- Gold and silver rose to report ranges in early 2026, however have since fallen considerably.

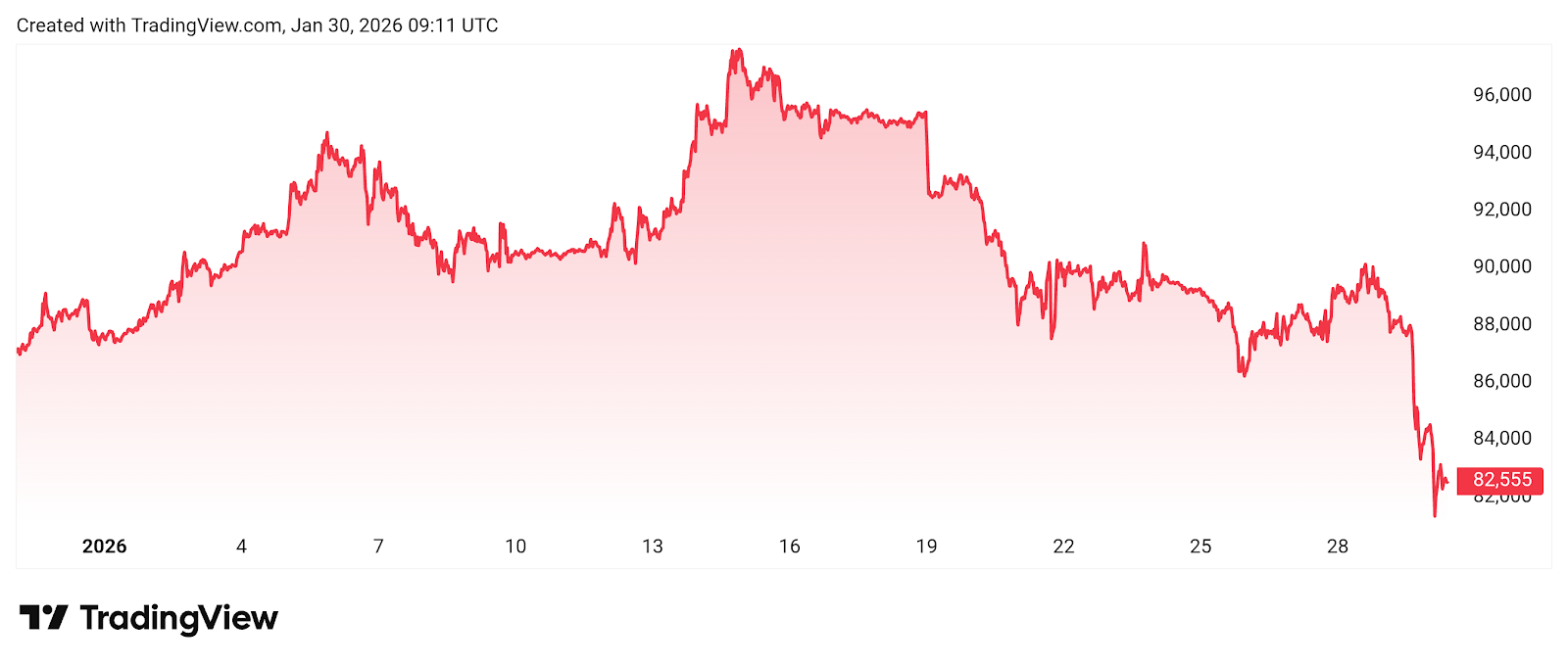

- Bitcoin is buying and selling round $82,000 after a day by day and month-to-month decline.

- Management via quarter-end will rely on macro indicators, threat urge for food, and rotation tendencies.

As macroeconomic circumstances change, we are going to see value fluctuations in gold, silver, and Bitcoin within the first quarter of 2026. The current rise in valuable metals and weak spot in Bitcoin highlights the altering place of traders. Coverage indicators, liquidity tendencies and market flows are anticipated to find out asset management by quarter-end.

Bitcoin falls amid risk-off sentiment

sauce: TradingView

Bitcoin is buying and selling at $82,078, down 6.9% up to now day and seven.1% over the previous month, in accordance with market information. The decline is about 35% beneath the all-time excessive of over $126,000 set in October and displays decrease threat urge for food and fewer speculative exercise throughout digital asset markets.

Regardless of the pullback, the macro atmosphere stays largely supportive for Bitcoin. The Fed reduce rates of interest 3 times final 12 months, with the bottom rate of interest starting from 3.50% to three.75%, and the market is pricing in further easing within the second half of 2026. International liquidity indicators resembling M2 proceed to rise, a development that has traditionally supported threat belongings resembling Bitcoin.

Nonetheless, demand from institutional traders has slowed. The Spot Bitcoin ETF recorded internet outflows of $4.57 billion in November and December 2025, the most important quantity since its inception. Annual internet inflows additionally fell 39% from the earlier 12 months, from $35.2 billion to $21.4 billion. Notably, there was an outflow of $817 million from the ETF yesterday alone as Bitcoin traded at a two-month low.

The decline follows a interval of sturdy costs earlier this month. Glassnode analysts famous that on-chain exercise has slowed attributable to decrease buying and selling volumes and lowered participation from short-term holders. Foreign money inflows elevated in the course of the decline, exhibiting indicators of profit-taking and threat mitigation by merchants.

Nonetheless, Bitcoin stays above the psychologically vital $80,000 degree. Analysts at CoinShares stated that whereas macro liquidity circumstances stay supportive within the medium time period, short-term value actions are more likely to rely on investor sentiment and broader inventory market tendencies.

Individually, analyst Benjamin Cowen stated Bitcoin is more likely to proceed to underperform relative to shares, including that expectations for a “large rotation” from valuable metals to cryptocurrencies could also be untimely.

Gold retreats after large rally in January

sauce: TradingView

Gold is buying and selling at $5,171.12 per ounce, down 3.89% over the previous day, following profit-taking after a robust rally.

Regardless of the day by day decline, gold stays up 24.68% this month and is up $1,065.07 because the starting of January. Central financial institution purchases and demand for safe-haven belongings supported costs all through the month, particularly as geopolitical dangers and inflation considerations continued.

Analysts at UBS stated gold’s January efficiency mirrored continued diversification by reserve managers and institutional traders. Nonetheless, they warned that even after such a speedy rise, a short-term correction may nonetheless ensue. Nonetheless, gold’s resilience has stored it one of many best-performing belongings of the primary quarter up to now.

Silver volatility displays blended demand indicators

sauce: TradingView

Silver traded at $107.83, down $6.67, or 5.83%, over the previous day. This decline follows a pointy rally earlier within the month, with silver gaining 51.95% ($39.61) over the previous 30 days.

Silver’s value actions mirror its twin position as a valuable metallic and an industrial product. Citi analysts stated speedy profit-taking drove the current pullback, whereas expectations for stronger demand from manufacturing and the clear vitality sector fueled the current rally. They predicted that silver may attain $150 an oz attributable to Chinese language demand and different structural components.

In comparison with gold, silver confirmed considerably greater volatility all through January. Regardless of greater day by day losses, silver’s month-to-month efficiency stays the strongest of the three belongings. Saxo Financial institution’s Ole Hansen warned that the rise in gold and silver costs is getting into a riskier section and rising volatility is beginning to erode market liquidity.

Which belongings will lead as the primary quarter progresses?

Evaluating Q1 asset efficiency reveals a transparent management sample. Gold and silver posted early beneficial properties, pushed by demand for safe-haven belongings, inflation considerations and central financial institution shopping for, however sharp beneficial properties led to profit-taking and short-term pullbacks.

In distinction, Bitcoin fell attributable to risk-off sentiment and weak institutional capital flows. On-chain indicators resembling MVRV-Z and NUPL are presently exhibiting impartial sentiment relatively than excessive worry or optimism.

Wanting forward, asset management via quarter-end is more likely to rely on coverage indicators, investor rotation, and future financial information. Additional charge cuts may assist threat belongings resembling Bitcoin, however sustained inflation and progress considerations may proceed to favor gold and silver.

Specifically, Milk Street highlighted a historic sample during which Bitcoin tends to comply with gold value actions with a lag of about six months. Evaluation means that Bitcoin’s current sideways commerce amid a rally in gold costs might mirror timing relatively than structural underperformance.

Nonetheless, analyst Charlie Morris Edwards warned that the 18-month rally in gold and silver may proceed, and warned in opposition to untimely capital rotation into Bitcoin.

Associated: Why the gold growth would not spell the top for Bitcoin

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply