- XRP has surpassed $2, overtaking BNB to change into the fourth-largest cryptocurrency.

- Whales are pulling XRP from exchanges, tightening provide in long-term positions.

- ETF inflows and technical momentum are supporting the rally, with analysts sustaining their $8 goal.

XRP is again within the highlight after breaking by the vital $2 stage. Its worth actions, on-chain information, and ETF inflows all level to new momentum. However amid rising optimism, analysts are debating whether or not this bull market has robust foundations for a brand new all-time excessive.

XRP positive factors momentum and exceeds $2

On the time of writing, XRP is buying and selling at round $2.05, its highest worth to date this yr after rising 8% up to now 24 hours. This transfer elevated XRP’s weekly efficiency by 10%, though the month-to-month chart nonetheless displays a 6.7% decline.

Recovering $2 is vital. Analysts see this stage as a psychological and technical pivot, and a break above this stage might enable XRP to determine new help. With this in thoughts, some market watchers are calling for an additional all-time excessive.

One of the crucial constant voices supporting the bullish outlook is Charting Man, who maintains a worth goal of $8 since 2024, primarily based on long-term technical formation. He stays supportive of the plan, though it’ll take time to comprehend his targets.

XRP overtakes BNB to change into the 4th largest cryptocurrency

The rating has additionally been reshaped as a result of rise in XRP. The asset’s market capitalization lately reached $122.7 billion, simply forward of BNB’s $120.4 billion, taking it to fourth place behind Bitcoin, Ethereum, and Tether.

This transfer, along with regular XRP ETF inflows, coincided with reviews of $3.6 billion in whales accumulating since late December.

Whales pull XRP from exchanges as provide tightens

On-chain information provides one other layer to the bullish story. Analyst John Squire, citing information from Glassnode, famous that XRP buying and selling balances are presently at an eight-year low. This means that cash are flowing out of the alternate relatively than flowing in.

Squire mentioned this development displays preparation relatively than panic, and is commonly associated to long-term positioning by massive holders.

Additional evaluation by Leo Hadjiloizou highlights the growing provide shock story. In accordance with information from CryptoQuant, XRP holdings throughout 11 main exchanges have declined by roughly 400 million tokens over the previous three months. Hadjiloizou identified that these exchanges account for roughly 70% of all XRP held on exchanges.

Hadjiloizou factors out that Korean exchanges reminiscent of Upbit and Bithumb have recorded a rise of roughly 570 million XRP since October 2025, whereas different exchanges aside from these two platforms have misplaced almost 1 billion XRP over the identical interval. This means that the availability of international alternate is quickly tightening outdoors of South Korea.

Associated: 2026 XRP Worth Prediction: SEC Victory and $1.14 Billion ETF Circulation, Goal $5-8

Technical Analyst Sticks to $8 XRP Goal

As XRP regains $2 territory for the primary time in 2026, technical analysts are revisiting greater targets. Also referred to as Matt Hughes nice matsbeelately agreed with Charting Man’s view that regardless of short-term market noise, XRP remains to be on monitor for $8.

The $8 prediction is in step with historic worth motion, the Fibonacci extension, and the completion of the present shock wave construction on the chart. As background, XRP beforehand spiked from $0.49 to $3.34 in about 10 weeks (from November 2017 to January 2018), paused, and resumed its upward development about 6 months later.

Rising to $8 from present ranges would require a rise of round 290%, which places the value close to the 1.272 Fibonacci stage on the weekly chart.

Some market individuals are already discussing a $20 situation, and The Charting Man says such a stage is feasible, however not included within the quick outlook.

XRP ETF continues to draw capital

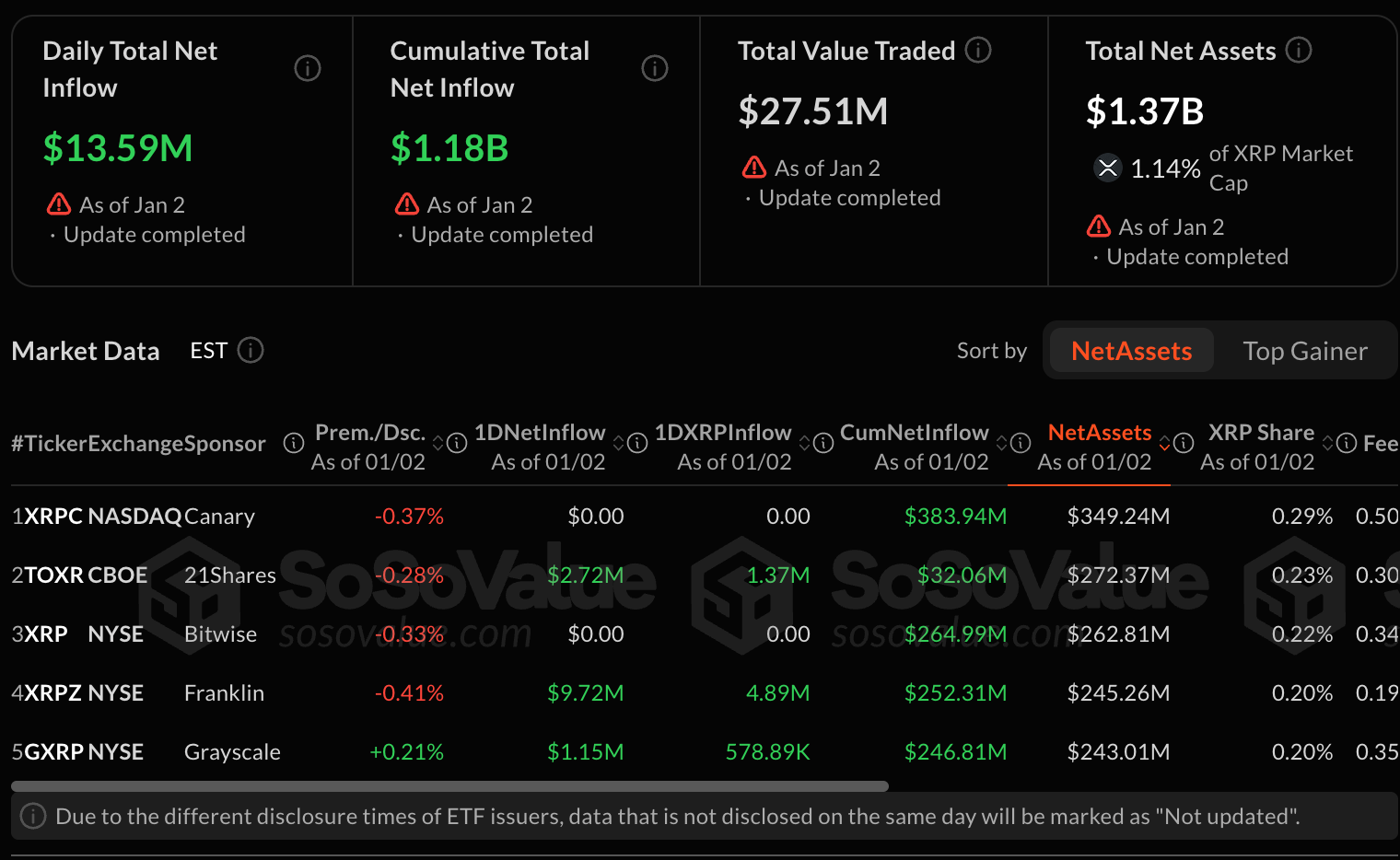

Institutional investor curiosity stays one other main pillar supporting XRP’s rise. The XRP ETF recorded $13.59 million in new inflows on Friday, bringing whole web inflows to roughly $1.18 billion and belongings underneath administration to $1.37 billion.

Supply: SoSoValue

Following a robust launch interval in November that noticed inflows of $666 million in simply two weeks, the XRP ETF attracted greater than $600 million in December alone. Since their launch on November thirteenth, these merchandise haven’t recorded a single day of web outflow.

On a bit-by-bit foundation, Franklin Templeton, Grayscale, Canary Capital, and 21Shares stay the largest contributors. Notably, the XRP ETF is presently thought of the best-performing ETF launched in 2025, reaching $1 billion in inflows the second-fastest after the Bitcoin and Ethereum ETFs.

Market commentators have prompt that capital inflows could have briefly slowed as XRP fell under $2 in November and December. Nonetheless, ETF executives argue that higher regulatory readability by 2026 might spark even stronger demand.

Is the XRP rally constructed to final?

The present bull run seems to be fueled by extra than simply hype, as XRP surpasses $2 and overtakes BNB, whales are pulling tokens from exchanges, and attracting regular ETF inflows. Nonetheless, the approaching days will decide whether or not XRP is ready to maintain its floor above the important thing ranges and switch the momentum right into a sustained development.

At current, sustainability points stay acute as a result of tight alternate provides, monetary establishments’ participation, and new technological confidence.

Associated: From $100 to $2: XRP Influencers Face Backlash Over Lacking 2025 Aim

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply