- Germany’s DZ Financial institution will legally begin providing cryptocurrency buying and selling companies by the meinKrypto platform.

- The financial institution will initially supply cryptocurrency buying and selling companies to establishments, with plans to broaden to retail later.

- DZ Financial institution launches meinKrypto on Atruvia, enabling buying and selling of BTC, ETH, ADA, and LTC.

DZ Financial institution has formally entered the crypto trade. Germany’s second-largest financial institution, with greater than €660 billion in belongings underneath administration (AUM), plans to begin providing crypto-related companies to company purchasers earlier than rolling it out to retail merchants within the close to future.

DZ Financial institution receives EU MiCA license

In accordance with the announcement, DZ Financial institution has obtained the suitable authorization to function cryptocurrency buying and selling companies in Europe by the Marketplace for Cryptocurrency Property (MiCA) regulatory framework.

DZ Financial institution introduced that BaFin, Germany’s prime monetary regulator, has approved its cryptocurrency buying and selling platform MainCrypto on the finish of 2025. Because of this, DZ Financial institution will be capable to seamlessly present digital foreign money buying and selling companies to roughly 700 monetary establishments.

First, DZ Financial institution gives cryptocurrency buying and selling companies for Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Litecoin (LTC). The meinKrypto platform was launched in collaboration with the financial institution’s IT accomplice Atruvia to present customers of the DZ Financial institution app direct entry to cryptocurrencies.

In the meantime, DZ Financial institution will make the most of Boerse Stuttgart Digital for crypto asset custody companies and EUWAX AG for commerce execution.

What does that imply for crypto merchants in Germany?

DZ Financial institution’s entry into the cryptocurrency house in 2026 may have a serious affect on your complete Web3 trade. Moreover, Germany’s crypto trade has grown quickly over the previous few years, pushed by clear crypto rules.

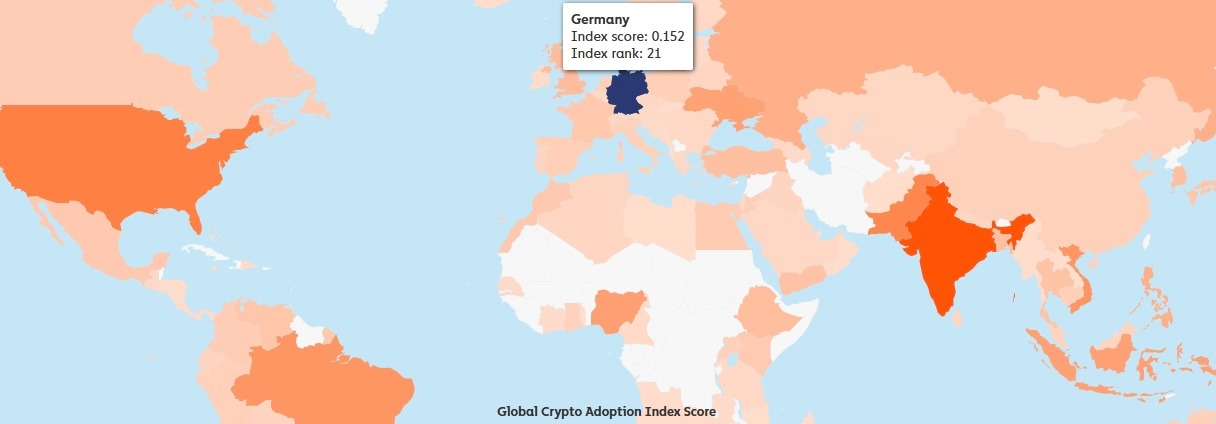

In accordance with the Chainaracy 2025 report on world adoption index, Germany ranks twenty first in cryptocurrency adoption. The entry of DZ Financial institution will play an vital position in offering sustainable liquidity, as many crypto merchants in Germany have held their cryptocurrencies for at the very least a 12 months to optimize earnings underneath the brand new crypto tax regime.

Notably, in Germany, spending on cryptocurrencies is 100% tax-free if merchants maintain them for at the very least one 12 months. However, in Germany, short-term cryptocurrency holders of lower than one 12 months are taxed as atypical earnings.

What’s subsequent?

DZ Financial institution’s approval to enter the cryptocurrency trade may have a serious affect on different monetary establishments. Already, a number of different establishments in Germany have obtained the suitable licenses to enter the cryptocurrency trade.

Establishments licensed to offer crypto-related companies in Germany embrace Commerzbank AG, DekaBank, BitGo Europe, and Bullish DE Custody. In the meantime, Deutsche Financial institution and Volksbanken Group are within the technique of acquiring acceptable licenses to offer crypto-related companies.

Associated: High nations with zero Bitcoin taxes enter a brand new period in world reporting

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply