- ZEN maintains bullish construction above main EMA, suggesting upkeep of stability reasonably than decline

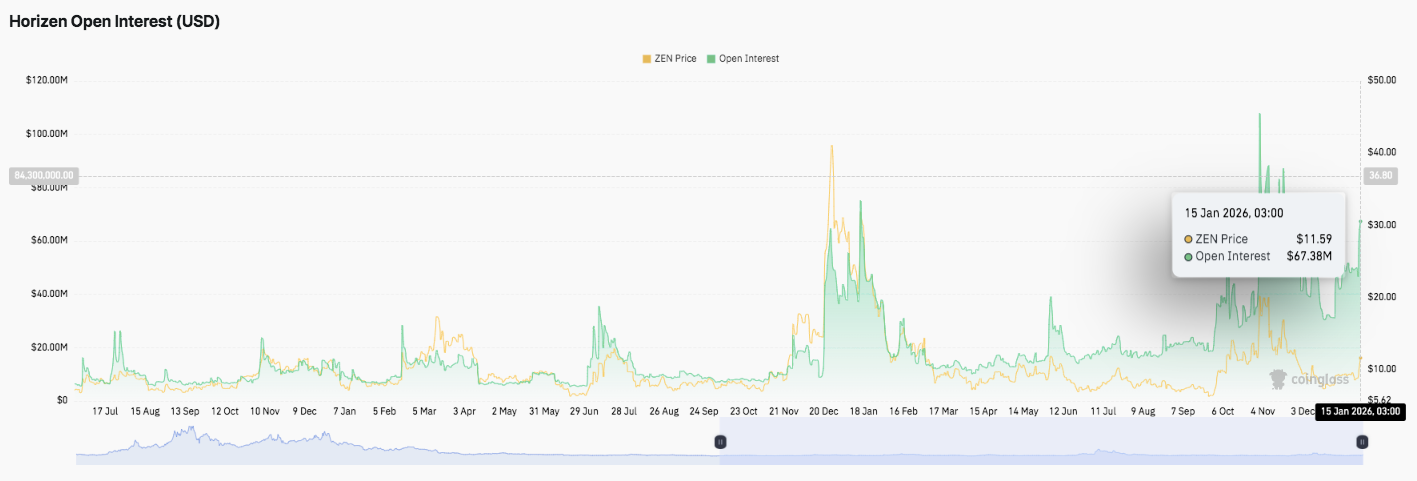

- Increasing open curiosity and not using a worth spike suggests positioning forward of a decisive transfer.

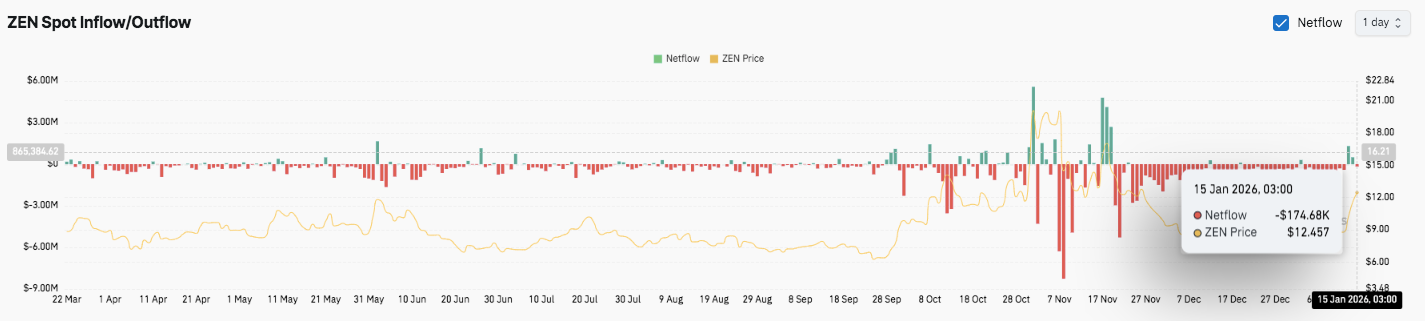

- Spot stream cools after the breakout, indicating a pause in accumulation because the development construction holds

Horizen’s ZEN token continues to achieve traction after a robust rebound reshaped the short-term market construction. On the 4-hour chart, ZEN exhibits a transparent bullish setup following a pointy impulsive transfer that took the worth above a key technical degree.

Because of this, merchants at the moment are targeted on whether or not the continued decline indicators power or depletion. A pause under the present resistance displays stability reasonably than weak spot as consumers defend increased ranges. Market information means that momentum stays constructive, however affirmation stays depending on follow-through above close by resistance zones.

Bullish construction is above the main averages

ZEN’s latest breakthrough has modified the tone of the market. The value decisively broke above the earlier consolidation vary and regained the 0.618 Fibonacci degree round $11.32. Importantly, ZEN is presently buying and selling above the 20, 50, 100, and 200 exponential shifting averages. This association typically displays robust directional momentum.

Moreover, the supertrend indicator continues to point out a bullish image, reinforcing the upside bias. Subsequently, the broader construction favors a continuation whereas worth stays above key assist. Nevertheless, consolidation close to resistance means that the market is ready for brand new participation earlier than selecting a path.

The fast focus is on the $12.40 to $12.50 zone. ZEN is presently testing this space following latest advances. A clear 4-hour shut above $12.50 may affirm acceptance and expose the $13.90 space. This degree is in step with a full Fibonacci extension and represents the following main upside goal.

On the draw back, preliminary assist is positioned round $11.98 to $12.00, indicating a retest breakout space. Moreover, the $11.32 degree stays vital to take care of development consistency. A major pullback may revisit the earlier demand at $10.50 and even $9.72.

Including context with derivatives and spot flows

Open curiosity information supplies additional perception into dealer conduct. After an prolonged compression part, open curiosity steadily expanded in direction of $67 million. Importantly, costs haven’t been accelerating aggressively with this improve. This divergence suggests new leveraged positioning forward of a directional transfer reasonably than late-cycle hypothesis.

Moreover, spot stream information reveals modifications in conduct. The breakout was accompanied by a big influx, suggesting accumulation. Nevertheless, subsequent outflows curbed the upward momentum and strengthened the worth consolidation. Lately, the stream has stabilized round neutrality, reflecting a decline in perception on either side.

Horizen (ZEN) worth technical outlook

The essential ranges for Horizen stay clearly outlined as costs consolidate following a robust bullish impulse.

The upside degree is seen as a right away resistance zone between $12.40 and $12.50. If confirmed above this vary, the rally may prolong in direction of $13.90, which might coincide with the 1.0 Fibonacci extension and point out the following large upside goal.

On the draw back, preliminary assist lies between $11.98 and $12.00, which represents a breakout retest space. Sustaining this zone stays vital for short-term development stability. Beneath that, $11.32 stands out because the 0.618 Fibonacci degree and key structural assist.

Extra draw back ranges embrace $10.50 related to the 0.5 Fibonacci retracement and former consolidation, adopted by $9.72 indicating deeper development assist across the 0.382 Fibonacci degree.

The technical image means that ZEN will not be displaying indicators of depletion, however is shifting under resistance after a definitive breakout. Costs stay above the main shifting averages, rising bullish momentum. This correction part typically precedes elevated volatility, particularly when supported by elevated participation.

Will Horizen go additional?

Horizen’s near-term worth path will rely on whether or not consumers are capable of defend the $11.30-$12.00 zone whereas rising strain on the resistance. If the bullish momentum strengthens with regular inflows and rising open curiosity, ZEN may problem $12.50 and push in direction of $13.90.

Nevertheless, if the breakout space fails to carry, the construction will weaken and expose us to sub-$10.50 ranges. For now, Horizen stays within the essential zone, with momentum persevering with in favor of consumers so long as key helps stay intact.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply