of $3,165 to $3,187.

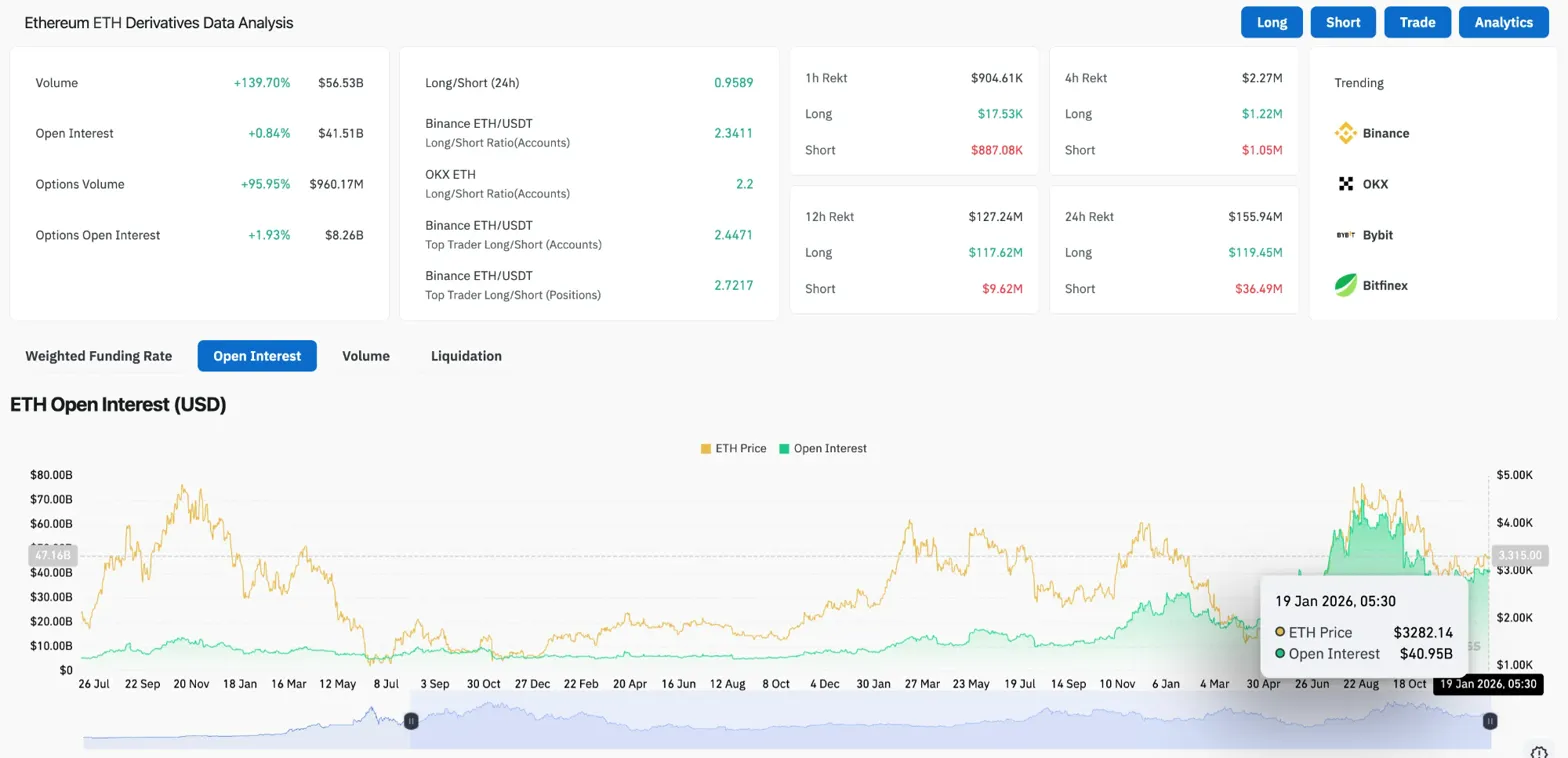

- Derivatives markets noticed $119.45 million in long-term liquidations in 24 hours as buying and selling volumes surged 139%, reflecting energetic place modifications.

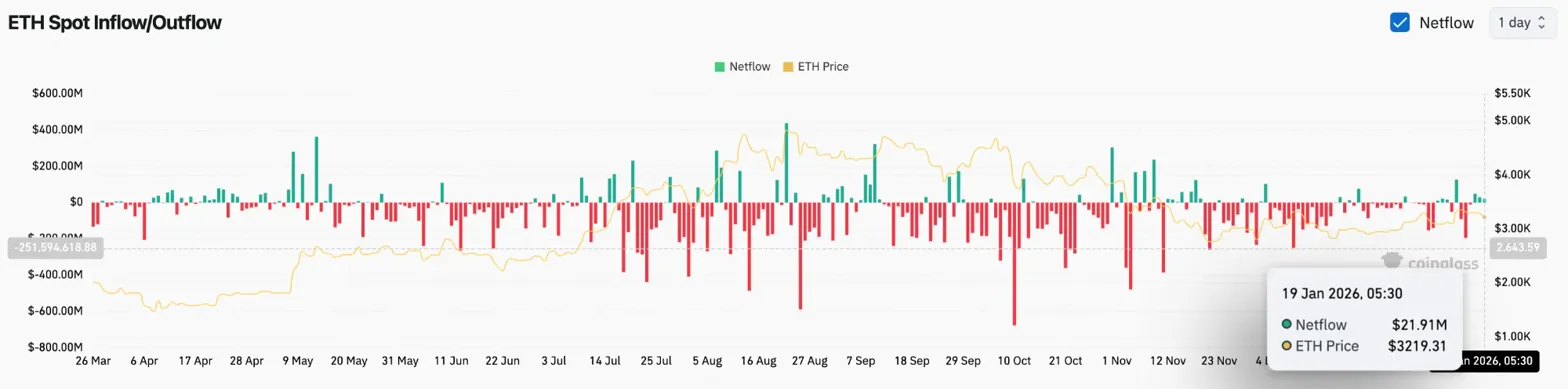

- The $21.91 million influx from spot exchanges means that patrons are accumulating regardless of the decline, creating a possible divergence from the value development.

Ethereum worth is buying and selling round $3,208 at this time after a 2.25% drop testing the decrease sure of a multi-week symmetrical triangle. Though this decline triggered a big long-term liquidation, spot flows paint a special image as patrons step in to soak up the promoting.

Flushing leveraged positions by means of long-term liquidation

Derivatives markets have absorbed vital harm prior to now 24 hours. Coinglass stated $119.45 million in lengthy positions had been liquidated, in comparison with $36.49 million in brief positions. This 3:1 ratio signifies that the leveraged bulls received concerned as the value fell beneath intraday assist.

Regardless of liquidations, open curiosity remained comparatively steady at $41.51 billion, up 0.84%. Buying and selling quantity surged 139.70% to $56.53 billion, indicating energetic exercise reasonably than passive promoting. If OI holds regardless of a spike in quantity coinciding with a liquidation, it usually alerts rotation reasonably than capitulation.

The lengthy/quick ratio is 0.95, indicating a slight tendency to quick amongst retail merchants. Binance’s high merchants stay web lengthy at 2.34, indicating a divergence that usually resolves with a pointy transfer in both path.

Spot inflows create bullish divergence

Foreign money movement information contrasts with the bearish worth motion. Coinglass recorded web inflows of $21.91 million on January 19, which means spot holders are shifting ETH from exchanges to personal wallets.

Associated: Cardano worth prediction: ADA bears take management as Hoskinson questions CLARITY legislation odds

When spot accumulation happens throughout a decline, it means that long-term holders view the decline as a possibility reasonably than a warning. This dynamic creates a possible worth flooring regardless of short-term merchants panicking.

This sample repeated all through January. Regardless of a number of declines, spot flows have remained web constructive for many periods, constructing a basis of pent-up provide that won’t return to the market throughout corrections.

EMA assist maintains triangular construction

On the day by day chart, Ethereum has been buying and selling inside a symmetrical triangle since its December lows close to $2,800. This sample reveals converging development strains compressing the value between assist at $3,100 and resistance at $3,400.

Right this moment’s candlestick examined the decrease sure however rose above the 20-day and 50-day EMA clusters from $3,165 to $3,187. The decrease Bollinger Band at $2,958 supplies further assist within the occasion of a escape of the triangle.

Present main stage:

- Instant assist: $3,187 (20 EMA)

- Secondary assist: $3,165 (50 EMA)

- Triangle assist: $3,100

- Bollinger flooring: $2,958

- Instant resistance: $3,287 (100 EMA)

- Key resistance: $3,336 (200 EMA)

- Triangle restrict: $3,400

The construction stays impartial till one boundary is confidently damaged. A bearish decision might be confirmed if the value closes beneath $3,100 for the day, with a goal of $2,800. A break above $3,400 would point out a bullish continuation in direction of $3,600.

Intraday momentum approaches oversold

A shorter timeframe signifies the depth of the decline. On the 30-minute chart, the value broke beneath the ascending channel that had led to the rally from $3,100 to $3,360.

Associated: Solana Worth Prediction: $59M Lengthy Liquidation Slips SOL Under EMA Cluster

The RSI has fallen to 35.99, approaching oversold territory. The MACD stays bearish, with the histogram increasing downward, however such readings usually precede stabilization makes an attempt.

The channel assist that broke round $3,280 is now appearing as resistance. If we try a bounce, we’ll first encounter this stage earlier than reaching the $3,336 zone the place the 200-day EMA converges with the higher Bollinger Band.

Outlook: Can Ethereum maintain the triangle?

This setup favors endurance. Liquidations take away some leverage, spot inflows present bids, and the triangular construction stays intact. The subsequent 48 hours will decide whether or not this can be a shakeout or the start of a collapse.

- Bullish case: Worth rebounds from the $3,165-$3,187 EMA cluster and regains $3,280. A detailed above $3,336 will break the 200 EMA and goal the highest of the triangle at $3,400.

- Bearish case: A day by day shut beneath $3,165 will break the EMA assist and take a look at the decrease sure of the triangle at $3,100. The $3,100 loss confirms the breakdown and targets Bollinger assist at $2,958.

Ethereum sits at a choice level throughout the consolidation spectrum. Spot accumulation suggests latent demand, however the technical construction requires a maintain above $3,165 to keep up the bullish case.

Associated: DASH Worth Prediction: DASH lands on HyperLiquid with 5x leverage as worth rises

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply