- When ZRO breaks above $1.99, the rising low confirms momentum management and the construction reverses to a bullish route.

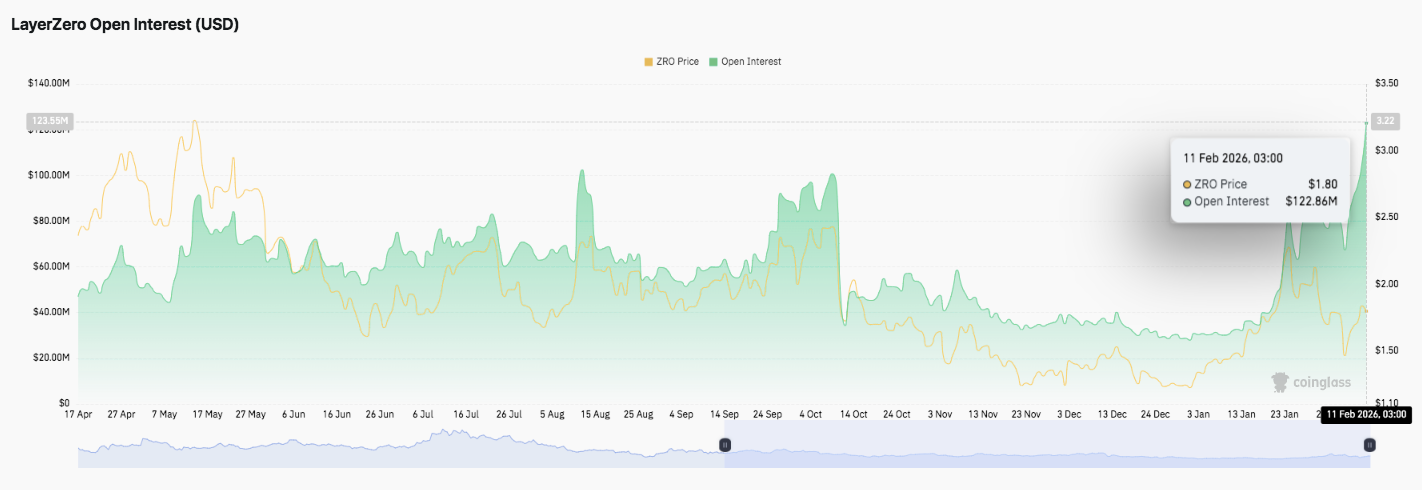

- Open curiosity close to $122 million signifies new leverage, driving upside whereas rising volatility

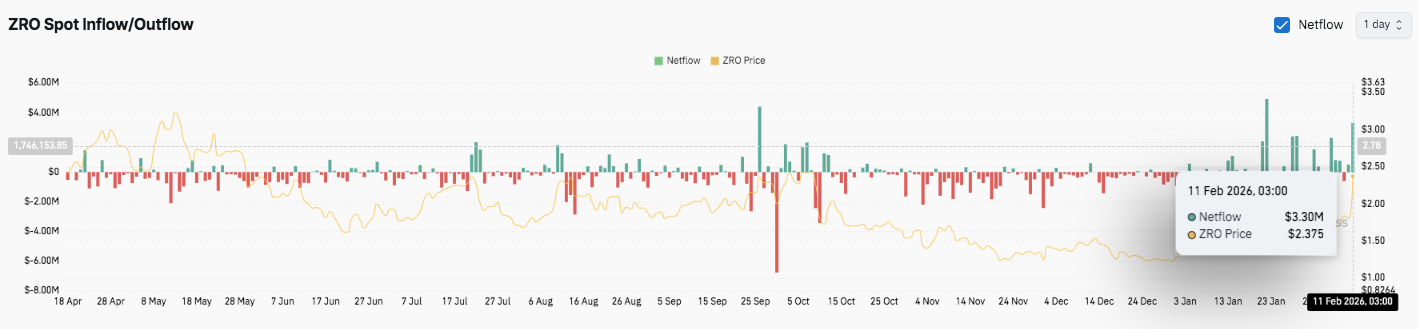

- Spot inflows and main partnerships strengthen accumulation as LayerZero story grows

LayerZero’s token ZRO is buying and selling close to $2.38 after a robust 4-hour breakout try. This transfer follows a decisive rebound from the $1.50 to $1.55 demand zone. Consumers are at present focusing on the current swing excessive close to $2.46.

In consequence, the broader construction moved from consolidation to enlargement. The rising lows and rising momentum verify that bullish management is rising.

Technical construction turns bullish

ZRO has regained some essential Fibonacci ranges throughout its current rally. The worth first broke by means of the 0.382 degree at $1.69. It then cleared the 0.5 degree at $1.84.

Moreover, the bulls broke out of the essential 0.618 pivot round $1.99. That degree now serves as a structural help. The token additionally rose above the 0.786 retracement at $2.19 in the course of the day.

The short-term shifting common is at present trending upward. Worth trades above the 50, 100 and 200 EMAs. Subsequently, development corrections are favorable to patrons. The Supertrend indicator turned bullish round $1.60 early within the rally.

The primary resistance degree is $2.46. This degree represents a current regional excessive. Moreover, $2.50 is a psychological barrier. A 4-hour shut above $2.46 may begin a transfer in the direction of $2.60 or above.

However help stays important. At the moment, the $2.20 zone is appearing as short-term help. Beneath that, $1.99 stays the important thing pivot. A decline under $1.84 will weaken momentum and result in a chronic consolidation.

Open curiosity and move information recommend new threat urge for food

Derivatives information displays elevated speculative exercise. Open curiosity has elevated from about $50 million early within the cycle to greater than $80 million. Throughout the risky mid-cycle section, the spike approached $100 million. Nonetheless, these expansions typically preceded liquidation.

Associated: Cardano Worth Prediction: ADA Checks Multi-Month Lows As Open Curiosity Falls and Outflows Proceed

The leverage was then eliminated and open curiosity declined in the direction of $30 million. Lately, the publicity has jumped to about $122 million. Notably, this was a brand new regional excessive. Merchants are actually placing in new cash with increased leverage. In consequence, volatility threat additionally will increase.

Spot move information exhibits related adjustments. Runoff was concentrated from late spring to early winter. Crimson bars mirror regular promoting strain throughout worth declines. Nonetheless, the inflow of greens spiked in early February. Internet inflows of $3.3 million matched the rebound to $2.37. So it appears just like the buildup is coming again.

Institutional help strengthens the story

LayerZero continues to develop past buying and selling metrics. The corporate partnered with Google Cloud to discover blockchain infrastructure for AI-driven financial exercise. Moreover, DTCC goals to reinforce the tokenization of belongings utilizing LayerZero expertise.

As well as, Intercontinental Change plans to judge how LayerZero’s Zero Chain can help steady buying and selling. This community claims a scalable structure with multi-million transaction capability.

LayerZero (ZRO) worth technical outlook

The important thing degree stays nicely outlined as LayerZero trades round $2.38. The worth has just lately regained a key Fibonacci degree and is at present approaching resistance at $2.46. This construction marks the bottom worth because the $1.50-$1.55 demand base, confirming a short-term development change.

High degree: $2.46 is near-term resistance and the excessive of current worth motion. If the breakout is confirmed, it may open room for $2.50 and $2.60. As soon as above $2.60, momentum may enhance in the direction of the $2.75 zone if quantity strengthens.

Lower cost degree: $2.20 serves as the primary short-term help and breakout zone earlier than that. Beneath that, $1.99 (0.618 fibnia) stays the important thing structural axis. Deeper help lies at $1.84 and $1.69, and the broader bullish construction will face invalidation.

The 50/100/200 EMA is at present sloping upwards and helps a bullish correction. Moreover, worth has damaged above supertrend help, reinforcing the upside bias. Nonetheless, momentum will rely upon whether or not the value can keep $1.99 regardless of the pullback.

Will LayerZero attain new highs?

LayerZero’s worth outlook is dependent upon whether or not patrons can keep strain above $2.20 and bravely problem $2.46. A robust shut above that degree may verify a continuation and trigger elevated volatility. Moreover, elevated open curiosity close to cycle highs signifies elevated speculative positioning.

Nonetheless, if the value is unable to maintain $1.99, momentum may flip to consolidation as soon as once more. A break under $1.84 will weaken the bullish argument and expose $1.69.

For now, ZRO is in a pivotal enlargement section. Sustained inflows and structural help will decide whether or not the following leg targets above $2.60 or returns to vary situations.

RELATED: River Worth Prediction: Spot itemizing sparks 33% rally as river exams triangle resistance

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply